Tilray short sellers lost $122 million this week betting against the cannabis stock

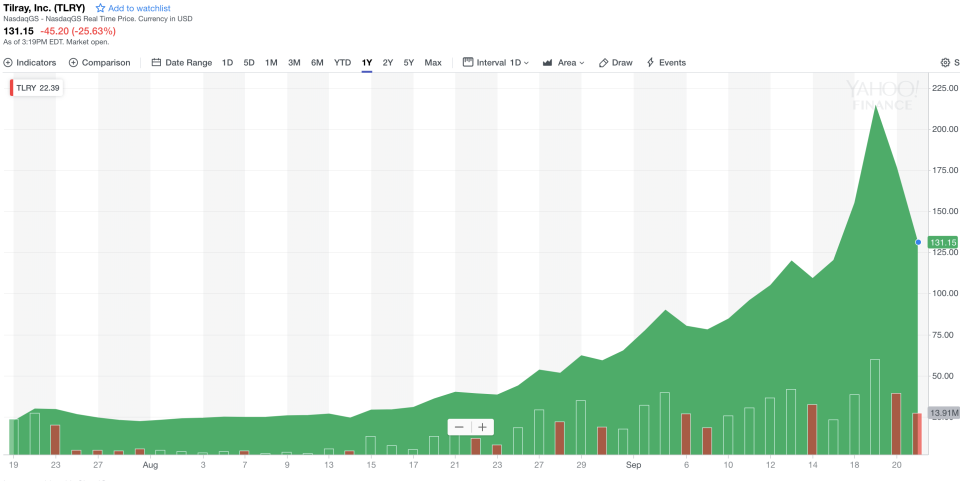

Short sellers are down, but they’re not out just yet when it comes to betting against pharmaceutical company and favored cannabis play Tilray (TLRY). The stock surged by 61% between Monday and Thursday, posting gains of 10% on Monday, followed by surges of 29% and 38% on Tuesday and Wednesday, respectively, hurting short sellers to the tune of $122 million this week.

The loss of more than $100 million hasn’t deterred the bearish sentiment, though. Data from analytics firm S3 Partners, which also calculated the dollar value of the short position losses, shows short interest — or the total value of investors betting the company’s stock will lose value — has now risen to a total of $556 million, with 3.15 million shares being shorted.

Short sellers “rent” out stock at a price, betting it will fall, and then hope to buy at a lower price and pocket the difference.

“We saw [183,000 shares] covered by short sellers as TLRY’s week-long rally and high short financing costs took down short sellers with less conviction and not so deep pockets,” said Ihor Dusaniwsky, S3 Partners’ managing director.

Shorts were eventually rewarded

Those who have been able to ride out the bumpy ride have been rewarded, Dusaniwsky noted. The short bet was up $115 million in mark-to-market profits Thursday, and shorts are up again on Friday as TLRY’s stock price is down by 25% during the day.

“Some shorts have exited their positions but the vast majority have held steady, and are now being rewarded for their perseverance,” Dusaniwsky said.

Despite Tilray’s impressive run this week and the strong performance of marijuana stocks so far this year — or perhaps because of that outperformance — investors are piling on the bearish bets against marijuana stocks broadly, betting they will fall.

S3’s data shows short interest of $1.85 billion in a basket of 60 cannabis stocks, up 77% from the $1.04 billion or short interest at the end of June. Shorts in the sector have recouped $195 million as of Friday, nearly halving their losses this week.

However, short sellers are still down $201 million for the week and $608 million for the year in the broader sector. Besides Tilray, Canopy Growth (CGC) is the second biggest losing bet for short sellers in the sector, costing them $151 million for the year with short interest of $264 million.

—

See also:

Wall Street managers have cost Americans more than $600 billion over the past decade

It’s the end of the world as we know it, and investors feel bullish

The dollar’s status as the world’s funding currency is in question

Why Trump’s trade war hasn’t tanked the market or the economy yet

Dion Rabouin is a global markets reporter for Yahoo Finance. Follow him on Twitter: @DionRabouin.

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn.

Yahoo Finance

Yahoo Finance