The Top Energy Stocks in Canada for 2021 Continue to Rally

Throughout 2021 top energy stocks have been some of the best performers in Canada for a couple of reasons.

First, energy stocks lagged the rest of the market when the recovery started after the market pullback early last year. It wasn’t until vaccines were announced that these stocks started to rally in a big way.

However, economies worldwide have also been recovering well, which means that demand for energy has been picking up.

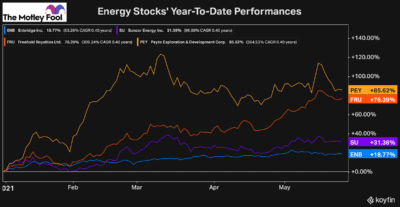

Early in February, I recommended these stocks as the four top picks for the industry. So let’s see how they’ve performed so far this year.

Enbridge: A top energy stock for income and stability

Enbridge (TSX:ENB)(NYSE:ENB) is one of the best blue-chip stocks in Canada. Its massive size and incredible operations make it highly stable and a massive cash cow.

Because it’s so stable, Enbridge was one of the least impacted stocks that are tied to the energy industry. So it’s no surprise that the stock has gained the least of the bunch.

The stock was undervalued and due for a rally, but because it’s so stable, the stock is never as volatile as some of its energy peers.

Today, though it continues to offer exceptional value, currently paying a dividend that yields 7.1% and trading with nearly 20% upside to its consensus analyst target price.

Suncor: One of the biggest and best stocks in the energy industry

Suncor Energy (TSX:SU)(NYSE:SU) is another massive energy stock that’s similar in many ways to Enbridge. Because it actually produces energy, it’s more volatile than Enbridge. However, because it’s a massive company with integrated operations, it’s a lot less volatile than smaller energy producers.

Up 30% this year so far, the stock has performed well. However, it still has a lot more potential for recovery, especially as energy demand worldwide continues to pick up.

Currently, the stock trades with more than 25% upside to its consensus analyst target price and pays a dividend that yields upwards of 3%.

Freehold: One of the top energy stocks in Canada during 2021

Freehold Royalties (TSX:FRU) is one of my favourite energy stocks in Canada. Although it’s a lower risk investment than buying a single producer, the company is still highly correlated to the energy industry and considerably volatile.

This gives it a tonne of upside potential when the industry is recovering, as it’s been lately. It’s not just Freehold’s stock that’s recovering, though. As the entire energy industry recovers and production picks up again, royalty payments are increasing, which means that Freehold’s operations are seeing a significant boost.

The stock has already increased its dividend three times since last December. So today, with the stock yielding 5.3% and trading with roughly 15% upside to its consensus target price, it continues to be one of the top energy stocks in Canada.

Peyto is one of the top energy stocks to buy for 2021 and beyond

Finally, Peyto Exploration and Development (TSX:PEY) has been one of the best performers so far in 2021. After being heavily impacted in 2020, the energy stock has had a tonne of momentum this year.

Peyto is a great investment because it’s one of the lowest-cost stocks in a natural gas industry that many expect to grow for years.

Natural gas is one of the cleanest forms of fossil fuels and will be a crucial commodity as we phase out coal and try to reduce our greenhouse gas emissions.

Because Peyto has such low costs, it holds the potential to be a top growth stock in the energy industry for years to come. The stock currently trades at a price-to-earnings ratio of just 12.7 times, making it extremely cheap and one of the best energy stocks to buy for 2021 and beyond.

The post The Top Energy Stocks in Canada for 2021 Continue to Rally appeared first on The Motley Fool Canada.

Speaking of top stocks to buy for 2021, check out this top FREE PICK!

We’re issuing a BUY alert on this TSX space stock

Our team of diligent analysts at Motley Fool Stock Advisor Canada has identified one little-known public company founded right here in Canada that’s at the cutting-edge of the space industry and recently completed a transformational acquisition, all while making a handsome profit in the process!

The best part is that in a market where many stocks are selling at all-time-highs, this stock is trading at what looks like a VERY reasonable valuation… for now.

Click here to learn more about our #1 Canadian Stock for the New-Age Space Race

More reading

Fool contributor Daniel Da Costa owns shares of ENBRIDGE INC and FREEHOLD ROYALTIES LTD. The Motley Fool owns shares of and recommends Enbridge. The Motley Fool recommends FREEHOLD ROYALTIES LTD.

2021

Yahoo Finance

Yahoo Finance