Those Who Purchased Fortress Technologies (CVE:FORT) Shares A Year Ago Have A 24% Loss To Show For It

Fortress Technologies Inc. (CVE:FORT) shareholders should be happy to see the share price up 22% in the last month. But that doesn't change the reality of under-performance over the last twelve months. In fact, the price has declined 24% in a year, falling short of the returns you could get by investing in an index fund.

View our latest analysis for Fortress Technologies

With just CA$1,390,462 worth of revenue in twelve months, we don't think the market considers Fortress Technologies to have proven its business plan. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. Investors will be hoping that Fortress Technologies can make progress and gain better traction for the business, before it runs low on cash.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing.

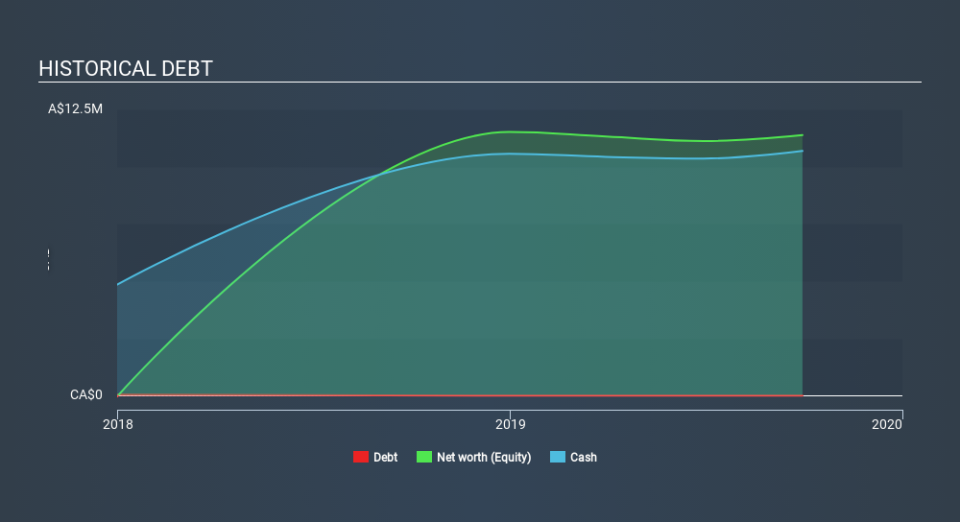

When it last reported its balance sheet in September 2019, Fortress Technologies could boast a strong position, with cash in excess of all liabilities of CA$10m. This gives management the flexibility to drive business growth, without worrying too much about cash reserves. But with the share price diving 24% in the last year , it could be that the price was previously too hyped up. You can see in the image below, how Fortress Technologies's cash levels have changed over time (click to see the values).

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. What if insiders are ditching the stock hand over fist? It would bother me, that's for sure. You can click here to see if there are insiders selling.

A Different Perspective

We doubt Fortress Technologies shareholders are happy with the loss of 24% over twelve months. That falls short of the market, which lost 17%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 15% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand Fortress Technologies better, we need to consider many other factors. For instance, we've identified 5 warning signs for Fortress Technologies (2 make us uncomfortable) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance