Top Ranked Value Stocks to Buy for April 21st

Here are four stocks with buy rank and strong value characteristics for investors to consider today, April 21st:

Korea Electric Power Corporation (KEP): This integrated electric utility company has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 4.4% over the last 60 days.

Korea Electric Power Corporation Price and Consensus

Korea Electric Power Corporation price-consensus-chart | Korea Electric Power Corporation Quote

Korea Electric Power has a price-to-earnings ratio (P/E) of 7.67, compared with 12.60 for the industry. The company possesses a Value Score of A.

Korea Electric Power Corporation PE Ratio (TTM)

Korea Electric Power Corporation pe-ratio-ttm | Korea Electric Power Corporation Quote

Washington Prime Group Inc. (WPG): This retail REIT engaged in ownership, management, acquisition and development of retail properties has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 45.5% over the last 60 days.

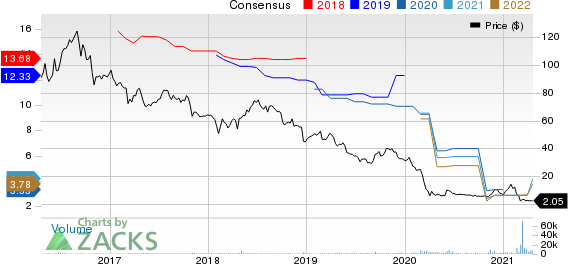

Washington Prime Group Inc. Price and Consensus

Washington Prime Group Inc. price-consensus-chart | Washington Prime Group Inc. Quote

Washington Prime Group has a price-to-earnings ratio (P/E) of 0.51, compared with 9.80 for the industry. The company possesses a Value Score of A.

Washington Prime Group Inc. PE Ratio (TTM)

Washington Prime Group Inc. pe-ratio-ttm | Washington Prime Group Inc. Quote

Goodrich Petroleum Corporation (GDP): This independent oil and natural gas company has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 42.6% over the last 60 days.

Goodrich Petroleum Corporation Price and Consensus

Goodrich Petroleum Corporation price-consensus-chart | Goodrich Petroleum Corporation Quote

Goodrich Petroleum has a price-to-earnings ratio (P/E) of 4.31, compared with 20.50 for the industry. The company possesses a Value Score of B.

Goodrich Petroleum Corporation PE Ratio (TTM)

Goodrich Petroleum Corporation pe-ratio-ttm | Goodrich Petroleum Corporation Quote

Mid Penn Bancorp, Inc. (MPB): This provider of commercial banking services to individuals, partnerships, non-profit organizations, and corporations has a Zacks Rank #2, and seen the Zacks Consensus Estimate for its current year earnings rising 13.9% over the last 60 days.

Mid Penn Bancorp Price and Consensus

Mid Penn Bancorp price-consensus-chart | Mid Penn Bancorp Quote

Mid Penn Bancorp has a price-to-earnings ratio (P/E) of 7.72, compared with 13.30 for the industry. The company possesses a Value Score of B.

Mid Penn Bancorp PE Ratio (TTM)

Mid Penn Bancorp pe-ratio-ttm | Mid Penn Bancorp Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Zacks Top 10 Stocks for 2021

In addition to the stocks discussed above, would you like to know about our 10 best buy-and-hold tickers for the entirety of 2021?

Last year's 2020 Zacks Top 10 Stocks portfolio returned gains as high as +386.8%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2021 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Washington Prime Group Inc. (WPG) : Free Stock Analysis Report

Mid Penn Bancorp (MPB) : Free Stock Analysis Report

Korea Electric Power Corporation (KEP) : Free Stock Analysis Report

Goodrich Petroleum Corporation (GDP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance