Ultragenyx (RARE) Reports Wider-Than-Expected Loss in Q2

Ultragenyx Pharmaceutical RARE reported adjusted loss per share of $1.89 in the second quarter of 2019 compared with a loss of $1.87 in the year-ago quarter. The loss was also wider than the Zacks Consensus Estimate of a loss of $1.73. The adjusted loss excludes unrealized gain from the fair value adjustment on the investment in Arcturus equity.

For the second quarter, Ultragenyx reported $24.1 million in total revenues, up from $12.8 million in the year-ago quarter. Revenues exceeded the Zacks Consensus Estimate of $22 million.

Ultragenyx recognized $20.2 million in total Crysvita revenues. This includes $17.3 million of collaboration revenues in the U.S. profit share territory and $1.9 million of royalty revenues in the European territory from the collaboration and license agreement with Japanese partner, Kyowa Hakko Kirin. Net product sales for Crysvita in other regions were $1 million. Revenues also include $0.1 million received from Bayer BAYRY in relation to Ultragenyx’s research agreement with the former to develop adeno-associated virus gene therapies. Mepsevii product revenues were $3.2 million and UX007 revenues were $0.6 million.

Please note that though UX007 is not an approved product, the company recognizes sales from the candidate on a “named patient” basis. This is allowed in certain countries prior to the commercial approval of a product.

Crysvita is approved in the United States for the treatment of X-linked hypophosphatemia (XLH) in patients aged one year or older. The drug continues to deliver a strong performance in the United States. It was approved in Brazil for the treatment of XLH in patients aged a year or older.

Mepsevii, an enzyme replacement therapy, is the first and the only medicine approved for the treatment of children and adults with mucopolysaccharidosis VII (MPS VII) in the United States.

Shares of Ultragenyx have soared 39% year to date, compared with the industry's growth of 0.7%.

Pipeline Updates

The company submitted a new drug application (NDA) to the FDA for UX007 for the treatment of Long-Chain Fatty Acid Oxidation Disorders (LC-FAOD). The company expects to hear back from the agency on submission acceptance and review designation within 60 days.

The company reported positive longer-term results from the first cohort of phase I/II study of DTX401 gene therapy in Glycogen Storage Disease Type Ia (GSDIa). Data from the second-dose cohort of the phase I/II study in GSDIa is expected in the third quarter of 2019.

The company reported data from the first two dose cohorts of DTX301 gene therapy in Ornithine Transcarbamylase (OTC) deficiency. The data demonstrated that the two responders maintained ureagenesis levels above normal for 78 and 52 weeks. DTX301 phase I/II data from the third dose cohort are expected in the third quarter of 2019.

The company expanded the research collaboration and the license agreement collaboration with Arcturus Therapeutics ARCT to develop additional nucleic acid therapies. The agreement with Arcturus Therapeutics now includes the discovery and development of mRNA, DNA and siRNA therapeutics for up to 12 rare disease targets

Our Take

Ultragenyx reported a wider-than-expected loss and beat sales estimates in the second quarter of 2019. The company looks forward to expanding the global commercial reach of its approved therapies, submitted an NDA for UX007 and plans to advance its gene-therapy platform toward pivotal studies.

It expects strong momentum from the Crysvita launch in the United States.

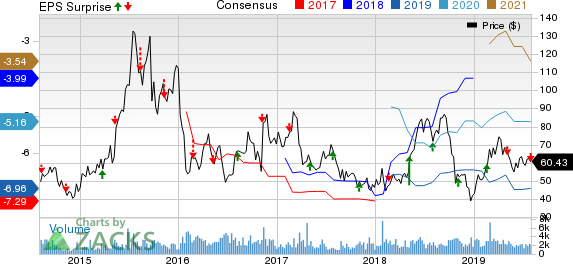

Ultragenyx Pharmaceutical Inc. Price, Consensus and EPS Surprise

Ultragenyx Pharmaceutical Inc. price-consensus-eps-surprise-chart | Ultragenyx Pharmaceutical Inc. Quote

Zacks Rank and A Stock to Consider

Ultragenyx currently carries a Zacks Rank #3 (Hold).

A better-ranked stock in the biotech sector is Alnylam Pharmaceuticals Inc. ALNY, sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alnylam’s loss per share estimates have narrowed from $6.88 to $6.43 for 2020 in the past 60 days. The company delivered a positive earnings surprise in three of the trailing four quarters, with the average positive surprise being 8.93%.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bayer Aktiengesellschaft (BAYRY) : Free Stock Analysis Report

Ultragenyx Pharmaceutical Inc. (RARE) : Free Stock Analysis Report

Alnylam Pharmaceuticals, Inc. (ALNY) : Free Stock Analysis Report

Alcobra Ltd. (ARCT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance