Tim Hortons fails to woo American customers as RBI earnings falter

Parent company of Tim Hortons, Restaurant Brands International, reported disappointing sales on its Q3 earnings report today.

Tim Hortons, along with fellow RBI-owned brands Burger King and Popeye’s Louisiana Kitchen, saw sales that fell short of expectations in the last quarter, although Canada wasn’t fully responsible for missing the mark.

“Global comparable sales were 0.6 per cent, reflecting Canada comparable sales of nearly 1 per cent, partially offset by softer results in the U.S.,” Daniel Schwartz, Chief Executive Officer of RBI said on an earnings call.

“Our improving comparable sales in Canada reflect our growth in breakfast foods, driven by our breakfast anytime launch, while softer results in the U.S. were driven by weaker sales of brewed coffee and baked goods, partially offset by strength in breakfast foods and cold beverages,” Schwartz explained.

While the Tim Hortons brand (and in particular its coffee) has been widely seen as a Canadian institution, the cafe chain has failed to take root in the American psyche in quite the same way.

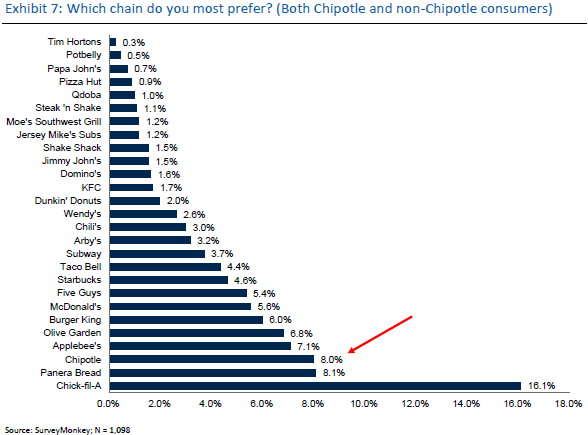

RBC Capital Markets recently conducted a survey, assessing the favourite quick service restaurants of American customers.

Tim Hortons came in dead last.

The survey results were part of RBC analyst David Palmer’s note to investors upgrading Chipotle to ‘Outperform’ status, good news for the chain after a rocky couple of years.

But the results put Tim Hortons at the very bottom of the ranking, asking more than 1,000 Americans “which chain do you most prefer?”

Only 0.3 per cent of respondents (about three people) selected Tim Hortons as their favourite restaurant chain on the list.

Tim Hortons expanded into the U.S. market in 1985, when it opened its first U.S. store on Niagara Falls Blvd. in Buffalo. Its expansion south of the border really got going in 1995, when it joined forces with Wendy’s International. Now owned by Restaurant Brands International (QSR.TO), which also owns Burger King and Popeye’s, Tim Hortons operates more than 600 stores in 14 U.S. states. By comparison, there are more than 2,100 Chick-fil-A stores (the top-rated chain included in the survey) in the U.S.

While the company did not address specific expansion plans for the future in the U.S. on the earnings call, RBI representatives did say that their plans globally include refining menus to meet the needs of specific markets (like including a kid’s menu and enhanced beverage options) and accelerated expansion in both established and new markets outside of Canada.

“Despite the softer comps and not yet reflecting the benefits of the potential accelerated growth for Popeyes and for Tim Hortons, we grew our systemwide sales by nearly seven percent,”

said Schwartz, speaking broadly about global sales and not specifically the U.S. “As we ramp up the pace of growth in Popeyes and in Tim’s, we resume to better same store sales, that would be a number we aspire to grow much faster in the long run. I think we have the right team and the right partnerships set up around the world to achieve that.”

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance