Turkey is using a backdoor method to avert an all-out currency crisis

Turkey is engaging in a trade war with the US after it announced that it would double tariffs on some US imports including alcohol and cars. Investors are jittery and in the US market open stocks traversed lower over uncertainty over how the turmoil will spread.

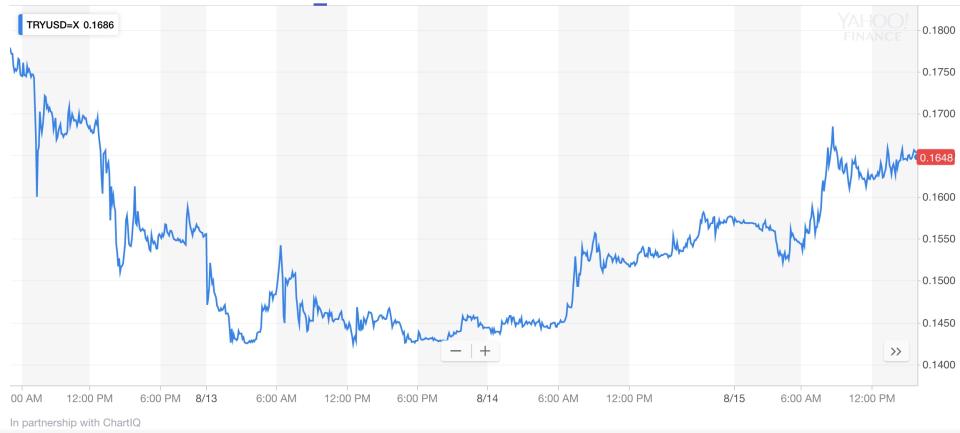

However, the Turkish lira recouped some of this week’s losses, rising about 6% (TRY/USD) after the central bank stepped in.

Usually in times of the currency crashing, a central bank would raise benchmark rates. While this hasn’t happened, the central bank has employed a backdoor method of squeezing lira liquidity in the market. This means that lenders have had to borrow cash overnight, which is more costly than drawing liquidity from usual auctions of one week cash.

“They are squeezing lira liquidity out of the system now and pushing interest rates higher,” said Cristian Maggio, head of emerging markets strategy at TD Securities. “Rates have gone up by 10% … The central bank has not done this through a change in the benchmark rates, but they are squeezing liquidity, so the result is the same.”

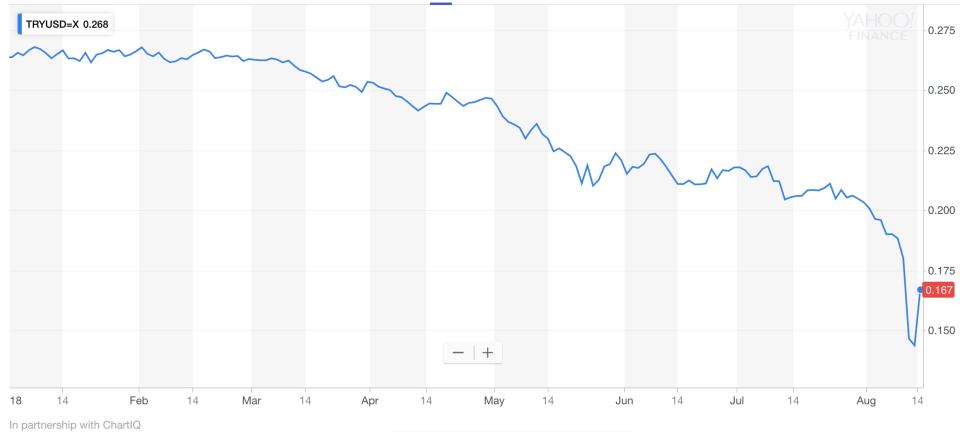

The central bank may have stopped the lira from completely bombing in day-to-day sessions for now but the currency (TRY/USD) is still down about 40% from the start of the year.

Investors have been worried over President Recep Tayyip Erdogan’s increasing influence on the economy and monetary policy. Despite high inflation, he has pushed for lower interest rates. Last month, Jason Tuvey of Capital Economics said in a note that “President Erdogan’s grip on the central bank looks set to strengthen. The pace at which he is moving to tighten his grip is alarming and, in response, Turkish financial assets have come under pressure.”

Yahoo Finance

Yahoo Finance