Those Who Purchased CommScope Holding Company (NASDAQ:COMM) Shares Three Years Ago Have A 73% Loss To Show For It

CommScope Holding Company, Inc. (NASDAQ:COMM) shareholders should be happy to see the share price up 20% in the last week. But the last three years have seen a terrible decline. To wit, the share price sky-dived 73% in that time. So it sure is nice to see a bit of an improvement. The thing to think about is whether the business has really turned around.

View our latest analysis for CommScope Holding Company

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

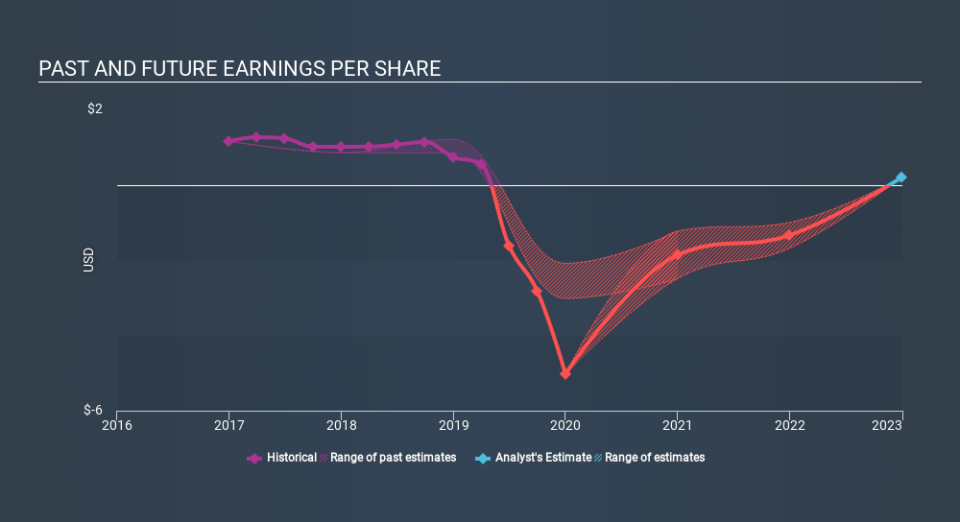

Over the three years that the share price declined, CommScope Holding Company's earnings per share (EPS) dropped significantly, falling to a loss. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. However, we can say we'd expect to see a falling share price in this scenario.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

We regret to report that CommScope Holding Company shareholders are down 55% for the year. Unfortunately, that's worse than the broader market decline of 2.1%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 17% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that CommScope Holding Company is showing 2 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

CommScope Holding Company is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance