Those Who Purchased TimkenSteel (NYSE:TMST) Shares A Year Ago Have A 36% Loss To Show For It

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. That downside risk was realized by TimkenSteel Corporation (NYSE:TMST) shareholders over the last year, as the share price declined 36%. That's disappointing when you consider the market returned 12%. However, the longer term returns haven't been so bad, with the stock down 14% in the last three years. The falls have accelerated recently, with the share price down 16% in the last three months.

View our latest analysis for TimkenSteel

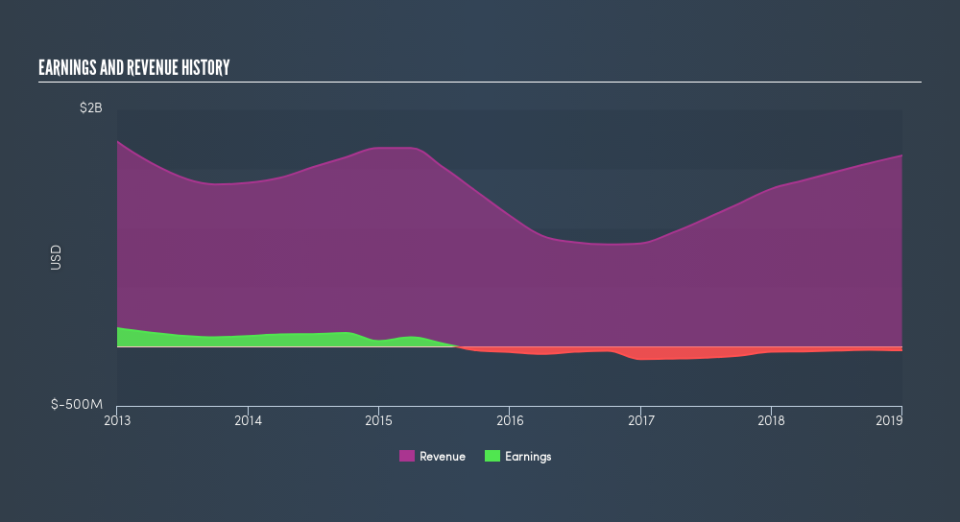

Given that TimkenSteel didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year TimkenSteel saw its revenue grow by 21%. We think that is pretty nice growth. Meanwhile, the share price is down 36% over twelve months, which is disappointing given the progress made. You might even wonder if the share price was previously over-hyped. However, that's in the past now, and it's the future that matters most.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

If you are thinking of buying or selling TimkenSteel stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

The last twelve months weren't great for TimkenSteel shares, which cost holders 36%, while the market was up about 12%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Shareholders have lost 4.8% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Warren Buffett famously said he likes to 'buy when there is blood on the streets', he also focusses on high quality stocks with solid prospects. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance