U.S. Silica (SLCA) to Cut Costs, Idle Utica and Tyler Mines

U.S. Silica Holdings, Inc. SLCA announced a reduction of roughly 230 employees in its workforce. The reduction equals roughly 10% of the company’s workforce and includes corporate employees as well as idling of both Utica and Tyler mines. Other facilities impacted but not idled by the action are Sparta, WI; Crane County, TX; and Festus, MO.

With the move, the company aims to boost efficiencies, and better align support staffing and operations, with current challenges in energy markets. Annual SG&A savings from the action and other cost reductions are anticipated to be $20 million. The workforce reduction is expected to reduce staffed O&G capacity by 7 million tons.

Per the company, the actions will likely protect margins and generate free cash flow in the competitive oil and gas completions market. Moreover, the move will also likely realign its cost structure and operational footprint to serve energy customers more efficiently and at the same time support anticipated growth of its Industrials & Specialty Products segment.

The company anticipates incurring $1.7 million in related severance costs in the fourth quarter of 2019.

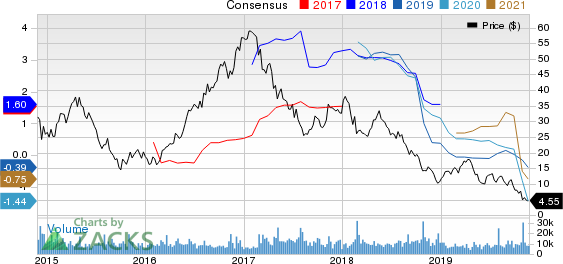

Shares of U.S. Silica have plunged 67.4% in the past year against the industry’s 6.7% growth.

In the third quarter, the company witnessed delays in purchasing decisions by certain customers in the Industrial & Specialty Products unit. Increased uncertainty in global industrial markets, intensified by tariffs, political uncertainty and increasing risk of economic slowdown, makes it tough for U.S. Silica to provide an outlook. The fourth quarter is usually characterized by a seasonal decrease in profitability of roughly 10%, per the company.

It expects a slowdown in North America completion activity to unfavorably impact the Oil & Gas unit’s fourth-quarter results. The company expects Oil & Gas sand volume to decline 10% sequentially in the fourth quarter.

U.S. Silica Holdings, Inc. Price and Consensus

U.S. Silica Holdings, Inc. price-consensus-chart | U.S. Silica Holdings, Inc. Quote

Zacks Rank & Stocks to Consider

U.S. Silica currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the basic materials space are Impala Platinum Holdings Ltd. IMPUY, Franco-Nevada Corporation FNV and Agnico Eagle Mines Limited AEM, each currently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Impala Platinum has an expected earnings growth rate of 255.2% for the current fiscal year. The company’s shares have surged 222.9% in the past year.

Franco-Nevada has a projected earnings growth rate of 46.2% for 2019. The company’s shares have rallied 40.9% in a year.

Agnico Eagle has an estimated earnings growth rate of 168.6% for the current year. Its shares have moved up 68.1% in the past year.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through Q3 2019, while the S&P 500 gained +39.6%, five of our strategies returned +51.8%, +57.5%, +96.9%, +119.0%, and even +158.9%.

This outperformance has not just been a recent phenomenon. From 2000 – Q3 2019, while the S&P averaged +5.6% per year, our top strategies averaged up to +54.1% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Franco-Nevada Corporation (FNV) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

U.S. Silica Holdings, Inc. (SLCA) : Free Stock Analysis Report

Impala Platinum Holdings Ltd. (IMPUY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance