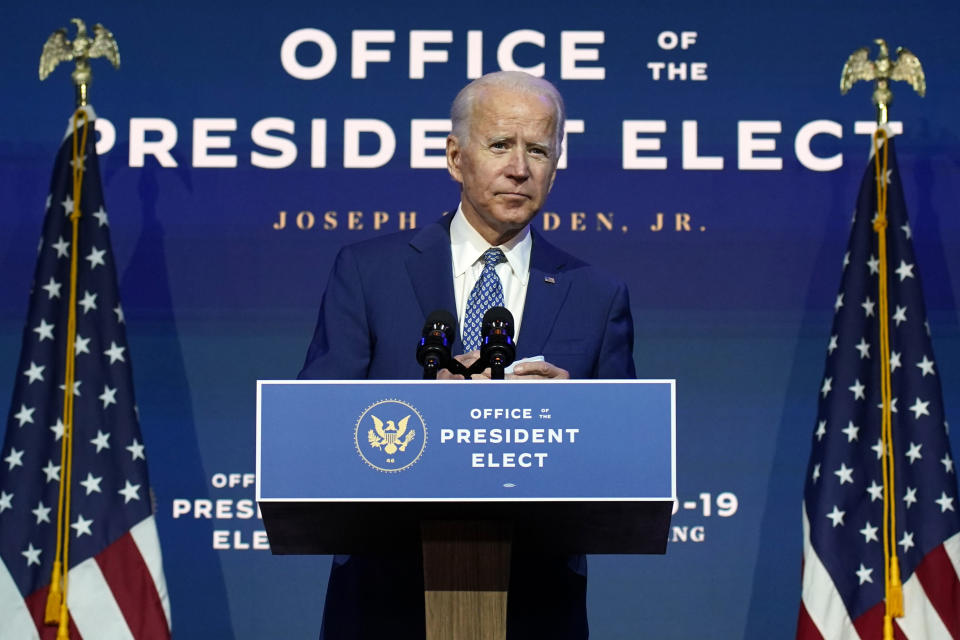

Trade will fade to background under Biden’s ‘tweet-free’ policy

Global trade is relieved to have a Joe Biden presidency.

President Trump and his tweets have set the tone for international trade for the past four years, usually to the chagrin of almost all economists except for his own trade hawks Peter Navarro and Secretary of Commerce Wilbur Ross.

One by one, Trump rankled both China and American allies in Europe, Asia, and the Americas with tariffs.

The trade wars that the president said were “easy to win,” in fact, were not easy to win and led to American consumers and businesses paying the tariffs instead of countries like China. A paper published in January by the National Bureau of Economic Research found that “U.S. tariffs continue to be almost entirely borne by U.S. firms and consumers,” and also found that the “substantial redirection of trade in response to the 2018 tariffs has accelerated.”

Trump’s aggression on certain trade policies was justified, such as the theft of intellectual property that many Chinese companies have perpetrated, and some thought that the “madman theory” where no one knew what the president would do next gave the U.S. an advantage at the negotiating table.

With Biden’s win, the landscape will change, at least somewhat.

“Perhaps the greatest clarity post-election is for global trade,” Citibank’s private bank division wrote in a note Monday. “US foreign policy will enter a more predictable phase without escalating tariff threats.”

The bank called the election result a “tweet-free return to traditional governance,” and said the markets will be able to stop focusing on trade discord at the levels they’ve had to over the past four years.

“As the province of the President, it will result in a major shift in the way foreign policy is conducted. Alliance building will return,” the note said. “‘Tariff threat first’ negotiating tactics will end.”

The key reason why this is seen as a positive by Citi and others is because, "the U.S. gained nothing economically for its trade wars ahead of COVID.”

In one estimation from Deutsche Bank last year, the cost to the stock market was "$5 trillion and counting.” Another from the New York Fed found that the tariffs reduced equity prices by 6% and "did not find any evidence of beneficial effects."

“As usual, all but the weakest foreign governments would rather lose economically than be seen to give in to coercion,” Citi wrote.

The U.S. lost in a few ways, too, Citi wrote. Exports dropped, manufacturing employment didn’t see a boost (in fact, the Federal Reserve found that tariff increases implemented in 2018 were “associated with relative reductions in manufacturing employment and relative increases in producer prices), and the trade wars “created periodic rounds of business pessimism and higher input costs which have not yet been reversed.”

--

Ethan Wolff-Mann is a writer at Yahoo Finance focusing on consumer issues, personal finance, retail, airlines, and more. Follow him on Twitter @ewolffmann.

Simple chart shows how much small businesses continue to struggle

Beware of ‘banks’ offering huge interest rates on savings accounts

63% of Americans have concerns about a coronavirus vaccine: Poll

Government should collect wealth data just like income: Berkeley economists

Intergenerational conflict is getting worse, Deutsche Bank warns

For tutorials and information on investing and trading stocks, check out Cashay

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Yahoo Finance

Yahoo Finance