Transformational Moves Aid ABM Industries (ABM) Amid High Debt

ABM Industries Incorporated ABM is currently benefitting from the GCA acquisition and transformational initiatives.

The company recently reported mixed second-quarter fiscal 2021 results, with earnings beating the Zacks Consensus Estimate and revenues missing the same. Adjusted earnings from continuing operations came in at 82 cents per share, beating the consensus mark by 9.3% and improving 36.7% year over year. Total revenues of $1.49 billion missed the consensus estimate by 0.3%, but inched up 0.1% from the year-ago quarter’s levels.

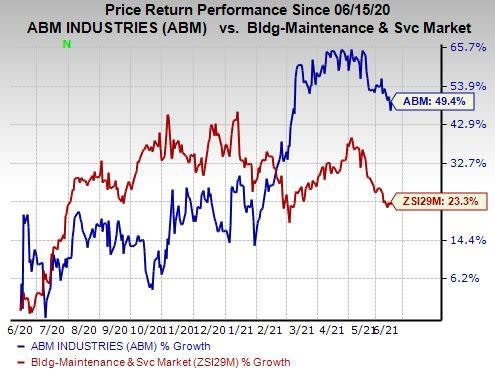

Notably, the stock has gained 49.4% in the past year compared with 23.3% rally of the industry it belongs to.

Image Source: Zacks Investment Research

Strategic Acquisitions & Vision 2020 are Positives

ABM Industries' strategy entails growth through strategic acquisitions. The acquisition of GCA Services Group has expanded the company’s long-term operational and financial position. The GCA integration has been completed and is making meaningful contributions to ABM Industries' overall operational results predominantly within Technology & Manufacturing, Business & Industry and Education segments.

Moreover, the company started a comprehensive transformational initiative called 2020 Vision in 2015. The goal of this initiative was to attain long-term profitable growth through an industry-based go-to-market approach. As part of this initiative, the company centralized key functional areas, reinforced sales capabilities as well as begun investing in service delivery tools and processes for supporting standard operating practices that are important for its long-term success.

Debt Woes Stay

ABM Industries' has a debt-laden balance sheet. The company’s cash and cash equivalent balance of $436 million at the end of second-quarter fiscal 2021 was well below the long-term debt level of $524 million underscoring that the company doesn’t have enough cash to meet this debt burden. However, the cash level can meet the short-term debt of $117 million.

Zacks Rank and Key Stocks to Consider

ABM Industries' currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader Zacks Business Services sector include Equifax Inc. EFX, Cross Country Healthcare CCRN and Charles River Associates CRAI, each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

The long-term expected earnings per share (three to five years) growth rate for Equifax, Cross Country Healthcare and Charles River is pegged at 14%, 10.5% and 15.5%, respectively.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Charles River Associates (CRAI) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

ABM Industries Incorporated (ABM) : Free Stock Analysis Report

Cross Country Healthcare, Inc. (CCRN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance