Two signs of strain on the global economy just came out from Japan

Two fresh signs of strain on the global economy were delivered by Japan today, after the country unveiled that exports slipped for the eighth consecutive month in July.

Japan’s Ministry of Finance confirmed in a statement that exports in July fell 1.6% from a year earlier, marking the longest run of declines in exports since the period of October 2015 to November 2016.

Exports to Japan’s top trading partner — China — fell for the fifth month, shrinking by 9.3% year-on-year.

The escalating US-China trade war has caused ructions across markets and caused investors and businesses great concern that it will push the world into a recession. Markets have roiled, particularly after China will hit back with counter measures to US president Donald Trump’s extra tariff threats.

READ MORE: Markets tank as China promises 'counter measures' in trade war

Meanwhile, a benchmark monthly poll — Reuters Tankan survey — gathered some more insight into how Japanese businesses are viewing the headwinds surrounding the US-China trade war. The survey surveyed a total 258 firms and calculated an index by “subtracting the percentage of pessimistic respondents from optimistic ones. A negative figure means pessimists outnumber optimists,” said Reuters.

Its survey showed that Japanese manufacturers’ business confidence turned negative for the first time since April 2013.

"The US-China trade war, Japan's export curbs to South Korea and the recent yen rises have formed a bottleneck for sales," said one respondent in the Reuters Tankan survey.

Another said: "The selling price remains in a downtrend due to expansion of e-commerce markets, while a scheduled sales tax hike keep shoppers on guard against price increases."

READ MORE: Japan manufacturers turn pessimistic for first time since 2013: Reuters Tankan

However, European and Asian markets today started off in a positive mood as investors latch onto hope that there will be a raft of stimulus measures to abate any economic concerns. For example, the Chinese government announced measures that lower borrowing costs for companies.

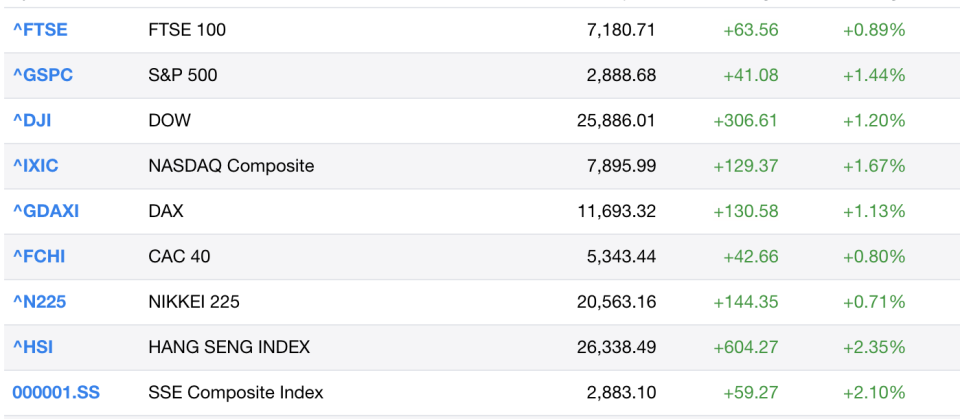

Japan’s Nikkei 225 (^N225) was up around 1%, while Hong Kong’s Hang Seng Index (^HSI) and China’s Shanghai Composite (000001.SS) rose by over 2% on Monday.

The UK’s FTSE 100 (^FTSE) had its best session in 10 days, Germany’s DAX (^GDAXI), and France’s CAC (^FCHI) were all up around 1% as well.

“European stocks began the week on the front foot, consolidating gains from Friday and building on a positive session in Asia,” said Neil Wilson, chief market analyst at markets.com. “Investors are braced for a tidal wave of stimulus, both monetary and fiscal. The major European bourses were up about 1% in early trade.”

However Wilson warned that “these are dip-buying kind of moves but we are yet to see the start of a new upwards trend for equities. US equities suffered a third straight weekly fall, despite Friday’s rally. The direction of travel has shifted even if we are seeing bounces like today. US futures are heading higher.”

READ MORE: Meet the ordinary Brits stockpiling at home for a no-deal Brexit

Yahoo Finance

Yahoo Finance