What Trump doesn’t get about tax cuts

Tax cuts are always good: That’s Republican orthodoxy, and it explains President Trump’s last-minute tax-cut plan meant to woo midterm voters.

Trump wants to cut middle-class taxes by 10%, and he says Congressional Republicans will gin up such legislation if they retain control of Congress after the midterm elections on Nov. 6. But Republicans just passed a big tax cut, and voters are unimpressed. More people disapprove than approve of the Tax Cuts and Jobs Act, which went into effect at the start of this year. That’s why Republicans seem likely to lose seats in the House of Representatives in the midterms, with Democrats possibly gaining control.

The Trump tax cuts are unpopular because many people feel they disproportionately benefit corporations and the wealthy. That’s why the latest Trump plan calls for a middle-class tax cut only—it’s a do-over meant to redress a flaw in last year’s tax-cut law. But Trump’s latest plan doesn’t go far enough. Many of the people opposed to the tax cuts don’t just want a bigger giveaway for themselves. What they really want is higher, not lower, taxes on businesses and high earners.

A recent survey published by the Democracy Fund Voter Study Group, for instance, finds very low enthusiasm for tax cuts for corporations and the wealthy. Seventy-three percent of voters say tax cuts for the wealthy are unimportant, with 55% saying the same for business tax cuts. Respondents are all people who voted in the 2016 election, so they’re politically active and more likely to influence the outcome of the 2018 midterms than the overall population.

Even Trump voters have mixed feelings on the matter, with 54% of people who voted for Trump in 2016 saying tax cuts for the wealthy are unimportant, and 22% saying tax cuts for businesses are unimportant. Among people who voted for John Kasich in 2016—more likely to be the kind of independent swing voters who will decide many 2018 races—66% said tax cuts for the wealthy are unimportant, with 38% saying the same with regard to corporate tax cuts.

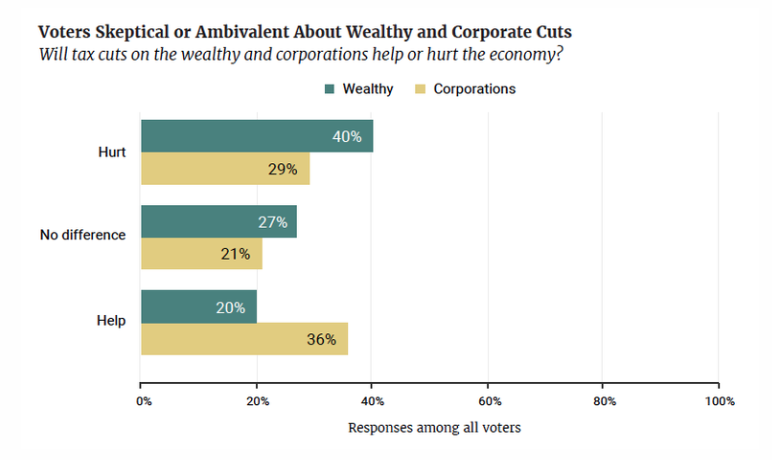

Many voters simply don’t think those two types of tax cuts are good for the economy—and some think they’re harmful. In the Voter Study Group poll, 40% said tax cuts for the wealthy hurt the economy, while just 20% said they help. Twenty-nine percent said tax cuts for corporations hurt the economy, with 36% saying they help.

Voters are generally correct in the view that the majority of last year’s tax cuts benefit corporations and the wealthy. About 35% of the tax cut, or $647 billion in tax savings over a decade, went to corporations, according to the nonprofit Tax Foundation—mainly through a cut in the corporate tax rate from 35% to 21%. That left about $1.1 trillion in tax cuts for individuals. But of that, 64% of the tax savings will flow to the top 20% of earners, and 83% will flow to the top 40%, according to the nonprofit Tax Policy Center. That leaves just 17% of the total for the lower 60% of earners.

Tax-cut advocates argue that businesses and high earners pay the bulk of taxes, so they’d naturally be the ones to benefit most from a tax cut. But that’s only if a tax cut is targeted at every income group, which it doesn’t need to be. Republicans could have cut middle-income tax rates last year while leaving rates untouched for higher earners, so that it would have been a true middle-class tax cut, of the sort Trump is promoting now.

Obviously they didn’t, arguing instead that boosting take-home pay for the wealthy, and putting more money in corporate coffers, would help ordinary people eventually through higher spending, which in theory boosts economic growth, creates more jobs and pushes pay up. But many economists doubt such trickle-down policies work, and evidence of a spending boom in 2018 is tepid at best. Growth seems more likely to slow than accelerate during the next few years, and some economists expect a recession by 2020 or 2021.

Some Democrats want to reverse the business and high-earner tax cuts. But they won’t be able to do anything as long as Trump can wield his veto as president. So we are probably stuck with an unpopular tax law and its consequences. The question is how many Republicans will still be around after Nov. 6.

Confidential tip line: rickjnewman@yahoo.com. Click here to get Rick’s stories by email.

Read more:

Rick Newman is the author of four books, including “Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman

Yahoo Finance

Yahoo Finance