Those Who Purchased SLM Solutions Group (ETR:AM3D) Shares Three Years Ago Have A 68% Loss To Show For It

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But long term SLM Solutions Group AG (ETR:AM3D) shareholders have had a particularly rough ride in the last three year. Sadly for them, the share price is down 68% in that time. The more recent news is of little comfort, with the share price down 36% in a year. It's up 3.5% in the last seven days.

See our latest analysis for SLM Solutions Group

Because SLM Solutions Group is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years SLM Solutions Group saw its revenue shrink by 7.2% per year. That is not a good result. The share price decline of 32% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Of course, it's the future that will determine whether today's price is a good one. We'd be pretty wary of this one until it makes a profit, because we don't specialize in finding turnaround situations.

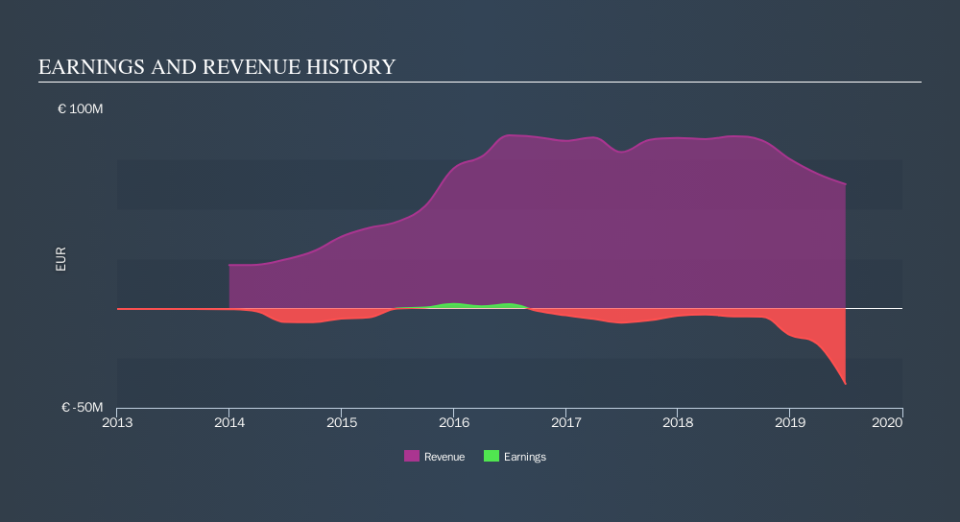

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at SLM Solutions Group's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market lost about 3.1% in the twelve months, SLM Solutions Group shareholders did even worse, losing 36%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5.4% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance