Is It Time to Dive Back into Stocks?

The net effect of what we learnt from the Fed last week was that interest rates would continue to be taken up, but it could be at smaller increments and it could be that the cumulative increase would be larger than what we had anticipated earlier. Clearly, the Fed wants to feel its way just as we do, because there really isn’t a crystal ball that can tell us the exact effect on inflation.

Historically, the Fed has always overdone it, so there’s no reason to think that this will be different. Which means that we could be headed into a recession sometime in the middle of 2023.

Additionally, the jobs data from last week, which would be kind of good in normal times, is kind of not-so-good now because it can only encourage the Fed to continue doing what it has been doing:

Total additions were a good bit stronger than expected, although hourly earnings (up 4.7% from last year, up 0.4% from the previous month) were about as expected (Bloomberg estimates, quoted by Yahoo Finance).

Therefore, despite all the doom and gloom in the forecast, companies still don’t want to let their employees go. Not only that, they’re building their forces. All except the tech companies that is, because that group has built itself an army that was great during the pandemic but expensive to feed as we move down.

What this means is that we still have a resilient consumer, i.e. people are still buying, which means that companies are still producing, which means earnings are still not as bad as they’re required to be (for the Fed). Which means that the rate hike saga is set to continue.

But there are “encouraging” signs as well.

The manufacturing PMI for October, although still above 1, registered its slowest growth this year, dropping to the levels seen in Jul 2020. Moreover, new orders suffered a big blow as rising inflation continued to increase uncertainties.

The housing market is also softening. Tied directly to interest rates, mortgage rates have jumped to 20-year highs. As a result of the hit to affordability, home prices are coming down. The Fannie Mae home price index shows a 9.0% increase in prices at 2022 year-end (it was previously at +16.0%). Home prices are expected to decline 1.5% in 2023 (previous forecast was for a 4.4% increase). Total home sales are expected to drop 18.1% from last year (previous forecast was for a 17.1% decline), driven by existing home sales.

The automotive market is also entering a soft phase. With supply chain problems easing, inventories have picked up. But higher rates have pushed up borrowing cost, which is keeping customers away. Therefore, prices should start coming down about now, with a corresponding positive effect on inflation.

The macro situation described above seems to indicate that further softness is in the cards. However, it’s worth noting that estimates have been coming down, with the S&P 500 benchmark dropping more than 10% for 2023 on an ex-Energy basis since mid-April. There could be downside risk to the 3.5% growth in aggregate 2023 estimates for the S&P 500, but as we stand today, we are only expecting a moderate recession in the back half. Therefore, there is a reasonable chance of companies reporting positive surprises next year, which would support prices.

And if such an outlook seems fraught with risk, large cap stocks that have a relatively stronger outlook based on estimate revisions trends, that also pay a nice dividend could be a hedge:

Coca-Cola FEMSA, S.A.B. de C.V. KOF

Based in Mexico City, the company is a franchise bottler, producing, marketing, selling and distributing Coca-Cola trademark beverages through retail outlets, restaurants and bars, auditoriums, supermarkets and other locations.

The Zacks #1 (Strong Buy) ranked stock pays an attractive dividend that yields 4.25%. It belongs to the Beverages - Soft drinks industry (top 34% of Zacks-ranked industries).

The 2022 earnings estimate is up 11.4% in the last 30 days. The 2023 estimate is up 7.4%. Therefore, analysts are relatively optimistic about its prospects.

The shares trade at 15.15X earnings, compared with the S&P’s 16.62X. They are trading below their 5-year median level of 16.73X P/E.

Japan Tobacco Inc. JAPAY

Tokyo-based Japan Tobacco manufactures and sells tobacco products, prescription drugs and processed foods in Japan and internationally.

The Zacks Rank #1 stock offers a 4.13% yield. It belongs to the Tobacco industry, which is in the top 24% of Zacks-ranked industries.

Its 2022 estimate is up 7.3% in the last 30 days while the 2023 estimate is up 12.2%.

Japan Tobacco’s shares trade at a 10.41X multiple, which is below its median value of 11.92X P/E over the last five years. Therefore, the shares are cheap at these levels.

Magellan Midstream Partners, L.P. MMP

Oklahoma-based Magellan Midstream engages in the transportation, storage, and distribution of refined petroleum products and crude oil in the United States.

The Zacks #2 (Buy) ranked stock’s dividend yields 8.12%. The Oil and Gas – Production Pipeline – MLB industry to which it belongs is however in the bottom 45% of Zacks-ranked industries. It is the top 50% that have historically been known to outperform the bottom 50% in the near term. But the high yield makes this stock a relatively safe play in the current environment.

Magellan’s 2022 estimate is up 9.7% in the last 30 days while its 2023 estimate is up 4.9%.

The shares trade at 10.35X P/E, which is cheaper than the S&P 500 and also its own median level of 12.36X P/E over the past five years.

HSBC Holdings plc HSBC

London-based HSBC provides banking and financial services worldwide.

The Zacks Rank #2 stock pays a dividend that currently yields 4.76%. It belongs to the Banks – Foreign industry (top 32%).

For 2022, analyst estimates have risen 5.1%. For 2023, they’re up 1.1%.

At 6.10X P/E, the shares are trading at a significant discount to their five-year median P/E of 10.77X.

Phillips 66 PSX

Houston-based Phillips 66 operates as an energy manufacturing and logistics company. It operates through four segments: Midstream, Chemicals, Refining, and Marketing and Specialties (M&S).

The Zacks Rank #2 stock pays a dividend yield of 3.75%. It belongs to the Oil and Gas - Refining and Marketing industry (top 2%).

Analysts have raised their 2022 estimates 6.8% in the last 30 days. 2023 estimates are also up an average 3.1%.

The shares are also going cheap. They’re trading at 8.25X earnings, which is a significant discount to the five-year median value of 12.00X.

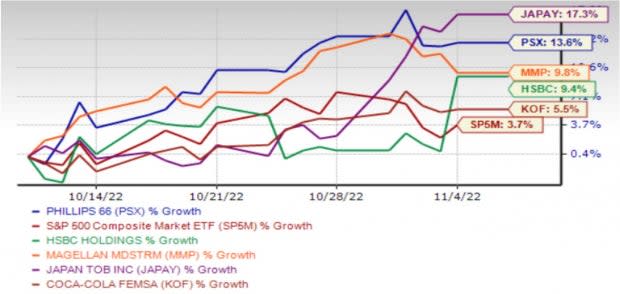

One-Month Price Performance

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Magellan Midstream Partners, L.P. (MMP) : Free Stock Analysis Report

Coca Cola Femsa S.A.B. de C.V. (KOF) : Free Stock Analysis Report

Phillips 66 (PSX) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

JAPAN TOB (JAPAY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance