UK banknote printer De La Rue profit jumps seven-fold

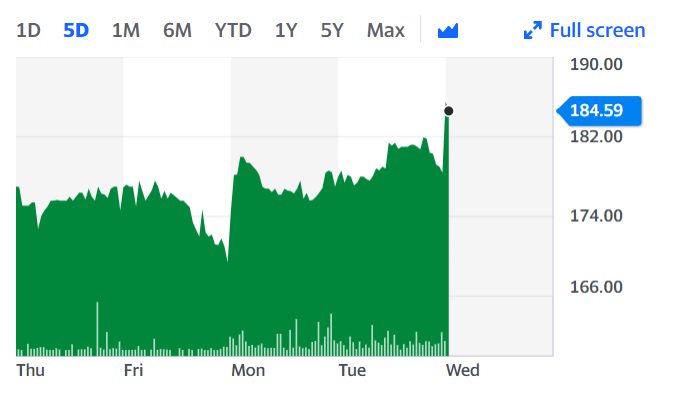

UK banknote printer De La Rue (DLAR.L) saw a huge jump in its adjusted operating profit for the first half of 2020/21, which it credited to its turnaround plan that included cost reduction programmes. However, shares ticked 2.3% lower as markets opened on Wednesday morning.

It posted an adjusted operating profit of £15.3m ($20.4m), up £2.2m year-on-year, a seven-fold increase, or a jump of nearly 600%.

The figure “represents significant improvement resulting from the ongoing implementation of the turnaround plan, including benefits from the reorganisation and cost reduction programmes,” the company said in a statement.

It said the its cost reduction plan was on track to contribute £23m of savings in 2020/21. In other positive news for the first half, its exclusive Bank of England banknote printing contract has been extended to 2028 and its net debt was down to £21.6m from £170.7m at this time last year.

The reduction in net debt was “principally due to equity capital raise, offset in part by cash spend on the turnaround plan,” it explained.

However, gross profit was down 3.7% to £49.4m and IFRS (International Financial Reporting Standard) revenue fell 22.6% to £179.7m.

READ MORE: Rishi Sunak pledges £2.9bn to help 1 million people find work

It said this was “mainly due to the decline in Identity Solutions revenue as a result of the sale of the International Identity Solutions business in October 2019 and the run-off of the UK passport contract.”

CEO Clive Vacher said the first half results “have shown a substantial improvement in the Group's performance, with very strong growth in adjusted operating profit as we increase efficiencies, resulting in positive cash generation from operating activities.”

"Our two ongoing divisions, Authentication and Currency, are performing well. We are building strong order books and have secured a number of important strategic wins in the first half of the year,” he added.

He also said the company’s outlook for revenue, adjusted operating profit and net debt for the full year in line with the board's expectations.

WATCH: Why can't governments just print more money?

Yahoo Finance

Yahoo Finance