UBS Group's (UBS) Q3 Earnings Impress on Lower Expenses

UBS Group AG UBS reported third-quarter 2021 net profit attributable to shareholders of $2.3 billion, up 9% from the prior-year quarter.

The company’s performance was supported by an 18% increase in the net fee and commission income, year over year, along with a 12% rise in the net interest income. Also, net credit loss release acted as a tailwind. Moreover, drop in expenses was a positive.

Performance of almost all the segments of UBS Group, except the Asset Management segment, was impressive during the quarter. It recorded higher profitability in the Global Wealth Management, Investment Bank and Personal & Corporate Banking segments.

Operating Income Climbs, Expenses Fall

UBS Group’s operating income increased 2% to $9.13 billion from the prior-year quarter. Operating expenses edged down 1% to $6.3 billion in the third quarter. This fall was due to lower personal expenses, general and administrative expenses as well as depreciation and impairment of property, equipment and software.

The company reported net credit loss releases of $14 million in the quarter as against the expense of $89 million witnessed in the year-ago quarter.

Business Division Performance

Global Wealth Management’s operating profit before tax was $1.5 billion, up 43% year over year. Higher recurring net fee income and net new fee-generating assets supported the company.

Asset Management’s operating profit of $214 million slumped 71%, year over year, primarily due to lower performance fees, as well as exclusion of the $571-million gain from the sale of a majority investment in Fondcenter AG (now Clearstream Fund Centre AG) in the third quarter of 2020. Also, invested assets dropped 1.5% sequentially to $1.15 trillion.

Personal & Corporate Banking reported operating profit before tax of $478 million, up 43% year over year. Revenues from credit card and foreign-exchange transactions mainly boosted the transaction-based income, marking a gradual rise in travel and leisure spending by clients as pandemic restrictions ease.

The Investment Bank unit’s operating profit before tax was $837 million, up 32% from the prior-year quarter, on solid Advisory and Capital Market revenues and lower expenses. However, lower revenues from Global Markets were an offsetting factor.

Group Functions incurred an operating loss before tax of $180 million in the reported quarter compared with the loss of $184 million witnessed in year-ago quarter.

Strong Capital Position

As of Sep 30, 2021, UBS Group's invested assets improved 16% at $4.5 trillion. Total assets increased slightly to $1.09 trillion from the previous quarter.

The company’s common equity tier (CET) 1 ratio was 14.9 % as of Sep 30, 2021, compared with 13.3% on Sep 30, 2020. CET 1 capital increased 18% to $45 billion. Fully applied risk-weighted assets increased 6.8% to $302.4 billion from the year-ago quarter.

Our Take

The company’s third-quarter performance seems impressive. UBS Group’s restructuring initiatives to free resources will likely boost its operating efficiency in the quarters ahead. However, the low interest-rate environment is a key headwind.

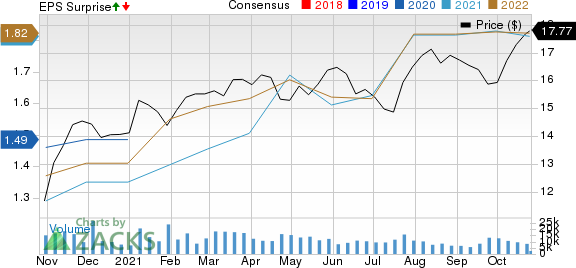

UBS Group AG Price, Consensus and EPS Surprise

UBS Group AG price-consensus-eps-surprise-chart | UBS Group AG Quote

Currently, UBS Group carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Major Banks

Bank of America’s BAC third-quarter 2021 earnings of $1.03 per share handily beat the Zacks Consensus Estimate of 77 cents. The bottom line compared favorably with the 37 cents earned in the prior-year quarter.

PNC Financial PNC pulled off a third-quarter earnings surprise of 42.4% on substantial reserve release. The adjusted earnings per share of $4.50 exceeded the Zacks Consensus Estimate of $3.16.

Large reserve releases, solid investment banking performance and a modest rise in loan demand drove JPMorgan’s JPM third-quarter 2021 earnings of $3.78 per share. The bottom line comfortably outpaced the Zacks Consensus Estimate of $3.05.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank of America Corporation (BAC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

The PNC Financial Services Group, Inc (PNC) : Free Stock Analysis Report

UBS Group AG (UBS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance