Is it Time to Buy 3M Stock?

It hasn't been a vintage few years for 3M (NYSE: MMM). The stock has underperformed the S&P 500 by 30% since the start of 2016 and has declined 15% in the last year compared to a 7% gain in the index. What's going on, and does the latest set of earnings change anything about the investment case for the stock?

Why 3M's stock has been declining

To understand what's happened to 3M in the last few years, you have to rewind to the 2015-to-2017 period. Coming off the back of a good 2014, the company's growth in the next two years faltered due to the same sentence weakness in U.S. industrial production, which was largely caused by collapsing energy prices. In fact, the mid-2015-to-mid-2016 period was the first in 50 years in which a recession in U.S. industrial production occurred without being accompanied by an overall economic recession -- tough times for industrials with heavy industry exposure.

Bulls and bears continue to do battle over 3M stock. Image source: Getty Images.

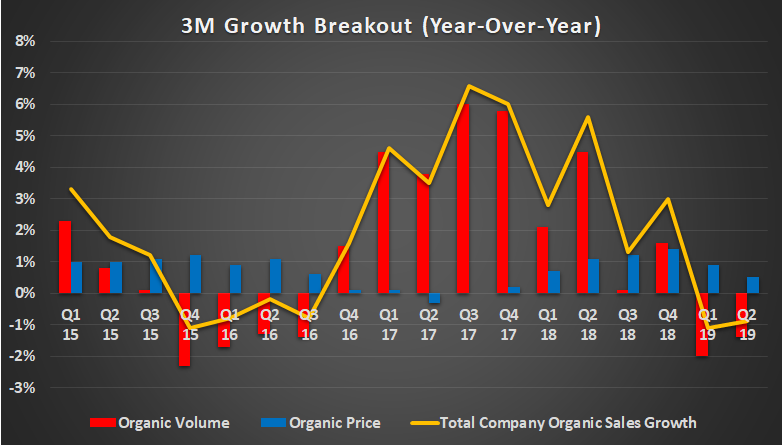

The chart below shows organic sales growth trends since 2015. As you can see, 2015 and 2016 were disappointing years -- organic sales growth came in below initial guidance -- but 2017 saw the company storming back to form with 5.2% organic sales growth compared to an initial forecast of 1% to 3%. What's gone wrong since then?

Data source: 3M presentations.

3M's pricing power

The seeds of the problem were actually visible as far back as 2017. A closer look at the chart above shows that 3M's sales growth in 2017 was largely on the back of volume growth -- there simply wasn't any significant pricing growth.

The question then is what happens to sales growth when the economy turns down and volume growth disappears? Moreover, should investors really pay a premium for a stock whose business model is predicated on creating differentiated products that are supposed to command pricing power when that pricing power is no longer apparent?

In addition, the two segments with the least cyclical exposure, namely healthcare and consumer, had been consistently underperforming management's expectations. Again, questions should be asked. What happens to 3M's growth if/when the economy slows and 3M is then relying on two less cyclical segments if they are underperformers?

What happened in 2019

The answers to these questions lie in the 27% underperformance of the stock in 2019 so far. Having started the year predicting 2% to 4% organic growth, a disappointing set of fourth-quarter results (released in January) saw 3M management cut its full-year 2019 organic sales growth guidance to 1% to 4%. Fast forward to the extremely disappointing first-quarter results in May, and once again organic sales growth guidance was cut to a negative 1% to positive 2% and adjusted full-year EPS guidance was cut to $9.25 to $9.75 from $10.45 to $10.90 previously.

All of which leads us to the recent second-quarter results, which saw a 0.9% decline (see chart above) in organic sales growth and significant margin decline, even as management reaffirmed the full-year sales and earnings guidance given on the first quarter.

What to make of 3M's second-quarter earnings?

To be fair, management was candid about its full-year expectations during the earnings call. Discussing guidance on a segmental level, CFO Nick Gangestad outlined that the healthcare segment would likely be "the high end of the range," with consumer "in the middle of the range that we've laid out."

Meanwhile, the far more cyclically exposed transportation and electronics segment would be "more likely toward the low end," and the equally cyclical safety and industrial segment "could be in this bottom half of the range."

Gangestad then indicated that 0% to 1% would be a "very fair zone" for where 3M's organic sales growth would be. Clearly, 3M's management is being more realistic with its sales guidance, and investors shouldn't expect organic growth to come in at the high end of guidance of 2%.

That said, management sounded an optimistic note for the second half. For example, revenue and margin took a hit in the first half due to 3M's customers contracting inventory in line with slowing sales growth, but CEO Mike Roman believes the majority of the inventory corrections will have taken place already in the first half. Therefore, he expects stabilization in the second half to lead to margin expansion.

That's all well and good, but the fact is that any further deterioration in end markets -- possibly in automotive, consumer electronics, and China -- will threaten 3M's guidance and as you can see in the chart above, there's still little evidence of any pricing power to overcome volume declines.

What to do with the stock

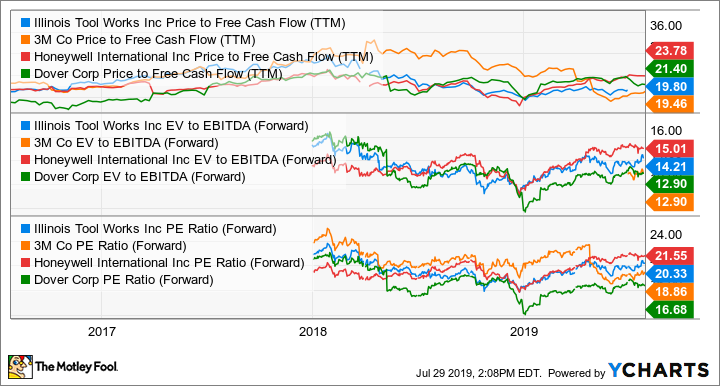

The best answer is probably nothing. 3M's sell-off means it's no longer priced at a premium to its peers, and many of the same cyclical concerns also apply to its rivals.

ITW Price to Free Cash Flow (TTM) data by YCharts.

In addition, 3M's guidance looks realistic given current conditions, and management is actively restructuring the company and cutting costs. All told, in my view, 3M may not be a buy right now, but neither should you rush to sell.

More From The Motley Fool

Lee Samaha owns shares of Honeywell International. The Motley Fool recommends 3M. The Motley Fool has a disclosure policy.

This article was originally published on Fool.com

Yahoo Finance

Yahoo Finance