UnitedHealth (UNH) Grows on Optum Strength, Cost Woes Stay

UnitedHealth Group Incorporated UNH is well poised to grow on the back of solid performance in its Optum and UnitedHealthcare businesses. New deals, renewed agreements and expansion of service offerings are helping the company to grow its profit levels and capture a bigger portion of the market.

Further, an improving commercial business environment is likely to expedite its growth. With the effects of the COVID-19 pandemic slowly wearing off, its commercial business is expected to thrive. As the unemployment rate goes down, employers are buying more and more insurance products for their workers. UNH, with its wide range of product portfolio, is likely to face rising demand for its services.

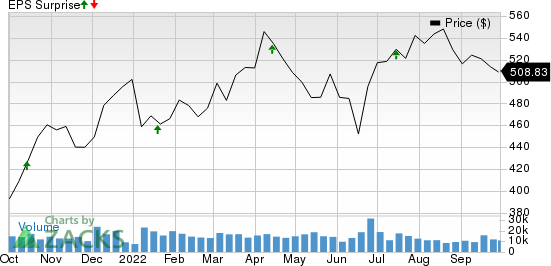

Thanks to its solid performance, UnitedHealth expects adjusted net earnings per share for 2022 to be within the $21.40-$21.90 band, up from the previous projection of $21.20-$21.70. The mid-point of the updated outlook suggests a 13.8% improvement from the 2021 figure. Notably, UNH beat earnings estimates in each of the past four quarters, with an average surprise of 3.7%.

UnitedHealth Group Incorporated Price and EPS Surprise

UnitedHealth Group Incorporated price-eps-surprise | UnitedHealth Group Incorporated Quote

Its health service business, Optum, is becoming increasingly valuable and is crucial to the company’s diversification strategy. The primary growth drivers for Optum are pharmacy care services, care delivery, technology, government services and international operations. Optum’s improved capabilities help UnitedHealth win new contracts.

The company made an extensive collaboration with Walmart Inc. WMT, the renowned operator of retail, wholesale and E-commerce stores worldwide, with an initial aim to benefit Medicare beneficiaries. The deal will enable Optum to back clinicians at Walmart Health with analytics and decision support tools.

UnitedHealth’s competitive product portfolio and efficient execution abilities enable it to win new government contracts. It was recently selected by the Department of Health and Human Services in Nebraska to manage the state's Medicaid program, Heritage Health. Along with UNH, Centene Corporation CNC and Molina Healthcare, Inc. MOH were also chosen to administer the program.

UnitedHealthcare has been present in Nebraska for 26 years and employs more than 750 people in the state. The company has a network of 100 hospitals and over 14,000 physicians and caregivers in Nebraska. It serves more than 500,000 individuals in the state.

UnitedHealth’s healthy balance sheet with strong financial flexibility, marked by consistent cash generated from operations over the years, enables it to take shareholder-friendly moves. This June, the company increased its quarterly dividend by 13.8%. Its dividend has grown at 17.6% per year for the past five years.

The company’s long-term earnings growth potential provides ample capacity to increase the dividend for the years to come. It has also been aggressively repurchasing shares. The company expects to buy back shares worth $5-6 billion this year.

UNH's free cash flow, in the trailing 12-month period, increased 2.8% year over year to $20.5 billion. It expects operating cash flow for 2022 to be around $24 billion, marginally up from $22.3 billion in 2021.

However, there are a few factors that can impede the stock’s growth potential.

UnitedHealth’s rising operating expenses can affect its profit levels. The metric jumped 12.3% last year, primarily due to a rise in medical costs and operating costs. Even in the first half of 2022, the metric further escalated 13.7% year over year to $146.4 billion.

Its global business is facing some headwinds. In 2019 and 2020, membership from its international business fell 8% and 5.2%, respectively. Although it witnessed a recovery in the membership figure last year, the same seems to be on a decline again, with a 0.4% year-over-year fall as of Jun 30, 2022.

UnitedHealth is also grappling with significant interest expenses, which might weigh on the company’s margins. In the first half of 2022, interest expenses increased 11.5% from the year-ago period. Nevertheless, we believe that a systematic and strategic plan of action will drive its long-term growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Molina Healthcare, Inc (MOH) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance