Ulta Beauty (ULTA) Down 2.9% Since Earnings Report: Can It Rebound?

A month has gone by since the last earnings report for Ulta Beauty Inc. ULTA. Shares have lost about 2.9% in that time frame.

Will the recent negative trend continue leading up to its next earnings release, or is ULTA due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Ulta Beauty Beats on Q1 Earnings and Sales

Ulta Beauty began fiscal 2018 on a solid note with first-quarter results beating the estimates and improving year over year. With this, the company reverted to its more than three-year long positive earnings trend, after a miss in the preceding quarter. Also, it reported sales beat in 16 of the last 18 quarters. While management issued guidance for the second quarter, it raised earnings view for fiscal 2018.

Q1 Numbers

Ulta Beauty posted adjusted earnings of $2.63 per share, which outpaced the Zacks Consensus Estimate of $2.48. Also, the bottom-line figure surged 37.7% year over year. Including gains from income tax accounting for share-based compensation, earnings per share were $2.70 compared with $2.05 in the prior-year quarter. Results benefited from the company’s store expansion efforts, comps growth along with impressive e-commerce sales and salon operations.

Net sales of this cosmetics retailer increased 17.4% year over year to $1,543.7 million. The reported figure surpassed the Zacks Consensus Estimate of $1,526 million. We note that Ulta Beauty adopted Accounting Standards Codification (ASC) Topic 606, Revenue from Contracts with Customers on Feb 4. Including the effect from adoption of this new revenue standard, the company’s top line grew by $14.1 million in the reported quarter.

Comps (including stores and e-commerce) increased 8.1% compared with 14.3% in the prior-year quarter. This upside was backed by favorable traffic and ticket along with stupendous e-commerce improvement. While the company registered transaction growth of 5.1%, average ticket was up 3% in the fiscal first quarter.

Retail business (comprising retail and salon) witnessed comps growth of 4.7%, which includes 3.2% improvement in salon comps. Sales for the salon business grew 10.1% to $75.7 million. Also, Ulta Beauty witnessed a 48% surge in e-commerce sales to $154.4 million, reflecting about 340 basis points (bps) of total comps growth in the quarter.

Gross profit rose 17.8% year over year to $560.7 million. Additionally, gross profit margin expanded 10 bps to 36.3% owing to the impact of new revenue recognition accounting and lower fixed store costs. This metric was somewhat offset by category and channel mix shifts along with investments in the salon services and supply chain activities. Including the impact from adoption of this new revenue standard, gross margin increased 50 bps.

While operating income expanded 11.4% year over year to $209.8 million, operating margin contracted 70 bps to 13.6%. The decrease in operating margin can be attributed to a rise of 80 bps in SG&A expenses (as a percentage of sales). Also, pre-opening expenses were up 29.5% to $5.2 million.

Other Financials

Ulta Beauty ended the quarter with cash and cash equivalents of $231.9 million, short-term investments of $237.1 million and shareholders’ equity of $1,783.4 million. Merchandise inventories totaled $1,136.8 million, marking an increase of 8.4% from the year-ago period. However, average inventory per store dipped 3%.

Net cash provided by operating activities came in at roughly $277.3 million at the end of the first quarter.

In the reported quarter, management bought back 618,551 shares for a total of $133.1 million. With this, the company had nearly $529.2 million outstanding authorization as of May 5, 2018, under its $625 million share repurchase plan announced in March this year.

Store Updates

In the fiscal first quarter, Ulta Beauty opened 34 stores while shuttered one store. With this, the company operated 1,107 stores at the end of the quarter while increasing its total square footage by 11.6% year over year.

In fiscal 2018, the company plans to open 100 stores and remodel or relocate 15 outlets.

Guidance

Ulta Beauty remains impressed with a year-over-year improvement in the top and bottom line owing to continued market share gains and benefits from strategic initiatives. Management updated its guidance for second-quarter and fiscal 2018.

For the fiscal second quarter, the company anticipates net sales in the $1,475-$1,488 million band compared with 1,289.9 million in the prior-year quarter. Comps, including e-commerce sales, are predicted to grow 6-7% compared with an 11.7% rise in second-quarter fiscal 2017.

Earnings per share for the impending quarter are envisioned in the range of $2.35-$2.40 compared with $1.83 in the comparable quarter, last fiscal. The Zacks Consensus Estimate for second-quarter earnings stands higher at $2.50 but is likely to witness a downward revision.

For fiscal 2018, Ulta Beauty still expects total sales to grow in low teens’ percentage with comps growth (including e-commerce) in the range of 6-8%. Further, the company continues to anticipate e-commerce sales growth in the 40% range. However, operating margin is projected to decline in the band of 50-70 bps.

As a result, management envisions GAAP earnings per share to grow in the low 20% range versus the earlier guidance of roughly 20% range. The guidance is inclusive of nearly $500 million impact from share repurchases. Also, the company assumes an effective tax rate of 24% for fiscal 2018.

Ulta Beauty still plans to deploy about $375 million toward capital expenditures this year compared with $441 million incurred last year.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed a downward trend in fresh estimates. There have been 11 revisions lower for the current quarter.

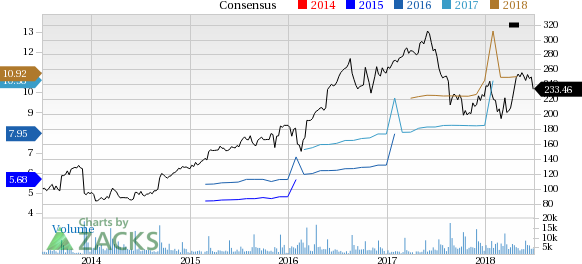

Ulta Beauty Inc. Price and Consensus

Ulta Beauty Inc. Price and Consensus | Ulta Beauty Inc. Quote

VGM Scores

At this time, ULTA has a great Growth Score of A, though it is lagging a bit on the momentum front with a B. The stock was allocated a grade of C on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of A. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our scores, the stock is primarily suitable for growth investors while also being suitable for those looking for momentum and to a lesser degree value.

Outlook

Estimates have been broadly trending downward for the stock and the magnitude of these revisions indicates a downward shift. Notably, ULTA has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ulta Beauty Inc. (ULTA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance