Trump isn’t worried about rising government debt, and neither are voters

As a presidential candidate, Donald Trump promised he would pay down the nation’s debt in eight years. But more than two years into his presidency the national debt is more than $2 trillion higher than when he moved into the White House. The nation’s debt is now $22 trillion.

Trump’s failure to keep that campaign promise, however, doesn’t seem to be hurting his standing with voters, because, according to Deutsche Bank, they don’t care. That analysis suggests the ballooning national debt won’t hurt Trump’s chances for re-election in 2020.

The last time the U.S. had a balanced budget — a federal surplus actually — was when President Bill Clinton left office in 2001. Ever since, the government debt levels have been rising, and spiked after the recession in 2008. (The national debt is the total of the annual budget deficits. The Congressional Budget Office projects that this year’s deficit will be $897 billion.)

Gross federal debt as a percentage of GDP

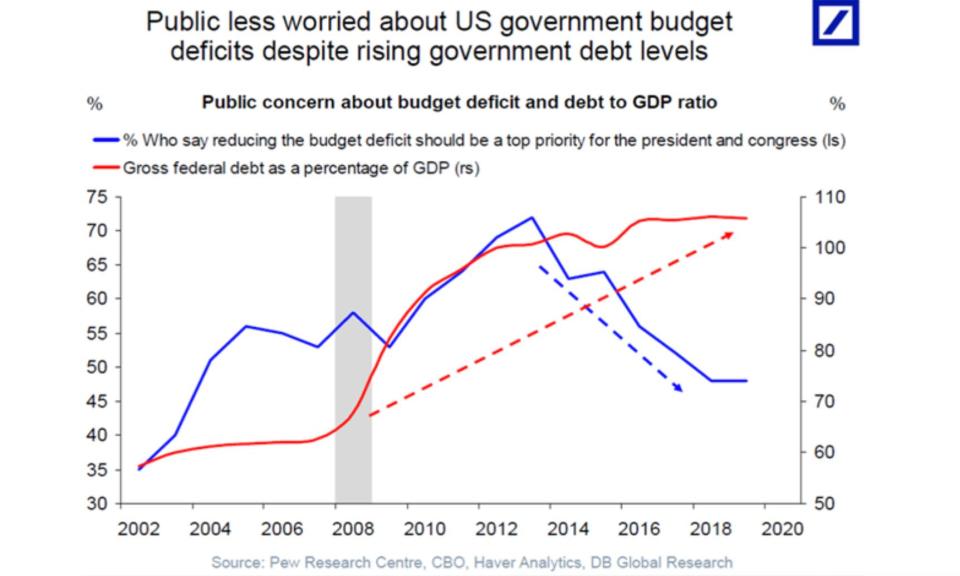

According to Deutsche Bank, the gross federal debt (both the debt held by the public and federal government accounts) as a percentage of GDP is roughly 105%.

Brett Ryan, a senior U.S. economist at Deutsche Bank, explains that the timing of the gross federal debt as a percentage of GDP doubling after the recession coincides with the baby boomer generation retiring. 2011 is the year the oldest baby boomers turned 65 and each day an additional 10,000 can start their retirement.

“More people on the Medicare payroll, more people on Medicaid payrolls. So it reflects an aging population, it reflects a severe economic downturn which the government had to respond to by running large deficits,” says Ryan.

Public concern about government budget deficit

In 2013, more than 70% of people said reducing the budget deficit should be a top priority for the president and Congress, according to a recent Pew Research Center survey. That number has fallen to about 48%.

As the U.S. government continues to run consistent deficits, and debt to GDP doubles, the general public has become less concerned about it. “It’s striking to me in the chart that there’s a sharp downturn in the people polled that are starting to see the federal deficit as a problem,” says Ryan.

The climbing federal deficit isn’t necessarily something that touches voters’ lives in an immediate way — it’s an abstract figure with lots of zeros that connotes some measure of fiscal responsibility of the government.

A large and growing budget deficit does pose risks, though.

“It shouldn’t be a huge concern, but you want to be reasonable about how fast you’re spending over time,” Ryan says. “Because you have to issue debt, and you have to pay interest back on that debt. When you’re in good times, you should probably be saving a little bit more for the bad times.”

Ryan warns that when the next downturn comes, political resistance might make getting stimulus packages more challenging.

“I think the next recession will be a fairly mild one, so it’s not going to be a huge issue,” he says. “But that said, given that we haven’t used the relatively benign period over the past 10 years to put fiscal spending on a more sustainable trajectory, it does in a sense limit how much you can respond during the next downturn with fiscal stimulus.”

Ryan expects more market volatility as the U.S. debt skyrockets. “It’s not that the level of federal debt is a problem per se, but the way we go about this process of getting a budget done, a debt ceiling, having last-minute showdowns around this, it’s causing market disruptions,” he says. “It causes uncertainty, it’s an inefficiency. It should be a much smoother process that shouldn’t involve these manufactured crises.”

Follow Sibile Marcellus on @SibileTV

More from Sibile:

Marijuana is the fastest-growing sector in the U.S. job market

Want to be successful in business? Get a work wife

Workers threatened by automation shift their skills to become drivers, electricians: LinkedIn

Two-thirds of US millennial women say they’re in ‘poor or fair’ shape

Yahoo Finance

Yahoo Finance