Top 1st-Quarter Trades of Ray Dalio's Bridgewater

- By James Li

Bridgewater Associates, the $165 billion hedge fund founded by Ray Dalio (Trades, Portfolio), disclosed its first-quarter portfolio last week, revealing that its top trades included a new position in Lowe's Companies Inc. (NYSE:LOW) and boosts to its holdings in Proctor & Gamble Co. (NYSE:PG), Walmart Inc. (NYSE:WMT) and Coca-Cola Co. (NYSE:KO). Despite this, several of the hedge fund's top trades are sells in exchange-traded funds, including the SPDR Gold Shares Exchange-Traded Fund (GLD), SPDR S&P 500 Trust ETF (SPY), iShares MSCI Emerging Markets ETF (EEM) and iShares Core S&P 500 ETF (IVV).

The Greenwich, Connecticut-based hedge fund invests based on Dalio's life principles, which include working for what he wanted, not for what others wanted him to do, coming up with the best independent opinions and stress-testing them, and wrestling with reality without worrying too much about overconfidence.

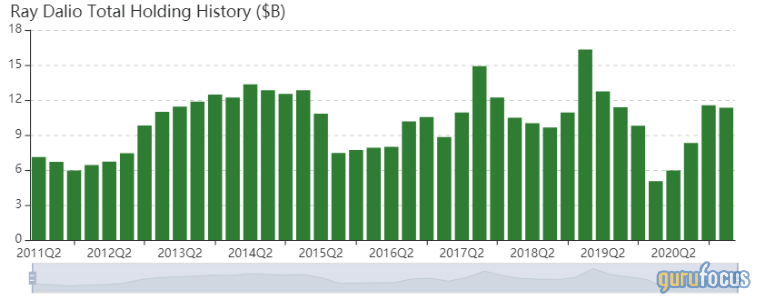

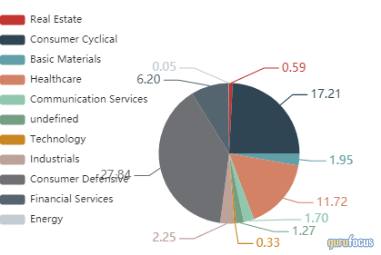

As of March 31, Bridgewater's $11.34 billion equity portfolio contains 455 stocks, with 127 new positions and a turnover ratio of 20%. Excluding ETF holdings, the portfolio's top three sectors in terms of weight are consumer defensive, consumer cyclical and health care, representing 27.84%, 17.21% and 11.72% of the equity portfolio.

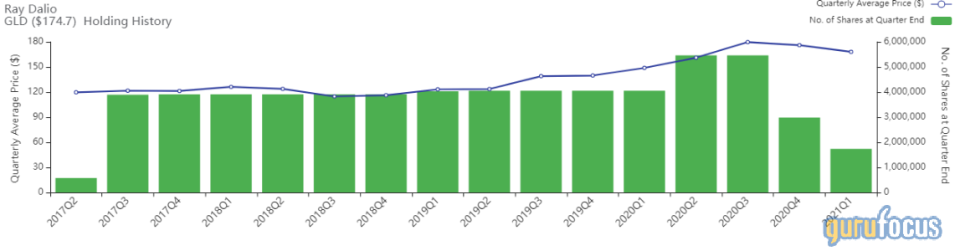

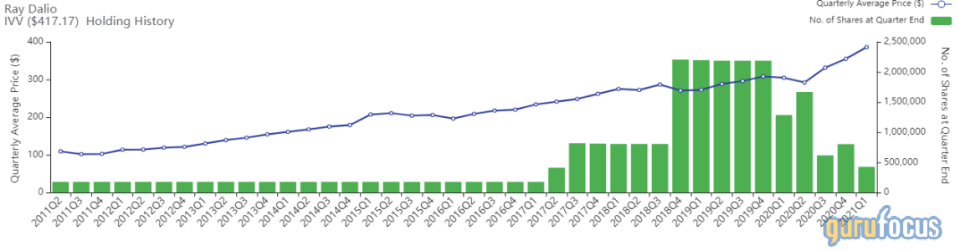

Firm trims several ETF positions

Bridgewater sold 1,252,684 shares of SPDR Gold Shares ETF (GLD), trimming the position 41.96% and the equity portfolio 1.93%. The firm also sold 548,244 shares of SPDR S&P 500 Trust ETF (SPY), curbing the position 14.87% and the equity portfolio 1.77%.

The hedge fund also reduced its positions in iShares MSCI Emerging Markets ETF (EEM) and iShares Core S&P 500 ETF (IVV), selling 89.06% of the former position and 47.01% of the latter position.

Lowe's

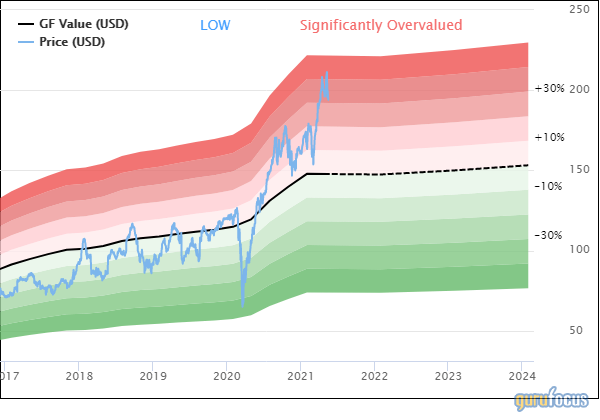

Bridgewater purchased 291,137 shares of Lowe's (NYSE:LOW), giving the position 0.49% weight in the equity portfolio. Shares averaged $171.69 during the first quarter; the stock is significantly overvalued based on Monday's price-to-GF Value ratio of 1.31.

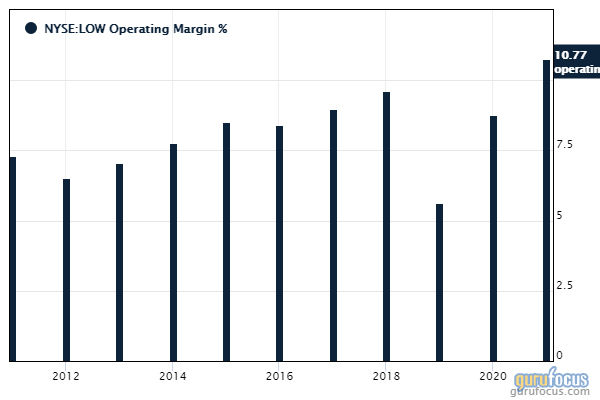

GuruFocus ranks the Mooresville, North Carolina-based home improvement retailer's profitability 9 out of 10 on several positive investing signs, which include a high Piotroski F-score of 9, a five-star business predictability rank and profit margins and returns that outperform over 85% of global competitors.

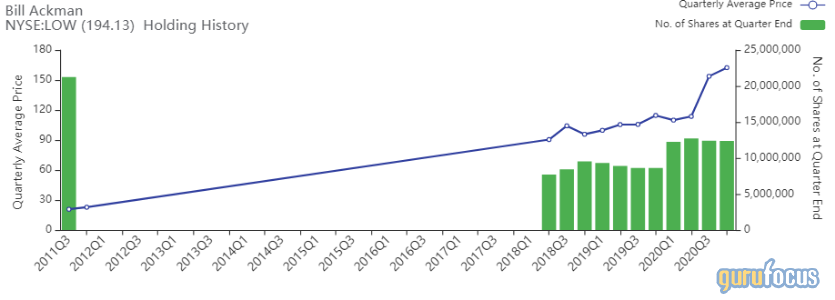

Other gurus with holdings in Lowe's include Bill Ackman (Trades, Portfolio)'s Pershing Square and Pioneer Investments (Trades, Portfolio).

Proctor & Gamble

Bridgewater purchased 523,180 shares of Proctor & Gamble (NYSE:PG), increasing the position by 19.41% and the equity portfolio by 0.62%. Shares averaged $130.43 during the first quarter; the stock is fairly valued based on Monday's price-to-GF Value ratio of 1.07.

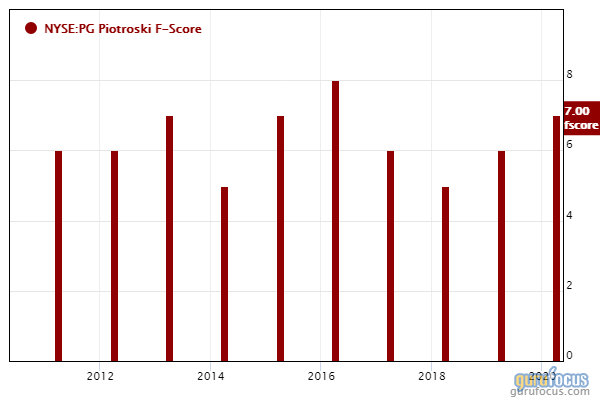

GuruFocus ranks the Cincinnati-based consumer product company's profitability 8 out of 10 on several positive investing signs, which include a high Piotroski F-score of 8 and operating margins that have increased approximately 2.4% per year over the past five years and is outperforming over 93% of global competitors.

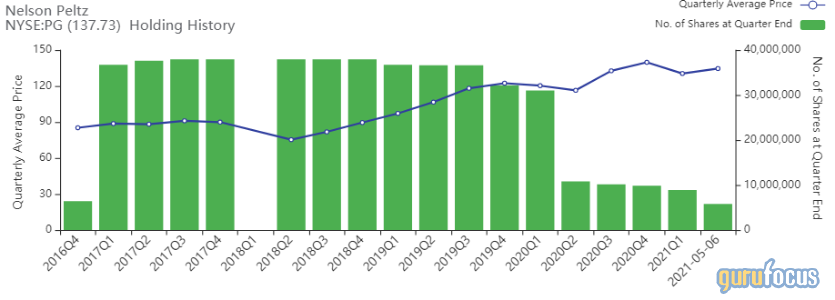

Gurus with large positions in Proctor & Gamble include Diamond Hill Capital (Trades, Portfolio) and Nelson Peltz (Trades, Portfolio)'s Trian Fund Management.

Walmart

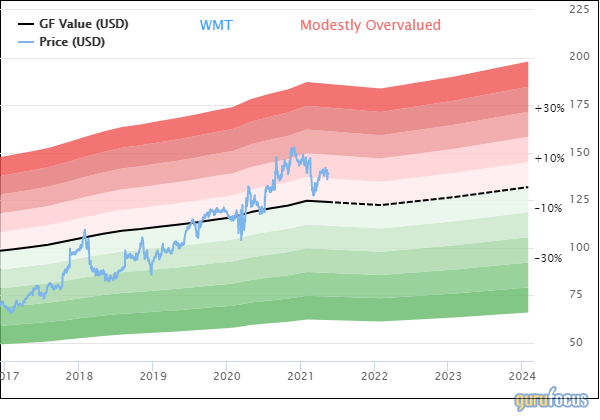

Bridgewater purchased 512,347 shares of Walmart (NYSE:WMT), increasing the holding by 16.64% and the equity portfolio by 0.61%. Shares averaged $139.05 during the first quarter; the stock is modestly overvalued based on Monday's price-to-GF Value ratio of 1.12.

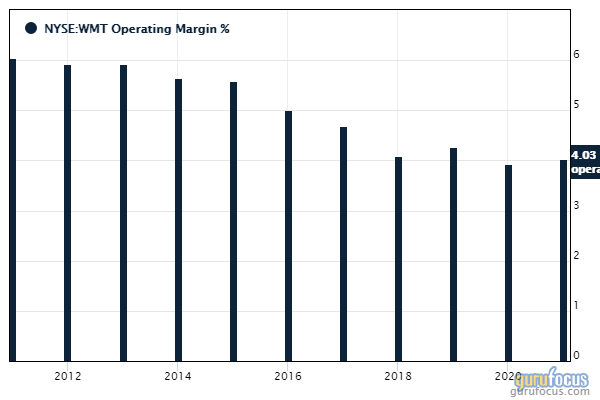

GuruFocus ranks the Bentonville, Arkansas-based retailer's profitability 7 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7 and profit margins and returns that outperform over 60% of global competitors.

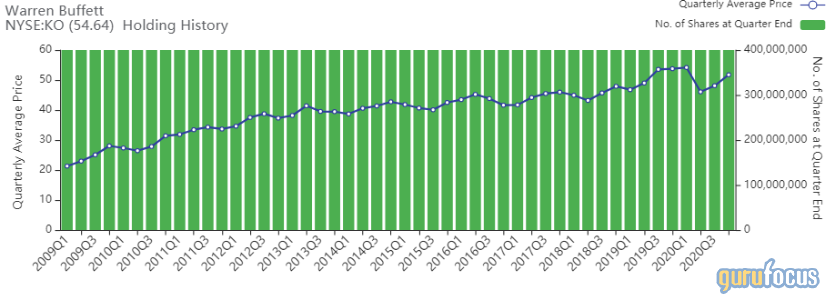

Coca-Cola

Bridgewater purchased 1,136,820 shares of Coca-Cola (NYSE:KO), expanding the position by 25.1% and the equity portfolio by 0.53%. Shares averaged $50.34 during the first quarter; the stock is modestly overvalued based on Monday's price-to-GF-Value ratio of 1.12.

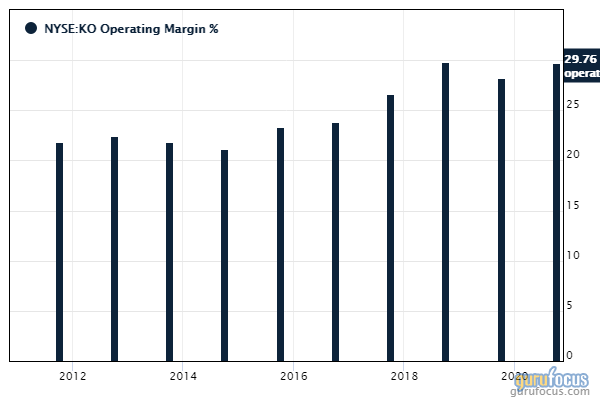

GuruFocus ranks the Atlanta-based beverage giant's profitability 7 out of 10 on the back of profit margins and returns that outperform over 92% of global competitors despite three-year revenue growth rates underperforming over 69% of global non-alcoholic beverage companies.

Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B) also has a holding in Coca-Cola.

Disclosure: Long Coca-Cola and Proctor & Gamble.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance