Time to Buy Snowflake or Nvidia Stock as Earnings Approach?

Tech innovators Nvidia (NVDA) and Snowflake's (SNOW) quarterly results on May 24 will highlight this week’s earnings lineup. As two of the more popular tech stocks investors are certainly wondering if shares of NVDA or SNOW can keep rising.

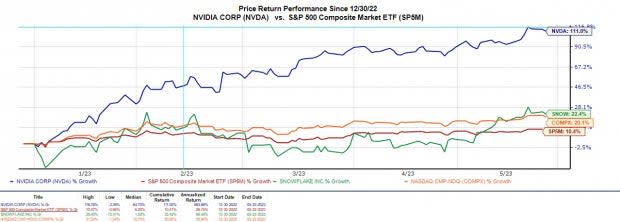

Both stocks have rebounded mightily this year especially Nvidia which has soared +111% to easily top the very respectable performances of the S&P 500 and Nasdaq. Snowflake’s +22% YTD performance has also edged the broader indexes.

Recent developments surrounding both companies’ endeavors into Artificial Intelligence could keep investor sentiment high. With that being said, let’s see if now is a good time to buy Nvidia or Snowflake stock for more upside as earnings approach.

Image Source: Zacks Investment Research

Nvidia Q1 Preview

The rebound among many chip stocks and the broader technology sector has been led by Nvidia’s strong performance. This makes Nvidia’s first-quarter report and outlook crucial after such an extensive rally over the first five months of the year.

AI Developments: Recent developments of a joint collaboration with Dell Technologies (DELL) on generative artificial intelligence (AI) are intriguing and could help the guidance side of Nvidia’s Q1 report. Project Helix as the venture is called will assist businesses with using AI models to deliver better customer service, market intelligence, and enterprise research among other capabilities.

According to Zacks estimates, Nvidia’s Q1 earnings are projected at $0.92 per share, which would be a -32% decrease from Q1 2023 EPS of $1.36 a share. Although Nvidia is still dealing with a tougher operating environment amid high inflation its stock tends to pop after beating earnings expectations, especially when offering favorable guidance.

To that point, the Zacks Expected Surprise Prediction (ESP) indicates Nvidia could beat bottom-line expectations with the Most Accurate Estimate having Q1 EPS at $0.94. On the top line, sales are expected to be $6.52 billion, down -21% from the prior-year quarter.

Image Source: Zacks Investment Research

Snowflake Q1 Preview

Software solutions provider Snowflake has commanded a premium in its realm similar to how Nvidia has among semiconductors and visual computing technologies. Snowflake’s data could capabilities and services have fostered the support of many notable investors. More upside in Snowflake stock will still rely on its Q1 results and guidance.

AI Developments: Notably, the database architect appears to be working on an intriguing artificial intelligence venture of its own with Snowflake reportedly in talks to buy AI search startup Neeva. Many analysts are very keen on the possibilities of the potential deal which could elevate and expand the software Snowflake provides along with its audience and end markets.

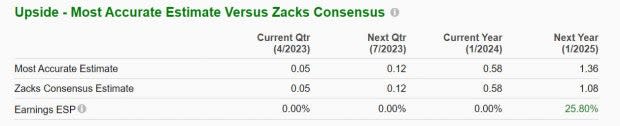

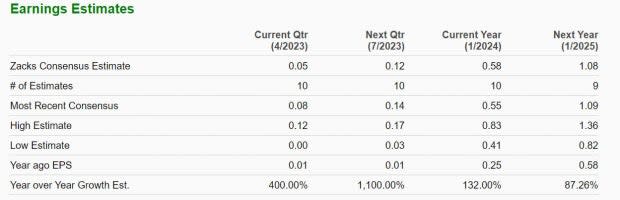

The Zacks Consensus for Snowflake’s Q1 earnings is $0.05 per share a seemingly small but 400% increase from Q1 2022 EPS of $0.01. The Zacks ESP indicates Snowflake should reach its quarterly earnings expectations with the Most Accurate Estimate also at $0.05 a share. Sales for the quarter are expected to be up 44% YoY at $607.57 million.

Image Source: Zacks Investment Research

Growth & Outlook

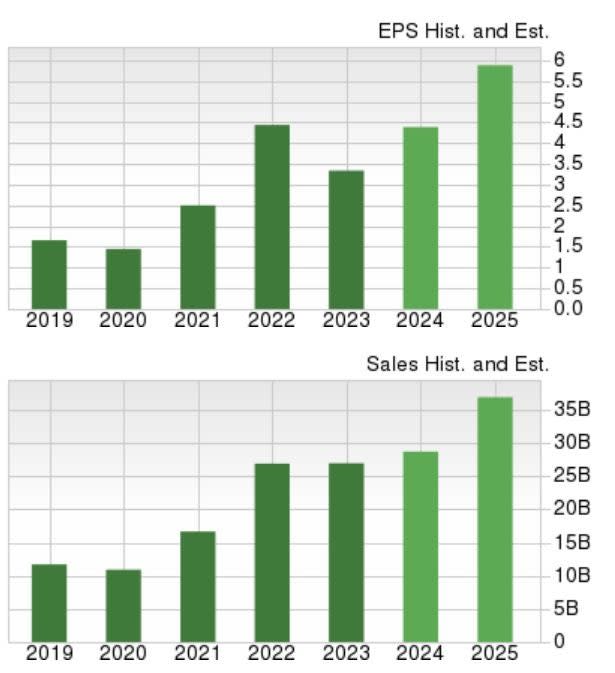

Despite Q1 EPS expected to be down from the prior-year quarter, Nvidia’s current fiscal 2024 earnings are still forecasted to rise 36% at $4.54 a share compared to EPS of $3.34 in the company’s FY23. Even better, FY25 earnings are projected to climb another 33% to $6.03 per share. Sales are projected to rise 11% in FY24 and jump another 25% in FY25 to $37.42 billion.

Image Source: Zacks Investment Research

Pivoting to Snowflake, earnings are expected to skyrocket 132% in its current fiscal 2024 to $0.58 a share compared to EPS of $0.25 in FY23. More impressive, fiscal 2025 earnings are anticipated to climb another 87% to $1.08 per share. On the top line, sales are projected to soar 39% in FY24 and climb another 39% in FY25 to $3.99 billion.

Image Source: Zacks Investment Research

Bottom Line

Artificial Intelligence could certainly boost Nvidia and Snowflake’s expansion capabilities with both stocks landing a Zacks Rank #3 (Hold) at the moment. Further guidance on their AI prospects could extend this year’s rally but at least reaching Q1 EPS expectations and offering a favorable outlook will be just as important.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Snowflake Inc. (SNOW) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance