Top Ranked Value Stocks to Buy for July 7th

Here are three stocks with buy rank and strong value characteristics for investors to consider today, July 7th:

Big Lots, Inc. (BIG): This retailer has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising more than 100% over the last 60 days.

Big Lots, Inc. Price and Consensus

Big Lots, Inc. price-consensus-chart | Big Lots, Inc. Quote

Big Lots has a price-to-earnings ratio (P/E) of 6.57, compared with 10.30 for the industry. The company possesses a Value Score of B.

Big Lots, Inc. PE Ratio (TTM)

Big Lots, Inc. pe-ratio-ttm | Big Lots, Inc. Quote

BrightSphere Investment Group Inc. (BSIG): This asset management holding company has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 13.2% over the last 60 days.

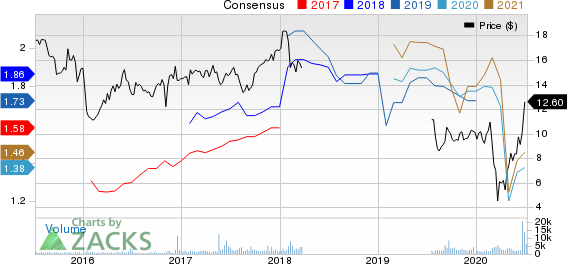

BrightSphere Investment Group Inc. Price and Consensus

BrightSphere Investment Group Inc. price-consensus-chart | BrightSphere Investment Group Inc. Quote

BrightSphere Investment has a price-to-earnings ratio (P/E) of 8.77, compared with 12.00 for the industry. The company possesses a Value Score of A.

BrightSphere Investment Group Inc. PE Ratio (TTM)

BrightSphere Investment Group Inc. pe-ratio-ttm | BrightSphere Investment Group Inc. Quote

AbbVie Inc. (ABBV): This developer and manufacturer of pharmaceuticals has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 4.9% over the last 60 days.

AbbVie Inc. Price and Consensus

AbbVie Inc. price-consensus-chart | AbbVie Inc. Quote

AbbVie has a price-to-earnings ratio (P/E) of 9.40, compared with 16.30 for the industry. The company possesses a Value Score of B.

AbbVie Inc. PE Ratio (TTM)

AbbVie Inc. pe-ratio-ttm | AbbVie Inc. Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Zacks’ Single Best Pick to Double

From thousands of stocks, 5 Zacks experts each picked their favorite to gain +100% or more in months to come. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This young company’s gigantic growth was hidden by low-volume trading, then cut short by the coronavirus. But its digital products stand out in a region where the internet economy has tripled since 2015 and looks to triple again by 2025.

Its stock price is already starting to resume its upward arc. The sky’s the limit! And the earlier you get in, the greater your potential gain.

Click Here, See It Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BrightSphere Investment Group Inc. (BSIG) : Free Stock Analysis Report

Big Lots, Inc. (BIG) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance