This Top Gold Stock Is Up +80% in the Last 12 Months

The price of gold has been caught in a downdraft in the last few months and now sits at under US$1,200 per ounce. Gold producers have generally been down a whole lot.

As I was researching for a potential value investment in gold miners as protection in a down market, I was intrigued by a mid-cap gold producer that has outrun the rest of the pack, leaving them in the dust. While most of Kirkland Lake Gold’s (TSX:KL)(NYSE:KL) peer stocks are down 10-40% in the last 12 months, Kirkland Lake Gold stock has actually appreciated about 83% in the period!

Here’s a chart comparing the price action of Kirkland Lake Gold, its peer, Kinross Gold Corp. (TSX:K)(NYSE:KGC), and large-cap peers, Barrick Gold Corp. (TSX:ABX)(NYSE:ABX) and Goldcorp Inc. (TSX:G)(NYSE:GG).

KL data by YCharts

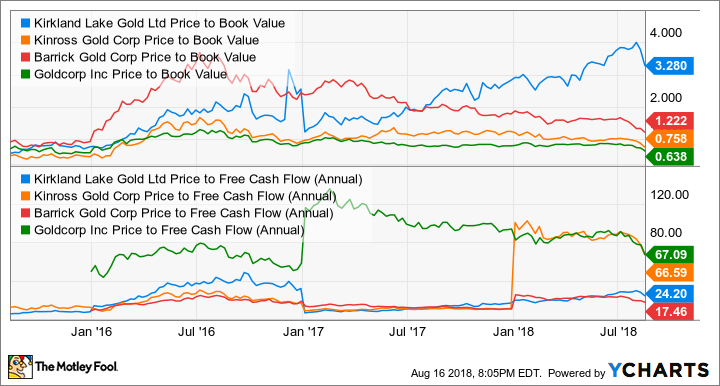

Let’s compare the valuations of these gold producers. Goldcorp and Kinross Gold are trading at meaningful discounts from their book values, while Barrick Gold and Kirkland Lake Gold are trading at a premium to their book values.

When looking at the valuation from a price-to-free-cash-flow perspective, Kirkland Lake Gold looks relatively cheap.

KL Price to Book Value data by YCharts

What makes Kirkland Lake Gold stand out?

Other than being an outperformer, Kirkland Lake Gold also stands out with its quality assets located in Canada (three mines) and Australia (two mines), a clean balance sheet, and strong cash flow generation.

For the year, management estimates Kirkland Lake Gold will produce more than 620,000 ounces of gold. In the first half of the year, the miner produced about half of that.

Image source: Getty Images.

Kirkland Lake Gold expects to ramp up the production of the Fosterville mine from this year’s 260,000-300,000 ounces to +400,000 ounces by 2020 as well as roughly double the production of the Macassa mine to +400,000 ounces in five to seven years.

In the meantime, the gold miner is gushing out cash. In the first half of the year, the company’s diluted earnings per share were US$0.52, which doubled from the same period in 2017. Comparing the same periods, the company increased its operating cash flow by almost 45% to US$210.5 million and increased its free cash flow by about 24% to US$110.9 million.

What’s even more impressive is that Kirkland Lake Gold has been growing profitability without carrying any long-term debt.

Investor takeaway

Kirkland Lake Gold stock has no competition in terms of being the top-performing gold stock. Miraculously, it is probably the single gold stock that has still maintained its upward trend.

Thomson Reuters has a 12-month mean target of US$25.80 per share on Kirkland Lake Gold, which represents about 37% near-term upside potential from the recent quotation of US$18.84 per share.

With the pressures gold prices and gold miners have been experiencing, investors could very well be able to pick up Kirkland Lake Gold at an even cheaper price. Investors who are long-term bulls of gold should consider buying Kirkland Lake Gold on meaningful dips.

More reading

Free investor brief: Our 3 top SELL recommendations for 2018

This Is the Best Strategy to Rearrange Your TFSA for the Bear Market to Come

Fool contributor Kay Ng has no position in any of the stocks mentioned.

Yahoo Finance

Yahoo Finance