Uber asks Canadian riders to oppose new HST charge

Uber wants its customers to stand up to the Canadian government for “affordable transportation.”

On March 22, the Liberal government’s second budget proposed a levy on Uber and other ride-hailing services that would add GST/HST. Currently charged on traditional taxi services, this new tax will add only $3 million in federal revenues but appears to be aimed at creating tax fairness.

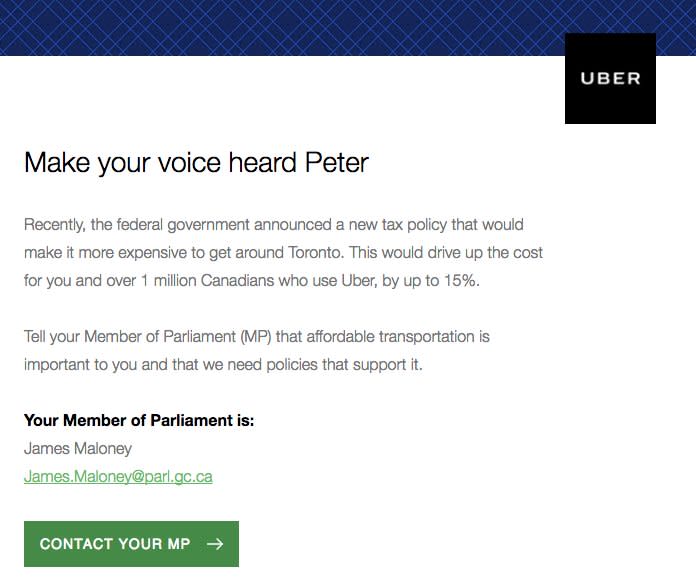

In its online Newsroom, Uber warns riders their costs could increase by up to 15 per cent and urges them to contact their Member of Parliament. It also sent emails reiterating this information to individual app users.

The issue highlighted by Uber is that most small business owners do not have to charge sales tax (HST/GST) unless they make more than $30,000 annually. However, Canada Revenue Agency states that self-employed taxi or limousine drivers in the taxi business have to register for the GST/HST regardless. The murkiness comes from whether or not ride sharing companies classify as taxi businesses.

This issue is not new. It came up in 2015, when Uber responded to complaints from Toronto City Councillor Jim Karygiannis over non-payment of HST by saying it was the responsibility of individual drivers to collect and file HST.

As for the millennials who are frequent users of the ride-share service, it’s likely their focus will be on the bottom line. Company culture didn’t factor into usage rates. It’s likely the avoidance of corporate tax won’t either. A new survey found that 93 per cent of millennials who use Uber will continue to use the app despite sexual harassment allegations and a highly publicized dashcam video showing CEO Travis Kalanick being rude to a driver.

Yahoo Finance

Yahoo Finance