Those Who Purchased Mandalay Resources (TSE:MND) Shares Three Years Ago Have A 90% Loss To Show For It

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Every investor on earth makes bad calls sometimes. But really bad investments should be rare. So consider, for a moment, the misfortune of Mandalay Resources Corporation (TSE:MND) investors who have held the stock for three years as it declined a whopping 90%. That would be a disturbing experience. And over the last year the share price fell 40%, so we doubt many shareholders are delighted. It's up 33% in the last seven days.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for Mandalay Resources

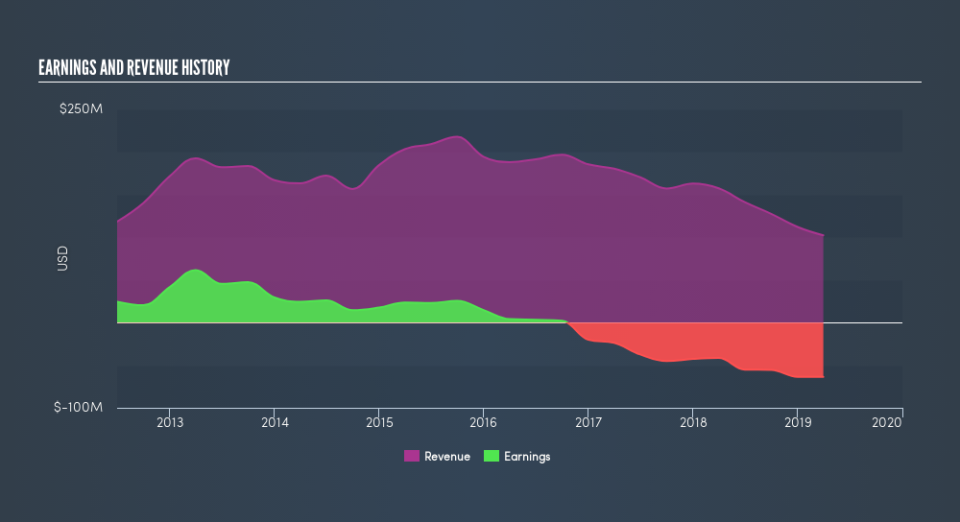

Because Mandalay Resources is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last three years, Mandalay Resources's revenue dropped 19% per year. That's definitely a weaker result than most pre-profit companies report. The swift share price decline at an annual compound rate of 53%, reflects this weak fundamental performance. Never forget that loss making companies with falling revenue can and do cause losses for everyday investors. There is a good reason that investors often describe buying a sharply falling stock price as 'trying to catch a falling knife'. Think about it.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

Balance sheet strength is crucual. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Mandalay Resources shareholders are down 40% for the year, but the market itself is up 1.6%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 33% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Before spending more time on Mandalay Resources it might be wise to click here to see if insiders have been buying or selling shares.

Of course Mandalay Resources may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance