The China trade war isn’t hurting Apple as much as many feared

Apple (AAPL) CEO Tim Cook announced a strong third-quarter Tuesday, saying the strong results were “driven by all-time record revenue from services, accelerating growth from wearables. We're thrilled to report a return to growth and a new June quarter revenue record of $53.8 billion.”

Analysts had expectations of $53.4 billion. It also posted $2.18 per share, against analysts’ expectations of $2.10.

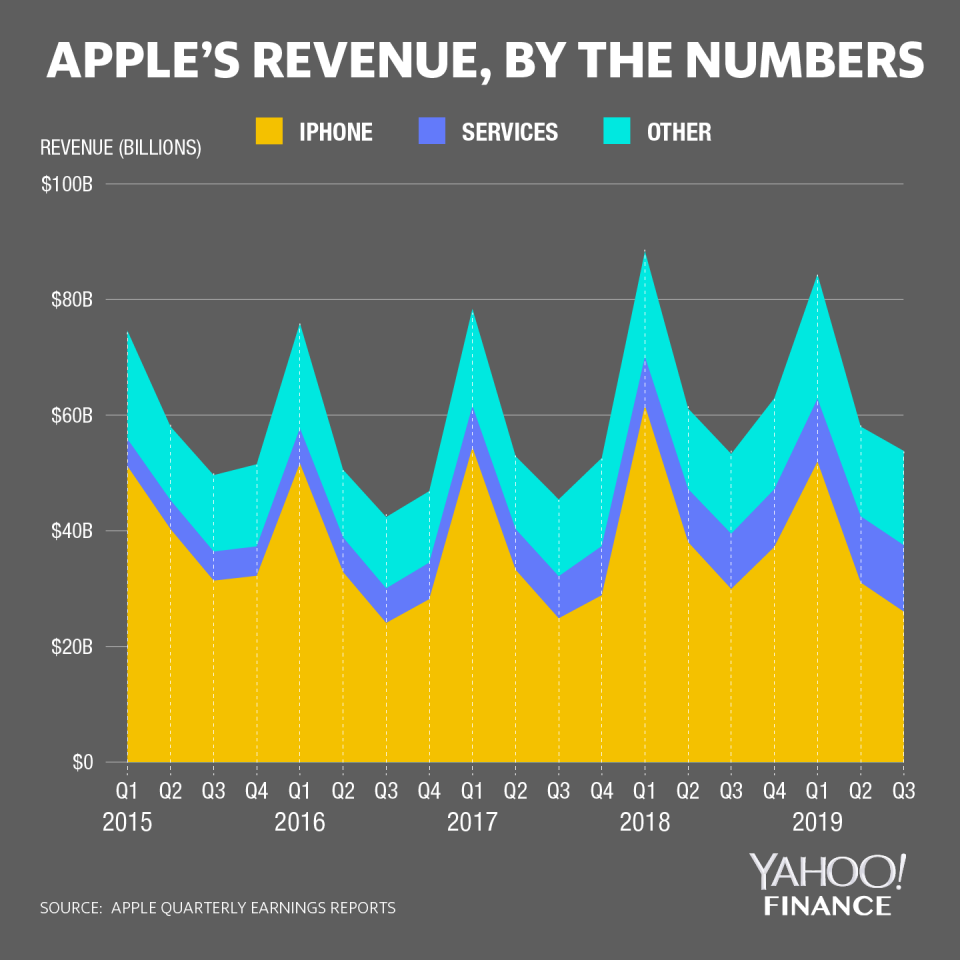

Apple’s report included a unique mix of growth and concern. A majority of Apple’s revenue comes from its iPhone. However, revenue from the popular device accounted for 48% of the quarter’s revenue – a far cry from the 63% of revenue it made up for last year.

Winning the battle during a trade war

China is a wildcard for most businesses. Attempting to grow within the country and the ongoing U.S-China trade war has been a sticking point for most.

Despite growing uncertainty, Apple has been weathering the battle on both fronts.

On the earnings conference call, Cook said, “The combined effects of government stimulus, consumer response to trade-in programs, financing offers, and other sales initiatives, and growing engagement with the broader Apple ecosystem, had a positive effect. We were especially pleased with a double-digit increase in services driven by strong growth from the App Store in China.”

When asked if investors can trust Apple’s rebound in China, Angelo Zino, senior industry analyst at CFRA Research, told Yahoo Finance, “It remains to be seen. On the iPhone side of things, you’re set up pretty nicely going into the next cycle because the comparables are very, very favorable as you get into the December quarter.”

“That being said,” Zino added, “clearly we need to keep our eyes on the trade situation and what’s at hand there. But our view is we remain very bullish on the China story long term for Apple.”

A “difficult cycle” is coming up, Zino said, but a silver lining is “you have 5G going in late 2020. Do I trust it? At the very least, you’ll see less bad numbers.” Zino has a buy rating on Apple stock.

Read more:

Apple earnings beat expectations, iPhone and services sales disappoint

Apple is a 'free cash flow machine' and that's why you should buy its stock: analyst

Huawei sets aggressive goal of 270 million phone shipments despite US ban: Exclusive

Inside Huawei’s $1.5 billion ‘European town’ campus in China

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance