Top 5 Picks to Gain From Best Economic Rebound in 80 Years

On Jun 8, in its semi-annual Global Economic Prospects report, the Washington-based World Bank projected that the global economy will see the fastest post-recession growth in 80 years in 2021. Despite muted growth in many emerging and developing economies, a few developed economies will spur an impressive turnaround that will elevate global GDP growth.

Notably, the United States will be at the forefront of this record-breaking global economic rebound. Several global economic agencies including the World Bank projected that an astonishing turnaround of the U.S. economy in 2021 will lead to global economic recovery. The U.S. rebound should drive demand for the country's major trading partners, including Canada, Mexico, China and the Eurozone countries.

U.S. to Lead Global Economic Recovery in 2021

On Jun 8, the World Bank estimated that the global economy will expand at 5.6% in 2021, its best post-recession turnaround in 80 years. January's projection was for 4.1% growth. However, the global economy will remain at around 2% below its pre-pandemic level. Meanwhile, the U.S. economy is forecast to grow at 6.8% in 2021.

On May 31, the Organization for Economic Cooperation and Development (OECD) raised the U.S. GDP growth rate for 2021 to 6.9% from 6.5% projected in March. Global GDP was projected to grow 5.8% in 2021 from 5.6% estimated in March.

On Apr 6, the International Monetary Fund (IMF) raised the U.S. GDP growth forecast for 2021 to 6.4% from 5.1% projected in January. Consequently, the global GDP growth rate for 2021 was raised to 6% from 5.5% forecast in January.

The Oxford Economics predicted 7.7% U.S. GDP growth in 2021, up from 7% estimated on March. Supported by strong U.S. economic growth, world GDP is estimated to rise 6.3% compared with the 6.1% forecast in March.

On Apr 18, Wall Street Journal reported that economists on average expect U.S. GDP to expand nearly 6.4% this year from 6% in March. Per the Wall Street Journal, this will be the largest U.S. GDP growth since 7.9% in 1983.

Wall Street is Not Overvalued

Before the global outbreak of the coronavirus, the U.S. stock markets were going through their historically longest bull run. The advent of the pandemic put Wall Street in recession within less than a month. However, this recession was not due to any economic or financial factors but purely owing to an unprecedented health hazard.

The three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — have soared 89.1%, 92.5% and 109.8%, respectively, from the recession trough on Mar 23, 2020.

However, if we eliminate the coronavirus-led recession, the Dow is up 16.5% from its pre-pandemic high recorded on Feb 12, 2020 to Jun 9, 2021. The S&P 500 has gained 24.3% from the pre-pandemic high registered on Feb 19, 2020 to Jun 9, 2021. The teach-heavy Nasdaq Composite rallied 41.4% in the same period.

None of the above-mentioned figures looks like exaggerated returns given the unprecedented fiscal and monetary stimulus injected into the U.S. economy. The current market valuation is likely to be sustained by a robust projection of U.S. GDP in 2021 and record-breaking corporate profits.

Per our projections on Jun 9, total earnings of the market's benchmark — the S&P 500 Index — are expected to climb 34.6% year over year on 10.4% higher revenues in 2021 compared with a 13.1% year-over-year decline in earnings on 1.7% lower revenues in the coronavirus-ridden 2020. Moreover, in 2022, total earnings of the S&P Index are forecast to grow 11.3% year over year on 6.4% higher revenues.

How to Select Stocks

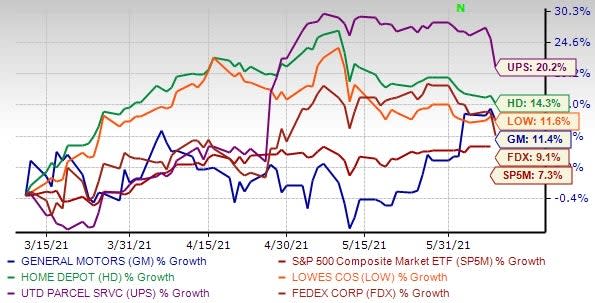

Several good stocks are available to invest in the rest of 2021. However, to filter among those we need to apply our VGM Style Score model. Using this model, we have narrowed down our search to five corporate giants (market capital > $50 billion) that have provided better returns than the S&P 500 Index in the past three months.

These stocks have strong growth potential for the rest of 2021 and have seen solid earnings estimate revisions within the last 30 days. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy) and a VGM score A. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The chart below shows the price performance of our five picks in the past three months.

Image Source: Zacks Investment Research

United Parcel Service Inc. UPS has an expected earnings growth rate of 29.8% for the current year. This Zacks Rank #2 company has a long-term (3-5 years) growth rate of 9.9%. The Zacks Consensus Estimate for its current-year earnings has improved 0.1% over the last 7 days. The stock has a current dividend yield of 2% and jumped 20.2% in the past three months.

The Home Depot Inc. HD has an expected earnings growth rate of 15.5% for the current year (ending January 2022). This Zacks Rank #2 company has a long-term growth rate of 11.4%. The Zacks Consensus Estimate for the current year has improved 9.6% over the last 30 days. The stock has a current dividend yield of 2.1% and climbed 14.3% in the past three months.

Lowe's Companies Inc. LOW has an expected earnings growth rate of 21.4% for the current year (ending January 2022). This Zacks Rank #2 company has a long-term growth rate of 13.7%. The Zacks Consensus Estimate for the current year has improved 9.8% over the last 30 days. The stock has a current dividend yield of 1.3% and appreciated 11.6% in the past three months.

General Motors Co. GM has an expected earnings growth rate of 10.4% for the current year. This Zacks Rank #1 company has a long-term growth rate of 9.9%. The Zacks Consensus Estimate for its current-year earnings has improved 2.3% over the last 7 days. The stock has advanced 11.4% in the past three months.

FedEx Corp. FDX has an expected earnings growth rate of 14% for the current year (ending May 2022). This Zacks Rank #2 company has a long-term growth rate of 12%. The Zacks Consensus Estimate for the current year has improved 0.3% over the last 7 days. The stock has a current dividend yield of 0.9% and surged 9.1% in the past three months.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

United Parcel Service, Inc. (UPS) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Lowes Companies, Inc. (LOW) : Free Stock Analysis Report

FedEx Corporation (FDX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance