U.S. Bancorp (USB) Q3 Earnings Top Estimates, Costs Increase

U.S. Bancorp USB reported third-quarter 2021 earnings per share of $1.30, which surpassed the Zacks Consensus Estimate of $1.16. The bottom line compared favorably with the prior-year quarter’s figure of 99 cents.

Lower revenues along with escalating expenses were the key worrying factors. Nonetheless, reserve releases and loan balance growth favorably impacted results. Also, the capital position remained strong.

Net income was $2.03 billion compared with the prior-year quarter’s $1.6 billion.

Revenues Decline, Costs Flare Up

In the third quarter, U.S. Bancorp’s total revenues were $5.86 billion, down 1.7% year over year. Nonetheless, the top line outpaced the Zacks Consensus Estimate of $5.77 billion.

U.S. Bancorp’s tax-equivalent net interest income totaled $3.2 billion in the reported quarter, down 1.7% from the prior-year quarter. The decline mainly stemmed from changes in loan portfolio composition and lower average loan volumes, partially mitigated by deposit and funding mix, and elevated loan fees.

Average earning assets climbed 3.5% year over year, supported by growth in average investment securities and average other earning assets, primarily driven by higher cash balances. However, the net interest margin of 2.53% shrunk 14 basis points, mainly due to declining interest rates on loan yields, the earning assets mix and lower reinvestment yields in the investment portfolio, partially offset by the net benefit of funding composition and higher loan fees.

U.S. Bancorp’s non-interest income decreased marginally on a year-over-year basis to $2.69 billion. The fall was mainly owing to lower mortgage banking revenues, commercial products revenues related to slower capital markets activities and other non-interest income offset by an improving payment service revenue growth, trust and investment management fees, deposit service charges, treasury management fees and investment products fees.

Provision for credit losses in the reported quarter was a benefit of $163 million against provisions of $635 million in the prior-year quarter.

U.S. Bancorp’s average total loans improved marginally sequentially to $297 billion. This stemmed from higher residential mortgages, credit card loans and other loans.

Average total deposits were up marginally from the prior quarter to $431.5 billion. The uptick resulted from growth in non-interest-bearing deposits.

U.S. Bancorp’s non-interest expenses climbed 1.2% year over year to $3.43 billion. The rise mainly resulted from elevated compensation, net occupancy and equipment, marketing and business development, professional services, posting, printing and supplies, and other tangibles. However, this was partly muted by reduced employee benefits, technology and communications, and other non-interest expenses to some extent.

Efficiency ratio was at 58.4%, higher than the year-ago quarter’s 56.6%. An increase in the ratio indicates a fall in profitability.

Credit Quality Strong

Net charge-offs were $147 million, down 71.5% year over year. On a year-over-year basis, the company witnessed improvement across all loan categories.

U.S. Bancorp’s non-performing assets were $944 million, down 25.7% year over year. Total allowance for credit losses was $6.3 billion, down 21.4%.

Healthy Capital Position

In the third quarter, U.S. Bancorp maintained a solid capital position. The Tier 1 capital ratio came in at 11.7% compared with the prior-year quarter’s 11%. Common equity Tier 1 capital to risk-weighted assets ratio under the Basel III standardized approach fully implemented was 10.2% as of Jun 30, 2021, up from 9.4% reported in the year-ago quarter.

All regulatory ratios of U.S. Bancorp continued to be more than well-capitalized requirements. In addition, reflecting the full implementation of the current expected credit losses methodology, the Tier 1 capital to risk-weighted assets ratio was 9.7 % as of Sep 30, 2021.

U.S. Bancorp posted an improvement in book value per share, which increased to $32.22 as of Sep 30, 2021, from $30.93 recorded at the end of the year-earlier quarter.

The tangible common equity to tangible assets ratio was 6.8 % as of Sep 30, 2021, down from the prior-year quarter’s 7%.

Capital Deployment Update

During the third quarter, the company approved a 9.5% dividend hike, payable in October 2021. It also suspended share repurchases at the beginning of the third quarter due to its recent acquisition of MUFG Union Bank’s core regional banking franchise.

Conclusion

U.S. Bancorp put up a decent performance in the third quarter. The revenue decline, affected by margin contraction, is likely to continue. Though escalating expenses remain a problem, the capital position is expected to stay decent.

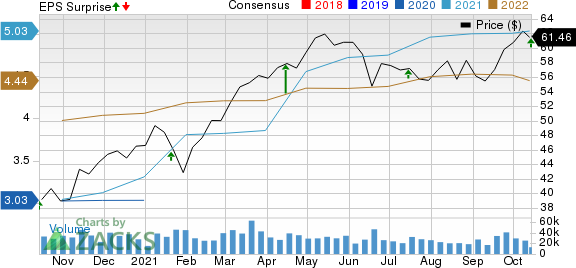

U.S. Bancorp Price, Consensus and EPS Surprise

U.S. Bancorp price-consensus-eps-surprise-chart | U.S. Bancorp Quote

U.S. Bancorp currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other banks, PNC Financial PNC and Goldman Sachs GS are slated to report quarterly results on Oct 15, while Northern Trust Corporation NTRS will announce on Oct 20.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

The PNC Financial Services Group, Inc (PNC) : Free Stock Analysis Report

U.S. Bancorp (USB) : Free Stock Analysis Report

Northern Trust Corporation (NTRS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance