The US-China billionaire race is heating up

The U.S. might have the largest concentration of billionaire wealth, but China’s billionaires are a rapidly growing class of individuals. According to UBS and PwC’s annual Billionaire Insights Report, the two companies forecast that China could eventually overtake the US as the global “billionaire hotspot.”

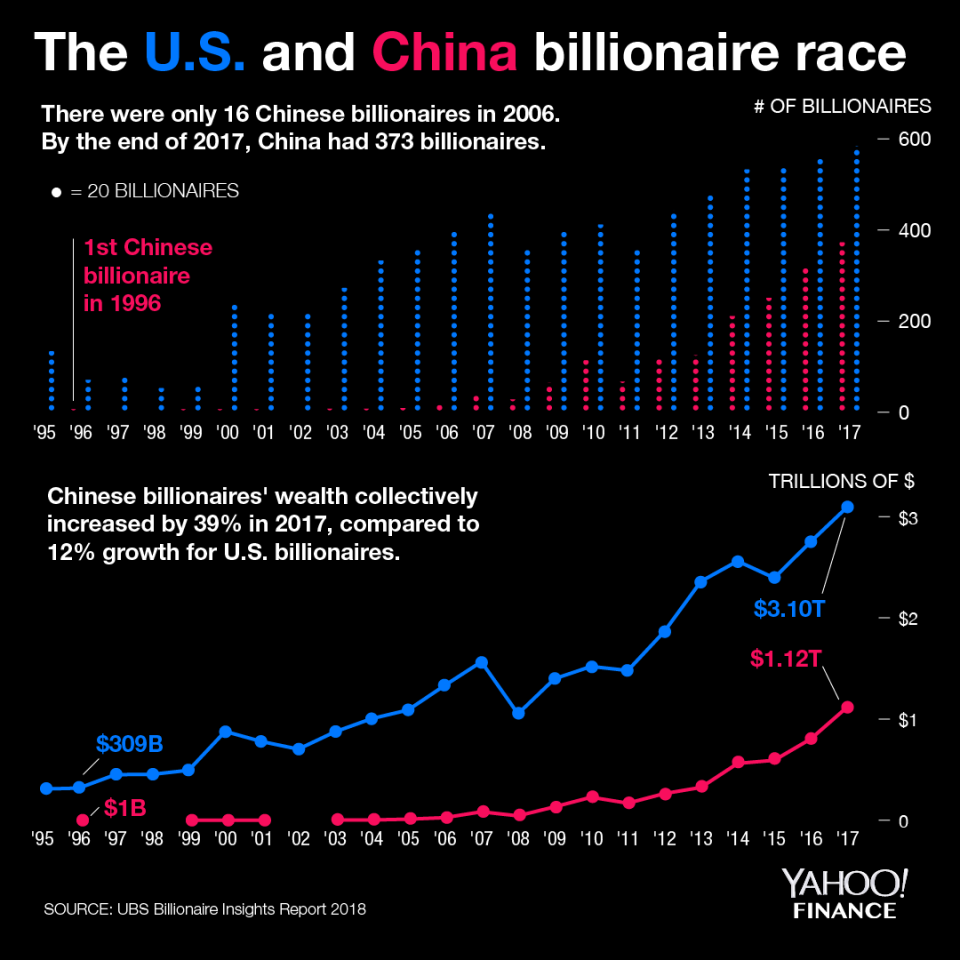

In 2006, there were just 16 billionaires in China. The latest report found 373 within mainland China, and 475 billionaires in Greater China (which includes Hong Kong and Taiwan). That compares to 631 in the U.S.

China’s billionaires are quickly building wealth

According to UBS/PwC, Chinese billionaire wealth “increased by 39% to $1.12 trillion” in 2017. U.S. billionaire wealth growth grew 12% to $3.1 trillion last year. Age is also a factor: While the average age of billionaires globally is 64, it’s 55 in China.

UBS/PwC noted that China’s billionaires often have a high turnover, as 51 people dropped off the list in 2017, “illustrating the risks of doing business in China.” Nevertheless, the report found that more than two Chinese billionaires were minted each week. “By the end of the year, there were 55 net new billionaires.” (There were 30 American entrepreneurs who gained billionaire status in 2017.)

Overall, the world’s billionaires saw the “biggest wealth increase ever in 2017, with aggregate wealth among these 2,158 (and counting) individuals growing by $1.4 trillion to $8.9 trillion, a 19% leap.”

‘The growth of China’s e-commerce and technology businesses exploded’

UBS/PwC noted that China’s “outstanding economic and market conditions made it ideal for wealth creation.” China’s real GDP grew by 6.9% in 2017.

“The growth of China’s e-commerce and technology businesses exploded in 2017,” UBS/PwC wrote. Significantly, China has 770 million internet users to utilize these homegrown industries.

From the new group of billionaires, 7% of the Americans founded businesses less than 10 years ago while the number for China came in at 17%.

“This is the Chinese phenomenon,” John Mathews, head of ultra-high net worth Americas at UBS Global Wealth Management, previously told Yahoo Finance. “There is such massive growth going on in Asia, particularly in China.”

Notable American billionaires include Jeff Bezos (AMZN), Bill Gates (MSFT), Warren Buffett (BRK-A), Mark Zuckerberg (FB), and the Koch Brothers. China’s billionaires of note include Tencent CEO Ma Huateng (TCEHY) to Alibaba Co-founder Jack Ma (BABA) and Evergrande Group Chairman Hui Ka Yan.

Adriana is an associate editor for Yahoo Finance. Follow her on Twitter @adrianambells.

READ MORE:

More billionaires were created than ever before last year, and they’re richer too

China mints two new billionaires a week as Asia is set to overtake US as billionaire hotspot

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Yahoo Finance

Yahoo Finance