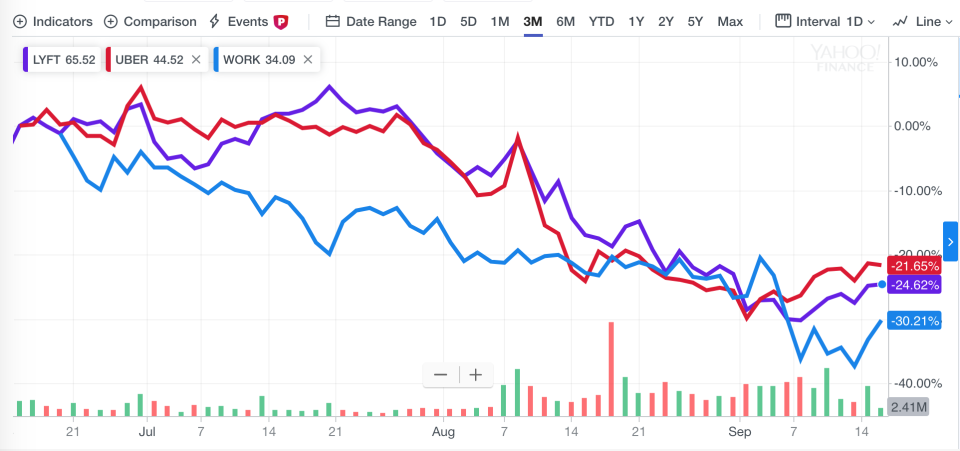

Uber, Lyft stock performance shows 'appetite for risk has diminished'

Lyft stock is down 39% from its March 29 IPO price. Uber is down 18% from its May 10 debut. Slack is down about 28% since its June 20 direct listing. Gig economy platform Fiverr has sunk 47% since its June 13 IPO. Secondhand clothing site The Real Real, which soared 40% on its June 28 IPO date, is down 42% since.

And on Tuesday, WeWork parent The We Company confirmed reports that it will hold off on its planned IPO, but still aims to go public before the end of 2019. Sentiment around the company has turned extremely negative since the release of its S-1 form.

And this is happening amid a bull market.

What happened to the much-hyped march of the unicorn IPOs?

If you ask Rebecca Felton, chief market strategist for Riverfront Investment Group, it’s simple: “I think the appetite for risk has certainly diminished.”

Felton adds that the negative reception speaks volumes to “where we are in the cycle.”

Year to date, the S&P 500 is up 21% and markets have come close to all-time highs, and yet recession fears linger due to macro factors like the U.S.-China trade war and slowdowns abroad.

Some investors just don’t see appeal right now in buying shares of money-losing tech names.

Not all recently debuted tech stocks have underperformed. Enterprise software plays like Zoom have received warmer welcomes—shares of the teleconferencing company are up 25% since its IPO.

Of course, WeWork is a singular case with its own specific problems: heavy losses, no clear plan to become profitable, and governance issues around the power and control of CEO Adam Neumann. But analysts point to WeWork as Exhibit A of the problem with tech IPOs right now.

“If you take a step back, it's really what's broader going on in the IPO market,” says Wedbush analyst Dan Ives. “And I think this all started with Uber and Lyft.” Investors are now viewing the steep losses of these companies as a red flag, and are lately less willing to believe that profitability will come.

WeWork, Ives says, has now “become the poster child” for the whole pack of sickly unicorns.

—

Daniel Roberts is a senior writer and show host at Yahoo Finance. Follow him on Twitter at @readDanwrite.

Uber is taking a page from the Amazon playbook

Netflix stock is vulnerable in a recession, Nomura says

Meet the ‘phoenix’ stocks: Zoom, MongoDB, PagerDuty and more

How Eventbrite’s horrible stock performance is hurting Square

Yahoo Finance

Yahoo Finance