Top TSX Dividend Picks For The Day

SmartCentres Real Estate Investment Trust is one of companies that can help grow your investment income by paying large dividends. These stocks are a safe bet to increase your portfolio value as they provide both steady income and cushion against market risks. A sizeable part of portfolio returns can be produced by dividend stocks due to their contribution to compounding returns in the long run. I’ve made a list of other value-adding dividend-paying stocks for you to consider for your investment portfolio.

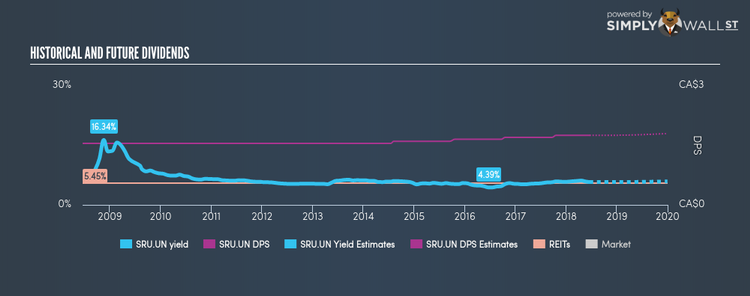

SmartCentres Real Estate Investment Trust (TSX:SRU.UN)

SmartCentres is one of Canada’s largest real estate investment trusts with total assets of approximately $9.4 billion. Formed in 1945, and currently headed by CEO J. Thomas, the company employs 336 people and with the stock’s market cap sitting at CAD CA$4.83B, it comes under the mid-cap group.

SRU.UN has a enticing dividend yield of 5.74% and is paying out 82.61% of profits as dividends . SRU.UN has increased its dividend from CA$1.55 to CA$1.75 over the past 10 years. They have been reliable as well, ensuring that shareholders haven’t missed a payment during this 10 year period. In the last 12 months, SmartCentres Real Estate Investment Trust has experienced an earnings growth of 12.04%. Continue research on SmartCentres Real Estate Investment Trust here.

IGM Financial Inc. (TSX:IGM)

IGM Financial Inc. manages and distributes investment funds and other managed asset products in Canada. Formed in 1894, and headed by CEO Jeffrey Carney, the company size now stands at 3,286 people and with the stock’s market cap sitting at CAD CA$9.42B, it comes under the mid-cap category.

IGM has a juicy dividend yield of 5.75% and their payout ratio stands at 88.71% . IGM’s dividends have increased in the last 10 years, with DPS increasing from CA$1.95 to CA$2.25. During this period, they haven’t missed a payment, as one would expect from a company increasing their dividend. It also looks like IGM Financial has some promising growth in store for the next year, with analysts expecting the company’s earnings to increase by 36.45% over the next 12 months. Dig deeper into IGM Financial here.

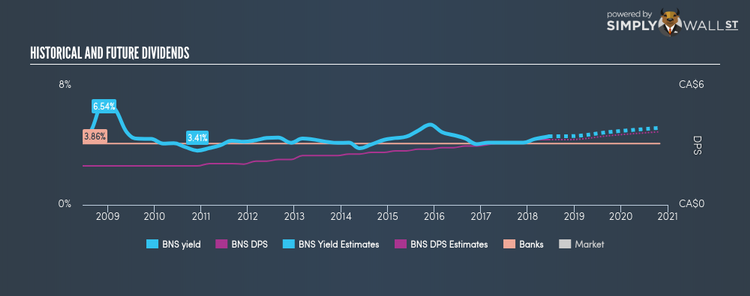

The Bank of Nova Scotia (TSX:BNS)

The Bank of Nova Scotia provides various financial services in North America, Latin America, the Caribbean and Central America, and the Asia-Pacific. Established in 1832, and now led by CEO Brian Porter, the company employs 89,809 people and with the company’s market capitalisation at CAD CA$93.63B, we can put it in the large-cap stocks category.

BNS has a sumptuous dividend yield of 4.32% and their current payout ratio is 45.69% , with the expected payout in three years being 46.29%. BNS’s dividends have seen an increase over the past 10 years, with payments increasing from CA$1.96 to CA$3.28 in that time. During this period, the company has not missed a dividend payment – as you would expect from a company increasing their dividend. More detail on Bank of Nova Scotia here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance