TSX Dividend Stock Picks

RioCan Real Estate Investment Trust is one of our top dividend-paying companies that can help boost the investment income in your portfolio. These stocks are a safe way to create wealth as their stable and constant yields generally hedge against economic uncertainty and deliver downside protection. Dividends can be underrated but they form a large part of investment returns, playing an important role in compounding returns in the long run. If you’re a long term investor, these high-performing top dividend stocks can boost your monthly portfolio income.

RioCan Real Estate Investment Trust (TSX:REI.UN)

RioCan is one of Canada’s largest real estate investment trust with a total enterprise value of approximately $13.7 billion at March 31, 2018. The company now has 645 employees and with the market cap of CAD CA$7.60B, it falls under the mid-cap group.

REI.UN has a juicy dividend yield of 6.00% and is paying out 67.81% of profits as dividends . REI.UN’s DPS have risen to CA$1.44 from CA$1.35 over a 10 year period. The company has been a dependable payer too, not missing a payment in this 10 year period. More on RioCan Real Estate Investment Trust here.

Fortis Inc. (TSX:FTS)

Fortis Inc. operates as an electric and gas utility company in Canada, the United States, and the Caribbean. Formed in 1885, and headed by CEO Barry Perry, the company employs 8,500 people and with the stock’s market cap sitting at CAD CA$17.26B, it comes under the large-cap group.

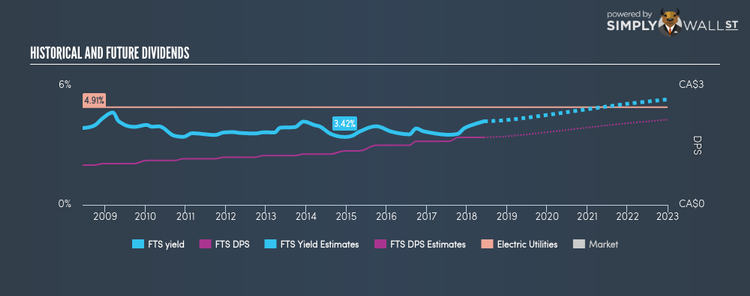

FTS has a large dividend yield of 4.21% and the company has a payout ratio of 69.77% , and analysts are expecting a 70.17% payout ratio in the next three years. In the case of FTS, they have increased their dividend per share from CA$1.00 to CA$1.70 so in the past 10 years. It should comfort existing and potential future shareholders to know that FTS hasn’t missed a payment during this time. Dig deeper into Fortis here.

National Bank of Canada (TSX:NA)

National Bank of Canada provides various financial products and services to retail, commercial, corporate, and institutional clients in Canada and internationally. Founded in 1859, and currently run by Louis Vachon, the company size now stands at 22,359 people and with the company’s market capitalisation at CAD CA$21.03B, we can put it in the large-cap stocks category.

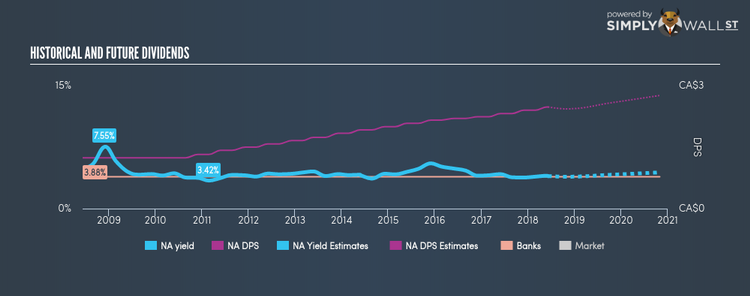

NA has a good dividend yield of 3.97% and their current payout ratio is 41.15% . NA’s DPS have risen to CA$2.48 from CA$1.24 over a 10 year period. They have been reliable as well, ensuring that shareholders haven’t missed a payment during this 10 year period. More detail on National Bank of Canada here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance