Universal Forest Products (UFPI) Q2 Earnings Beat, Margin Up

Universal Forest Products, Inc. UFPI reported better-than-expected earnings in the second quarter of 2019. The company’s bottom line not only surpassed the Zacks Consensus Estimate but also increased year over year, reaching its highest level ever.

Despite being hurt by rising labor costs and significant fluctuations in the lumber market, the company managed to generate strong earnings on the back of solid new and value-added products growth.

The company’s earnings of 88 cents per share topped the consensus estimate of 83 cents by 6%. Also, the reported figure increased 23.9% from 71 cents reported in the year-ago period.

Net sales of $1.24 billion marginally missed the consensus mark of $1.245 billion and declined 4% on a year-over-year basis from $1.29 billion. Lower lumber prices and 9% reduction in selling prices adversely impacted gross sales.

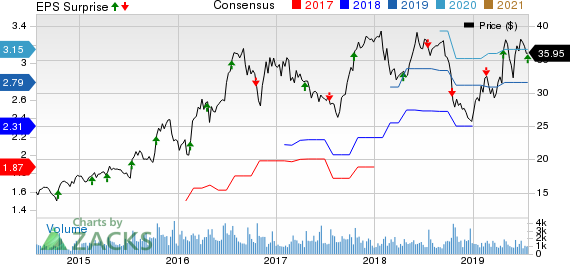

Universal Forest Products, Inc. Price, Consensus and EPS Surprise

Universal Forest Products, Inc. price-consensus-eps-surprise-chart | Universal Forest Products, Inc. Quote

End-Market Sales Discussion

Universal Forest Products, which shares space with Weyerhaeuser Company WY, Louisiana-Pacific Corporation LPX and Trex Company, Inc. TREX in the Zacks Building Products - Wood industry, classifies its top-line results on the basis of end-markets served. Investors should note that Universal Forest Products’ end-market sales sum up to total gross sales.

Gross sales during the reported quarter came in at $1,264.5 million, down 4.2% from the year-ago period. Unit sales during the reported quarter grew 7%, of which organic sales accounted for 4% and acquisitions added 1%.

New product sales were up 18% to $175.3 million year over year. Mix of value-added sales relative to commodity sales surged 67% from the year-ago period.

Retail (41.2% of gross sales): Retail segment sales fell 4% year over year to $521 million during the quarter. Selling prices dropped 10% from the prior-year quarter, offsetting the 6% increase in unit sales. The increase in unit sales was mainly attributable to strong organic growth, driven by sales of Deckorators decking and deck accessories.

Industrial (28.3%): The segment’s sales totaled $357.3 million, reflecting growth of 3% from the year-ago period. During the quarter, unit sales increased 7%, partially offset by 4% lower pricing. Moreover, acquisitions contributed 6% and organic growth added 1% to unit sales growth.

Construction (30.5%): Sales in the segment came in at $386.2 million, down 10% year over year. A 14% decline in selling prices offset the 4% positive impact of unit sales. Unit sales in commercial and residential market rose 5% each while the same increased 1% in manufactured housing market during the quarter.

Operating Highlights

Cost of goods sold, as a percentage of net sales, decreased 230 basis points (bps) to 84.9% compared with 87.2% in the year-ago quarter. Gross margin of 15.1% improved 230 bps to 15.1%.

Selling, general and administrative expenses, accounting for 9.1% of net sales, increased 10 bps year over year. Operating profit in the quarter improved 22% to $74.2 million. EBITDA totaled $90.8 million, indicating an increase of 18.2% year over year.

Balance Sheet & Cash Flow

At the end of the second quarter, cash and cash equivalents were $20.5 million, down from $27.5 million in the comparable year-ago period. Long-term debt and capital lease obligations totaled $187.5 million, down from $276.2 million in the year-ago period.

In the first six months of 2019, net cash provided by operating activities totaled $70.9 million against net cash used in operating activities of $36.1 million in the comparable year-ago period.

Zacks Rank

Universal Forest Products currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

This Could Be the Fastest Way to Grow Wealth in 2019

Research indicates one sector is poised to deliver a crop of the best-performing stocks you'll find anywhere in the market. Breaking news in this space frequently creates quick double- and triple-digit profit opportunities.

These companies are changing the world – and owning their stocks could transform your portfolio in 2019 and beyond. Recent trades from this sector have generated +98%, +119% and +164% gains in as little as 1 month.

Click here to see these breakthrough stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Trex Company, Inc. (TREX) : Free Stock Analysis Report

Universal Forest Products, Inc. (UFPI) : Free Stock Analysis Report

Weyerhaeuser Company (WY) : Free Stock Analysis Report

Louisiana-Pacific Corporation (LPX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance