Tractor Supply (TSCO) Posts In-line Q3 Earnings, Updates View

Tractor Supply Company TSCO reported in-line earnings in third-quarter 2019, while sales missed the Zacks Consensus Estimate. However, both metrics improved on a year-over-year basis. Furthermore, management updated its outlook for 2019.

Q3 Highlights

Tractor Supply’s adjusted earnings were $1.04 per share, which met the Zacks Consensus Estimate. However, the bottom line improved 9.5% from the prior-year quarter. Including the after-tax impact of the executive transition agreement, the company reported earnings of $1.02 per share.

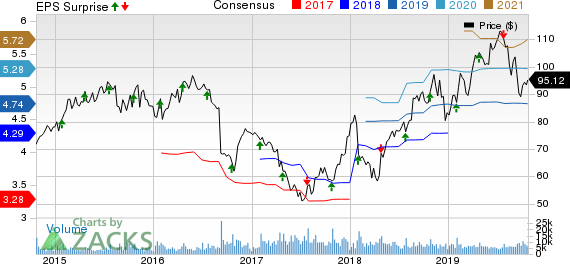

Tractor Supply Company Price, Consensus and EPS Surprise

Tractor Supply Company price-consensus-eps-surprise-chart | Tractor Supply Company Quote

Net sales grew 5.4% to $1,984.1 million but lagged the Zacks Consensus Estimate of $1,997 million. This year-over-year improvement was driven by comps increase of 2.9%, led by respective growth of 0.6% and 2.3% in comparable store transaction count and average ticket.

Furthermore, traffic and sales growth were aided by the company’s ongoing efforts to build customer loyalty and enhance digital capabilities. Also, comps gained from improvement across geographies as well as strength in everyday merchandise. Higher sales for spring and summer seasonal product categories too drove comps.

Margins & Costs

Gross profit rose 6.3% year over year to $694.2 million, with gross margin expansion of 28 basis points (bps) to 35%. The uptick was mainly backed by gains from the company’s price management program and lower freight costs, as a rate of net sales.

Selling, general and administrative (SG&A) expenses, including depreciation and amortization, as a percentage of sales, grew 26 bps to 26.8%. Higher costs related to a new distribution facility in Frankfort, NY. along with the executive transition agreement and a slight impact of investment in store team member wages led to the upside. These expenses were somewhat offset by lower occupancy and other costs coupled with decreased incentive compensation, as a percentage of sales. However, adjusted SG&A expenses, which exclude the impact of the executive transition agreement, grew 11 bps, as a rate of sales.

Financial Position

Tractor Supply ended the quarter with cash and cash equivalents of $82.6 million, long-term debt of $613.9 million, and total stockholders’ equity of $1,491.8 million.

Year to date through the third quarter, the company returned $611.2 million via share repurchases worth $490 million and dividends of $121.2 million. Additionally, it incurred capital expenditure of $144.3 million while generated cash flow from operating activities of about $414.3 million.

For 2019, management expects share buybacks of about $525-$550 million compared with $350-$450 million mentioned earlier. Moreover, the company continues to expect capital expenditure of $225-$250 million.

Store Update

In the first nine months of 2019, Tractor Supply opened 50 namesake and three Petsense stores, while shuttered one namesake and two Petsense outlets. As of Sep 28, 2019, the company operated 1,814 Tractor Supply stores across 49 states and 176 Petsense stores in 26 states.

For 2019, management expects to open 80 namesake stores and 10 Petsense stores.

Outlook

Depending on the company’s year-to-date performance, management updated guidance for 2019. Tractor Supply now projects net sales of $8.40-$8.42 billion for the year, with comps growth of 3.2-3.4%. Earlier, it anticipated net sales of $8.40-$8.46 billion, with comps growth of 3-4%. Operating margin is still estimated to be 8.9-9%.

Moreover, the company envisions net income of $564-$569 million for 2019 compared with $562-$575 million mentioned earlier. It anticipates adjusted net income of $566-$571 million.

Furthermore, the company expects earnings per share of $4.66-$4.70 for 2019 compared with $4.65-$4.75 mentioned earlier. Adjusted earnings, excluding after-tax effects from the executive transition agreement, are now anticipated to be $4.68-$4.72. In 2018, the company registered earnings per share of $4.31.

Price Performance

Year to date, the Zacks Rank #3 (Hold) stock has gained 14% against the industry’s 0.1% decline.

Stocks to Consider in the Same Space

Regis Corporation RGS has an expected long-term earnings growth rate of 7.5%. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Hibbett Sports, Inc HIBB has an impressive long-term earnings growth rate of 10.9% and a Zacks Rank #2 (Buy) at present.

The Michaels Companies, Inc MIK delivered average positive earnings surprise of 11.4% in the trailing four quarters. It currently carries a Zacks Rank #2.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Michaels Companies, Inc. (MIK) : Free Stock Analysis Report

Hibbett Sports, Inc. (HIBB) : Free Stock Analysis Report

Tractor Supply Company (TSCO) : Free Stock Analysis Report

Regis Corporation (RGS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance