Time to Buy these Top-Rated Growth Stocks at a Discount?

Finding the next company that will experience exponential growth in the upcoming years has become more and more challenging in the current market environment.

However, many of these companies are often right in front of us, with Advanced Micro Devices AMD being a prime example of such in recent times after mostly being irrelevant since it went public back in 1972.

Unfortunately, carrying a Zacks Rank #4 (Sell) at the moment, AMD stock may continue to be vulnerable to the tougher operating environment for semiconductor companies as inflation is harsher on the broader technology sector as a whole.

Here are three stocks that also experienced substantial EPS growth over the last five years that investors may want to consider buying at their current levels.

Image Source: Zacks Investment Research

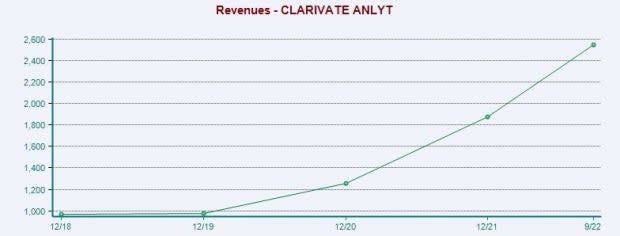

Clarivate CLVT

With many tech companies struggling in the current market environment Clarivate Analytics (CLVT) starts this list as the stock has arguably reached oversold territory.

Clarivate provides a diverse range of information and analytics services that includes scientific, patient, and academic research, along with intelligence, domain and brand protection, and intellectual property management solutions.

Image Source: Zacks Investment Research

Sporting a Zacks Rank #2 (Buy) earnings estimates have slightly trended higher again for CLVT stock with its valuation also supporting that there could be more upside. Trading around $10 a share and just 13.5X forward earnings CLVT stock trades well below its historical high of 66.5X and at a 54% discount to the median of 36.8X.

Performance: Clarivate is still down -20% since it went public in 2019 but has climbed 30% over the last month to largely outperform the broader indexes.

EPS Growth: Clarivate earnings are expected to jump 12% for its current fiscal 2022 and dip -1% in FY23 at $0.80 per share. Still, Fiscal 2023 would be a very stellar 129% increase from 2019 EPS of $0.35 a share.

Safe Bulkers SB

Out of the Transportation-Shipping Industry, which is currently in the top 12% of over 250 Zacks Industries, Safe Bulkers (SB) is another viable investment for expansive EPS growth as a provider of marine drybulk transportation services that includes grain, iron ore and coal among other cargoe.

Safe Bulkers stock currently sports a Zacks Rank #1 (Strong Buy) with earnings estimate revisions starting to trend higher for its upcoming fiscal 2023 as the company rounds out FY22. This in combination with its valuation makes Safe Bulkers stock stick out at the moment.

Safe Bulkers stock appears to be oversold considering its growth over the last five years. Trading at $3 per share and just 3X forward earnings, SB stock has an “A” Style Scores grade for Value. In fact, Safe Bulkers trades 96% below its decade high of 84.6X and at a 66% discount to the median of 9.1X.

Image Source: Zacks Investment Research

Performance: While Safe Bulkers stock is now down -23% over the last decade to largely lag the S&P 500’s +170%, the stock is up +15% over the last three months and +6% in the last month outperforming the benchmark to start the year.

EPS Growth: Safe Bulkers earnings are forecasted to dip -1% to round its current fiscal 2022 and drop another -17% in FY23 to $1.03 per share but fiscal 2023 would still be an outstanding 505% increase from 2018 EPS of $0.17 a share.

Targa Resources TRGP

Rounding out the list is Targa Resources (TRGP) which is part of the top-rated Oil and Gas-Refining and Marketing-Master Limited Partnerships Industry, currently in the top 1% of all Zacks Industries.

As a premiere energy infrastructure company, Targa Resources provides integrated midstream services in North America primarily deriving revenue from gathering, compressing, treating, processing, and selling natural gas.

Targa Resources lands a Zacks Rank #2 (Buy) with earnings estimate revisions trending higher again as the company rounds out its current fiscal 2022. Even better, FY23 earnings estimates are up 5% over the last 30 days to $6.05 per share.

Plus, trading at $75 per share and 13.2X forward earnings TRGP trades far more reasonably to its extreme decade high of 5,353.9X and at a 66% discount to the median of 39.6X.

Image Source: Zacks Investment Research

Performance: While Targa stock is only up +24% over the last decade, it has climbed 31% in the last year alone to crush the S&P 500’s -9% and has also topped the Oil Refining & Marketing MLP Markets +12% since last January.

EPS Growth: Targa Resources earnings are now expected to pop 141% for its current fiscal 2022 at $4.55 per share and jump another 33% in FY23. More impressive, FY23 earnings of $6.05 a share would be an astonishing 2,925% increase over the last five years with 2018 EPS at $0.20 a share.

Bottom Line

These three stocks have seen stellar EPS growth over the last five years and their attractive valuations make them appear to have more short-term upside in addition to being solid long-term investments. With the risk-to-reward being favorable at their current levels, as the broader economy continues to stabilize at some point, these are stocks that could potentially see substantial gains.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Safe Bulkers, Inc (SB) : Free Stock Analysis Report

Targa Resources, Inc. (TRGP) : Free Stock Analysis Report

Clarivate PLC (CLVT) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance