Top 5 Large-Cap Stocks Flying High YTD in Terrible 2022

The first three quarters of 2022 were highly disappointing for Wall Street. Year to date, the performances of the U.S. stock market have been pathetic, thanks to an ultra-hawkish Fed. The central bank has raised the benchmark lending rate by 3% so far this year.

However, the Fed has failed to cool the 40-year high inflation rate. This is because aggregate demand has remained strong owing to astonishing savings that Americans generated in the last two pandemic-ridden years with unprecedented fiscal and monetary stimuli.

As the Fed gave a clear indication of the continuation of a rigorous interest rate hike and tighter monetary control, the ICE U.S. Dollar Index (DXY), which measures the greenback’s strength against a basket of six major currencies, skyrocketed to a 20-year high, resulting in massive chaos in global financial markets.

Despite severe headwinds, a handful of large-cap stocks have rallied impressively year to date. We have selected five of these stocks with a favorable Zacks Rank. These are - HF Sinclair Corp. DINO, Enphase Energy Inc. ENPH, LPL Financial Holdings Inc. LPLA, ShockWave Medical Inc. SWAV and Targa Resources Corp. TRGP.

Threat of a Recession

Year to date, the three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — have plummeted 17.6%, 21.4% and 29.2%, respectively. The small-cap-centric benchmark – the Russell 2000 – has plunged 21.9%. The mid-cap-specific index – the S&P 400 – has tumbled 18.2%.

Economists and financial researchers are concerned that a rising dollar will hurt the sales of U.S. multinational companies as their products will be more expensive in the international markets. Further, the volume of international trade is likely to be impacted as most of these trades are settled in U.S. dollar terms.

Per the Fed’s latest projection of interest rate movement in the September FOMC meeting, it will hike interest rate by 75 basis points in November and by 50 basis points in December. The central bank is likely to hike the benchmark lending rate by 50 basis points in 2023. The first rate cut is expected not before 2024.

As of Oct 6, the yield on the short-term 2-Year U.S. Treasury Note closed at 4.264%. The yield on the benchmark 10-Year U.S. Treasury Note closed at 3.827%. On the other hand, the yield on the long-term 30-Year U.S. treasury Note ended at 3.785%.

The yields of 2-year and 10-Year Notes have inverted in the last three months. After the last round of rate hike in September, the yields on 10-Year and 30-Year Notes have also inverted. Economists generally consider this situation as a sign of an imminent recession.

Our Top Picks

We have narrowed our search to five large-cap (market capital > $10 billion) stocks that have popped more than 20% year to date. These stocks have strong upside left for the rest of 2022 and have seen positive earnings estimate revisions in the past 30 days. Each of our picks sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

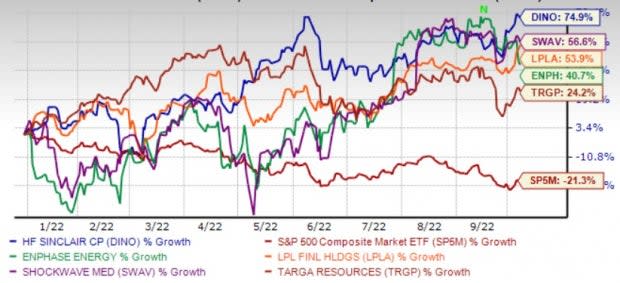

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

HF Sinclair operates as an independent energy company. DINO produces and markets gasoline, diesel fuel, jet fuel, renewable diesel, specialty lubricant products, specialty chemicals, specialty and modified asphalt, and others.

HF Sinclair also owns and operates refineries located in Kansas, Oklahoma, New Mexico, Utah, Washington, and Wyoming. DINO markets its refined products principally in the Southwest United States and the Rocky Mountains, Pacific Northwest, and other neighboring Plains states.

HF Sinclair has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 7.1% over the past 30 days. The stock price of DINO has soared 74.9% year to date.

ShockWave Medical is optimistic regarding the continued clinical acceptance and penetration of IVL, as evident from its strong results in the last reported quarter. SWAV’s results were driven by the increasing adoption of coronary IVL in the United States.

Continued sales force expansion led to growth in the United States, while improvement in international revenues over the prior year highlighted the impact of pandemic recovery and higher adoption in existing geographies.

ShockWave Medical has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 27.2% over the past 60 days. The stock price of SWAV has jumped 56.6% year to date.

LPL Financial has been benefiting from strategic acquisitions, including the buyout of Waddell & Reed's wealth management business. Solid advisor productivity and recruiting efforts are expected to keep aiding the advisory revenues of LPLA. Moreover, LPL Financial's efficient capital deployment activities reflect a solid balance sheet position.

LPL Financial has an expected earnings growth rate of 52.4% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2.6% over the past seven days. The stock price of LPLA has climbed 53.9% year to date.

Enphase Energy has revolutionized the solar industry by pioneering a semiconductor-based microinverter, which converts energy at the individual solar module level. ENPH enjoys a strong position as a leading U.S. manufacturer of microinverters.

Enphase Energy is striving to expand in Europe steadily throughout 2022. Such expansion plans may boost its long-term growth in the battery storage market. ENPH has also been making acquisitions to boost its long-term growth. It holds a strong solvency position.

Enphase Energy has an expected earnings growth rate of 69.7% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2% over the past 60 days. The stock price of ENPH has surged 40.7% year to date.

Targa Resources boasts an attractive portfolio of energy infrastructure assets, including a leading position in the Mont Belvieu NGL hub that generates stable and recurring fee and tariff-based revenues. TRGP is well-diversified geographically with its assets serving some of the most attractive oil and gas formations across the United States, and linked with major NGL hubs and logistics centers.

TRGP’s integrated business model and downstream presence offers an attractive upside opportunity compared to most of its peers. Moreover, Targa Resources’ sizable presence in the booming Permian Basin enhances its growth potential. Another plus is that TRGP is largely immune to commodity price fluctuations.

Targa Resources has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the past 60 days. The stock price of TRGP has advanced 24.2% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

LPL Financial Holdings Inc. (LPLA) : Free Stock Analysis Report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

Targa Resources, Inc. (TRGP) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

HF Sinclair Corporation (DINO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance