TransUnion (TRU) Inks Deal to Buy Neustar for $3.1 Billion

TransUnion TRU recently announced that it has inked a deal to acquire Neustar, an identity resolution company, headquartered in Reston, VA — from a private investment group led by Golden Gate Capital and with minority participation by GIC— for $3.1 billion in cash. Subject to customary closing conditions and regulatory approvals, the deal is anticipated to complete in fourth-quarter 2021.

Neustar’s security business (which is excluded from the deal) will become a Golden Gate Capital and GIC portfolio company, post deal closure.

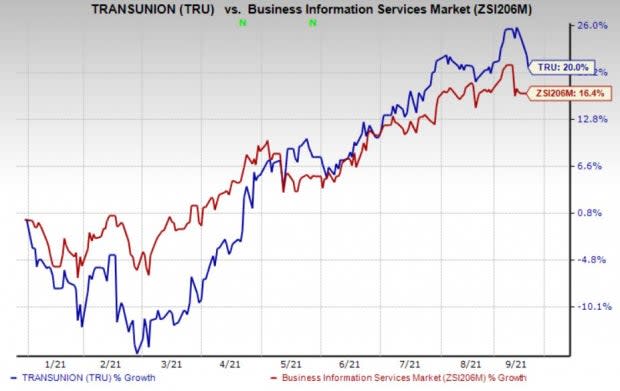

So far this year, shares of TransUnion have gained 20% compared with 16.4% growth of the industry it belongs to.

Image Source: Zacks Investment Research

How Will TransUnion Benefit?

The deal is expected to help TransUnion expand through both material revenue synergies and increased participation in the fast-growing digital marketing and identity fraud marketplaces. Inclusion of Neustar’s distinctive data and analytics should boost TransUnion’s digital identity capabilities, allowing consumers and businesses to enjoy secured online transactions. This should strengthen TransUnion’s competitive position as a global information and insights company offering diverse credit and non-credit solutions at scale, with high growth.

Neustar’s OneID identity resolution platform will modify TransUnion’s identity-based solutions and expand the latter's offerings across industry verticals in the United States as well as internationally. Neustar's wide customer base offers growth opportunities for cross-selling and innovation.

The acquisition is expected to boost TransUnion’s adjusted earnings per share in early 2023. The company is also hopeful of witnessing material cost synergies from the combined companies. Neustar is anticipated to generate nearly $575 million in revenues and $115 million in adjusted EBITDA in 2021.

Chris Cartwright, president and CEO of TransUnion, stated “The credit information and analytics that TransUnion provides make trust possible between consumers and businesses. As digital commerce continues to grow globally, TransUnion’s powerful digital identity assets, enhanced by Neustar’s distinctive data and digital resolution capabilities, will enable safer and more personalized online experiences for consumers and businesses.”

Zacks Rank and Other Stocks to Consider

TransUnion currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Some similar-ranked stocks in the broader Zacks Business Services sector are Equifax EFX, BGSF Inc. BGSF and Avis Budget CAR, each carrying a Zacks Rank #2 as well.

The long-term expected EPS (three to five years) growth rate for Equifax, BGSF and Avis Budget is pegged at 15.2%, 20% and 57.2%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

TransUnion (TRU) : Free Stock Analysis Report

BGSF, Inc. (BGSF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance