U.S. consumers paint a mixed picture ahead of the holiday season

On Thursday, we got a mixed picture of the U.S. consumer ahead of the holiday season.

Earnings out of Walmart (WMT) showed that in the third quarter shoppers were streaming into the company’s stores and increasing their spending online.

Same-stores sales at Walmart’s U.S. stores rose 3.4% in the third quarter and Sam’s Club saw same-stores sales rise 3.2%. Walmart’s eCommerce business saw U.S. sales rise 43% over last year.

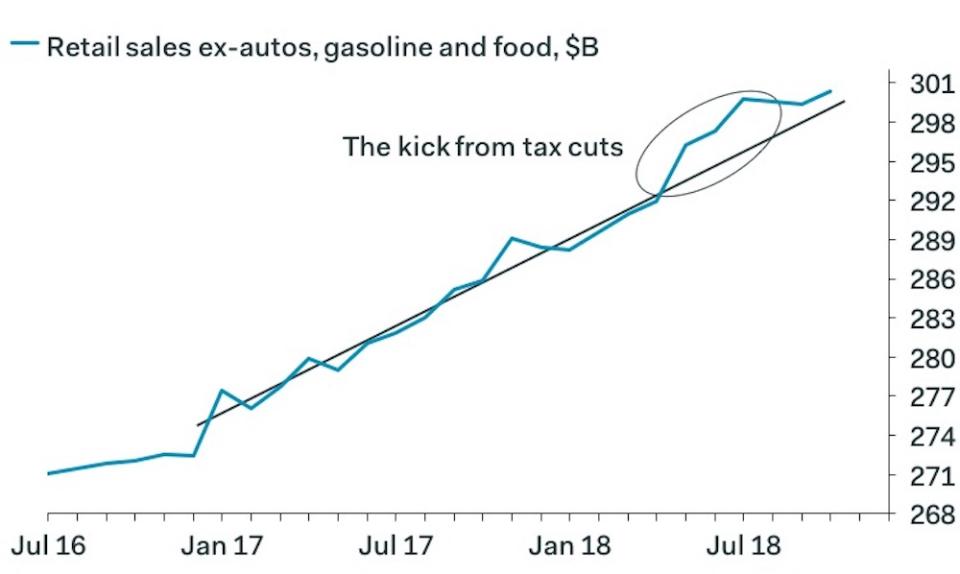

But October’s retail sales report indicated that while consumer spending continues to grow, the post-tax cut boost we saw to the consumer is starting to fade a bit.

Headline retail sales rose 0.8% last month, more than the 0.5% jump that was forecast. But “Control Group” retail sales, which strip out volatile items like food, auto sales, and building materials, rose 0.3% in October against a forecast for a 0.4% jump in this data. This group is closely watched by economists because this retail data feeds into the GDP calculation.

Ian Shepherdson, chief economist at Pantheon Macroeconomics, focuses on a core group of retail sales that excludes autos, food, and gas, which also rose 0.3% in October. Shepherdson noted Thursday that over the last three months, the annualized increase in sales from his core group is just 2.7%, the slowest pace since March and well below the 9.9% 3-month annualized pace of sales seen through July.

“This looks very much like the end of the boost from the tax cuts, and it strengthens our conviction that GDP growth has peaked,” Shepherdson said Thursday.

And though the boost from tax cuts may be fading, the holiday shopping season should still be strong, according to economists at Oxford Economics. In a note Thursday, the firm said that while October’s control group sales may be disappointing, back-to-back months of control retail sales rising 0.3% “[points] to solid momentum which bodes well for consumer spending as we head into the holiday season.”

Oxford Economics expects holiday sales will rise 4.6% this year after a 5.3% jump in 2017. Earlier this month, data from research firm eMarketer said 2018 will likely be the first trillion-dollar holiday shopping season in the U.S., with the firm forecasting a 5.8% jump in holiday sales to $1.002 trillion.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Yahoo Finance

Yahoo Finance