Top 5 Most Popular Guru Buys of the 1st Quarter

In the first quarter of 2020, many gurus had unusually high turnover rates in their portfolios as the market downturn in March led them to re-evaluate their holdings and distribute their funds to new value opportunities.

According to GuruFocus' Hot Picks, a Premium feature which allows investors to screen for the stocks that had the most guru buys or sells over a specific time frame, the most popular stocks among gurus during the first quarter (as determined by net buys) were Wells Fargo & Co. (NYSE:WFC), Booking Holdings Inc. (NASDAQ:BKNG), Charles Schwab Corp. (NYSE:SCHW), Baidu Inc. (NASDAQ:BIDU) and HCA Healthcare Inc. (NYSE:HCA).

Wells Fargo

Headquartered in San Francisco, Wells Fargo is the fourth-largest bank in the U.S. by assets. Like its peers, the bank earns most of its revenue from loans and credit cards, though it also has a small but growing investment banking arm.

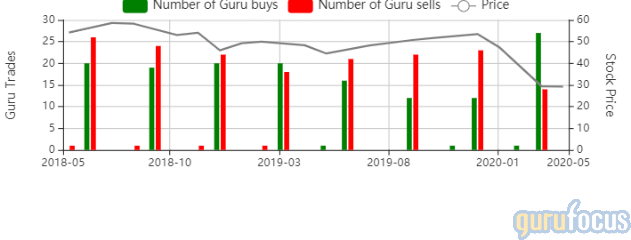

During the first quarter, 27 gurus bought shares of Wells Fargo while 14 gurus sold the stock, resulting in 13 net buys. As of the quarter's end, 37 gurus had a stake in Wells Fargo.

Warren Buffett (Trades, Portfolio) is the guru that has the biggest investment in the company with 7.88% of shares outstanding, followed by Dodge & Cox with 2.21%, Geode Capital Management with 1.39%, Primecap Management with 1.16% and Chris Davis (Trades, Portfolio) with 0.67%.

On May 29, shares of Wells Fargo traded around $26.46 for a market cap of $107.95 billion and a price-earnings ratio of 9.46. GuruFocus gives the company a financial strength rating of 3 out of 10 and a profitability rating of 4 out of 10.

In April, the Federal Reserve announced that it will be temporarily lifting the asset cap on Wells Fargo. The decision came after the bank pointed out that the asset cap prevented it from participating in the government's small business lending efforts, which are being implemented in an attempt to lessen the economic blow from the spread of the novel coronavirus (Covid-19).

The move will "temporarily and narrowly modify the growth restriction on Wells Fargo so that it can provide additional support to small businesses," according to the Fed, though there is a condition; unlike the other big banks, Wells Fargo will have to donate any potential profits from the lending programs to the Treasury or a Fed-approved non-profit. The most important benefit to Wells Fargo here is that the decision could provide the bank a path toward redemption in the eyes of the government and the public after its fake account scandal a few years back, which was the reason for the asset cap being imposed in the first place.

Booking Holdings

Based in Norwalk, Connecticut, Booking Holdings is a world leader in online travel services, providing booking services for everything from flights and cars to hotels and vacation packages. The company's focus is mainly on the more fragmented European and Asian hotel markets rather than the U.S. market.

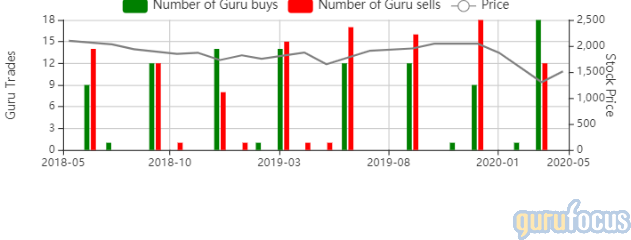

During the first quarter, 19 gurus bought shares of Booking Holdings while 11 gurus sold the stock, resulting in eight net buys. As of the quarter's end, 29 gurus had a stake in Booking Holdings.

T Rowe Price Associates had the biggest investment in the company with 5.66% of shares outstanding, followed by Dodge & Cox with 4.18%, Harris Associates with 2.02% and Invesco Ltd. with 1.50%.

On May 29, shares of Booking Holdings traded around $1632.31 for a market cap of $66.59 billion and a price-earnings ratio of 20.67. GuruFocus gives the company a financial strength rating of 6 out of 10 and a profitability rating of 9 out of 10.

This pick-and-shovel play for the travel industry saw share prices drop to a rare low valuation during the first quarter of 2020 as the Covid-19 pandemic and resulting travel restrictions cut into profits. According to the company's earnings report for the first quarter, gross travel bookings were $12.4 billion, a decrease of 51% from the year-ago quarter, while room nights decreased 43%. As travel picks back up, this financially strong market leader is in a strong position to grow, as Steven Romick (Trades, Portfolio) pointed out in the FPA Crescent Fund's first-quarter shareholder commentary:

"Booking attracted us with, in our view, the long-term strength of its business and a strong balance sheet with net cash, further complemented by several billion dollars of investments in various securities. We also expect Booking to pare its expense structure, albeit with some lag, to protect profitability. We believe those attributes should more than sufficiently ensure that Booking emerges from the other side of this pandemic in a stronger position than its poorly financed peers."

Charles Schwab

Charles Schwab is a financial services company that offers a wide range of products, from mutual funds and bonds to options and futures. Headquartered in San Francisco, the discount online broker has more than $12 million in client accounts and $3.85 trillion in assets under management.

During the quarter, 18 gurus bought shares of Charles Schwab, while 11 gurus sold the stock, resulting in seven net buys. As of the quarter's end, 25 gurus had a stake in Charles Schwab.

Significant guru shareholders included Al Gore (Trades, Portfolio) with 2.52% of shares outstanding, Primecap Management with 2.26%, Parnassus Investments with 1.18% and Ruane Cunniff (Trades, Portfolio) with 0.92%.

On May 29, shares of Charles Schwab traded around $35.81 for a market cap of $46.24 billion and a price-earnings ratio of 14.05. GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rating of 4 out of 10.

Charles Schwab announced in November that it has entered into a $26 billion all-stock deal to acquire fellow online broker TD Ameritrade Holding Corp. (AMTD). The deal is expected to be completed in late 2020, after which Schwab shareholders will own 69% of the combined company.

In addition to the advantages of scale and cost energies expected from the merger, Charles Schwab will also continue to benefit from its October 2019 decision to eliminate trading fees for stocks, exchange-traded funds and base options. These fees previously accounted for around 3% to 4% of revenue, but as the barriers for entry into the online brokerage space have lowered, the company made this decision to remain competitive with new players who already operated on a zero-commission basis.

Baidu

Baidu is a Chinese Internet and technology giant that specializes in artificial intelligence, internet services and search engines. Its most iconic products are the Baidu search engine and the Baike online encyclopedia.

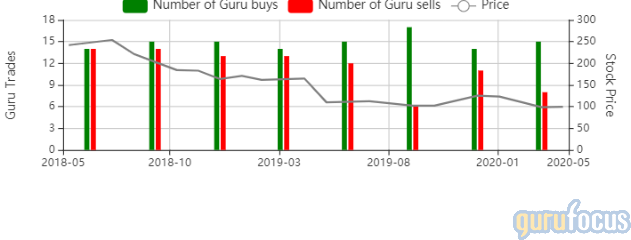

During the quarter, 15 gurus bought shares of Baidu, while eight gurus sold the stock, resulting in seven net buys. As of the quarter's end, 23 gurus had a stake in Baidu.

Significant guru shareholders included Primecap Management with 2.13% of shares outstanding, Sarah Ketterer (Trades, Portfolio) with 1.94%, Jim Simons (Trades, Portfolio)' Renaissance Technologies with 1.65% and David Herro (Trades, Portfolio) with 1.08%.

On May 29, shares of Baidu traded around $105.60 for a market cap of $36.21 billion and a price-earnings ratio of 106.53. GuruFocus gives the company a financial strength rating of 6 out of 10 and a profitability rating of 8 out of 10.

Baidu's search engine holds approximately 90% of the market share in China, the country that has the largest addressable population of internet users in the world, giving this segment of the company a wide runway for growth. The company owns a wide variety of other high-growth assets as well, including cloud services, artificial intelligence, apps, smart transportation and autonomous vehicles.

"Despite shelter-in-place in the first quarter, Baidu's total revenues declined just 7% year-over-year, resulting from our diversified revenue streams, including marketing services for wide-ranging industries, new AI businesses and iQIYI," CEO Robin Li said in the company's first -quarter earnings report. "With the pandemic coming under control in China, offline activities are rebounding and Baidu stands to benefit from a restart of the Chinese economy."

HCA Healthcare

HCA Healthcare is an American operator of health care facilities headquartered in Nashville, Tennessee. The for-profit company owns 184 hospitals and approximately 2,000 other health care sites, including urgent care centers and surgery centers, throughout 21 U.S. states and the U.K.

During the quarter, 14 bought shares of HCA Healthcare, while four gurus sold shares of the stock, resulting in 10 net buys. As of the quarter's end, 18 gurus had a stake in HCA Healthcare.

Significant guru shareholders included T Rowe Price Associates with 6.73%, Magellan Asset Management with 3.01%, Larry Robbins (Trades, Portfolio) with 0.83% and First Eagle Investment (Trades, Portfolio) with 0.70%.

On May 29, shares of HCA Healthcare traded around $107.23 for a market cap of $35.36 billion and a price-earnings ratio of 12.2. GuruFocus gives the company a financial strength rating of 3 out of 10 and a profitability rating of 8 out of 10.

According to the U.S. Bureau of Labor Statistics, jobs in the health care field are expected to grow 14% between 2018 and 2028 - a faster growth rate than any other occupational group. People are living longer and having fewer children, leading to an aging population and thus a greater demand for health care. This serves as a strong macroeconomic tailwind to for-profit health care companies such as HCA.

The company spent only $328 million on acquisitions during the first quarter of 2020 compared to $1.474 billion in the prior-year quarter and $1.682 billion in the fourth quarter of 2019, potentially due to the need to preserve cash during the pandemic. HCA aims to consistently grow its top and bottom lines through the acquisition of additional facilities.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful research and/or consult registered investment advisors before taking action in the stock market.

Read more here:

Michael Price Buys Taubman, Sells Campbell

Louis Moore Bacon Buys Ross, Bets on Corporate Debt

Top 1st-Quarter Buys of Steven Cohen's Firm

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance