Predictions for UK economy stop getting worse — but remain dire

Forecasts for the UK economy stopped worsening in September, suggesting the deepening pessimism about Britain’s financial future may have reached its nadir.

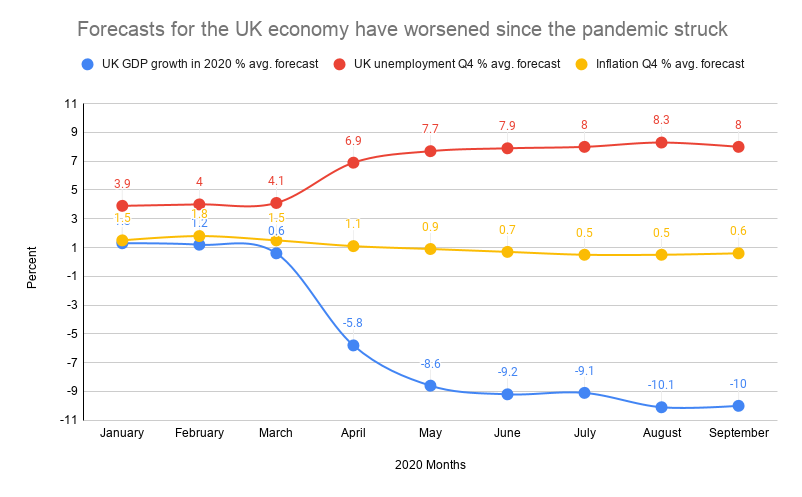

Private sector forecasts compiled by the UK Treasury show the outlook for the UK economy has improved marginally over the last month. An average of 18 new forecasts made by banks and think tanks since the start of September found improving expectations for GDP growth, unemployment, inflation, public sector borrowing, and the current account deficit.

The average forecast for UK GDP growth in 2020 is now -10%, compared to -10.1% in August. Unemployment is now expected to peak at 8% by the end of the year, compared to a forecast of 8.3% last month.

Watch: Why job losses have risen despite the economy reopening

On Wednesday, the OECD also said the outlook for the UK economy had improved, in-line with a broader upgrade to forecasts for the global economy. The OECD said it now expects UK GDP to shrink by 10.1% this year, compared to its June forecast of a 11.5% decline.

While the differences are slight, the uptick could signal that pessimism about the UK economy has bottomed out. Most measures of UK economic health have declined steadily since the pandemic struck in March, according to Treasury figures.

READ MORE: UK inflation falls sharply as Eat Out to Help Out cuts average prices

“Forecasters will likely be in the process of revising up their 2020 GDP numbers but could end up revising down their 2021 estimates,” David Owen, a European economist at investment bank Jefferies, said on Wednesday.

Recent UK economic data, including employment data, had been better than many expected, Owen said. Jefferies’ own “Economic Activity Radar” showed activity was now at 65% of pre-pandemic levels — its highest level since March.

However, the rising possibility of a no deal Brexit in the new year could derail the recovery, Owen said.

READ MORE: UK employers have cut 695,000 jobs since March as unemployment rate rises

The Treasury’s figures, which were published on Wednesday, showed a slight improvement in forecasts for next year. GDP is now expected to grow by 7% in 2021, compared to an average forecast of 6.5% in August.

However, the Treasury collected data only up until 10 September — the day most in the City saw no deal Brexit risks rising sharply. The forecasts are therefore unlikely to factor in the possibility of a disorderly exit from the EU.

Watch: What is a no-deal Brexit and what are the potential consequences?

Economists warned this week that the UK’s future remained uncertain due to surging COVID-19 cases in the UK and the rising risk of a no deal Brexit.

READ MORE: UK firms warn on 'triple threat': Local lockdowns, furlough wind-up and Brexit disruption

“Beyond September... the recovery likely will stall, not least because COVID-19 is resurging,” Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said this week.

“People likely still will retreat to their homes, if, as seems likely from the example of other European countries, the upward trend in new infections is sustained. Activity in sectors requiring close human contact likely will fall back, while output in the transport services sector probably will remain well below pre-COVID levels.”

Anna Titareva, an economist at UBS, said the speed of the UK’s recovery remains “highly uncertain” with “significant downside risks.”

Nomura’s global economics team said the recent bounce in UK economic activity could be difficult to sustain.

“We expect the UK’s recovery to look like a truncated-V,” the Japanese investment bank wrote in a note this week.

Yahoo Finance

Yahoo Finance