Three Things You Should Check Before Buying Tronox Holdings plc (NYSE:TROX) For Its Dividend

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Today we'll take a closer look at Tronox Holdings plc (NYSE:TROX) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

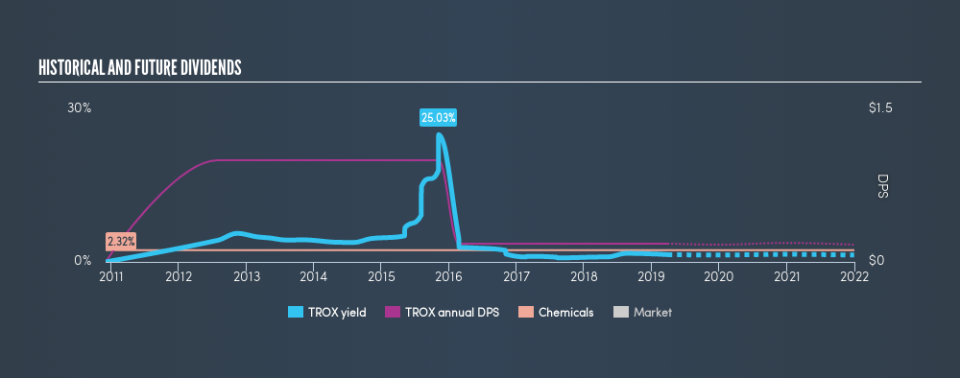

With a 1.7% yield and a seven-year payment history, investors probably think Tronox Holdings looks like a reliable dividend stock. A low yield is generally a turn-off, but if the prospects for earnings growth were strong, investors might be pleasantly surprised by the long-term results. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to be form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 740% of Tronox Holdings's profits were paid out as dividends in the last 12 months. Unless there are extenuating circumstances, from the perspective of an investor who hopes to own the company for many years, a payout ratio of above 100% is definitely a concern.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Tronox Holdings paid out 23% of its free cash flow as dividends last year, which is conservative and suggests the dividend is sustainable.

We think shareholders should look closer into how Tronox Holdings's 740% payout ratio came to be.

Is Tronox Holdings's Balance Sheet Risky?

As Tronox Holdings's dividend was not well covered by earnings, we need to check its balance sheet for signs of financial distress. A rough way to check this is with these two simple ratios: a) net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and b) net interest cover. Net debt to EBITDA is a measure of a company's total debt. Net interest cover measures the ability to meet interest payments on debt. Essentially we check that a) a company does not have too much debt, and b) that it can afford to pay the interest. Tronox Holdings has net debt of 5.22 times its earnings before interest, tax, depreciation and amortisation (EBITDA) which implies meaningful risk if interest rates rise of earnings decline.

We calculated its interest cover by measuring its earnings before interest and tax (EBIT), and dividing this by the company's net interest expense. With EBIT of 1.64 times its interest expense, Tronox Holdings's interest cover is starting to look a bit thin. Low interest cover and high debt can create problems right when the investor least needs them. We're generally reluctant to rely on the dividend of companies with these traits.

Remember, you can always get a snapshot of Tronox Holdings's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Looking at the data, we can see that Tronox Holdings has been paying a dividend for the past seven years. Although it has been paying a dividend for several years now, the dividend has been cut at least once by more than 20%, and we're cautious about the consistency of its dividend across a full economic cycle. During the past seven-year period, the first annual payment was US$1.00 in 2012, compared to US$0.18 last year. Dividend payments have fallen sharply, down 82% over that time.

Dividend Growth Potential

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. It's good to see Tronox Holdings has been growing its earnings per share at 37% a year over the past 5 years. Earnings per share have been growing very rapidly, although the company is also paying out virtually all of its profit in dividends. Generally, a company that is growing rapidly while paying out a majority of its earnings, is seeing its debt burden increase. We'd be conscious of any extra risk added by this practice.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. We're a bit uncomfortable with its high payout ratio, although we note cashflow was stronger than income. We were also glad to see it growing earnings, but it was concerning to see the dividend has been cut at least once in the past. While we're not hugely bearish on it, overall we think there are potentially better dividend stocks than Tronox Holdings out there.

Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 3 analysts we track are forecasting for Tronox Holdings for free with public analyst estimates for the company.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance