We Think MacroGenics (NASDAQ:MGNX) Needs To Drive Business Growth Carefully

Just because a business does not make any money, does not mean that the stock will go down. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So, the natural question for MacroGenics (NASDAQ:MGNX) shareholders is whether they should be concerned by its rate of cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

Check out our latest analysis for MacroGenics

How Long Is MacroGenics's Cash Runway?

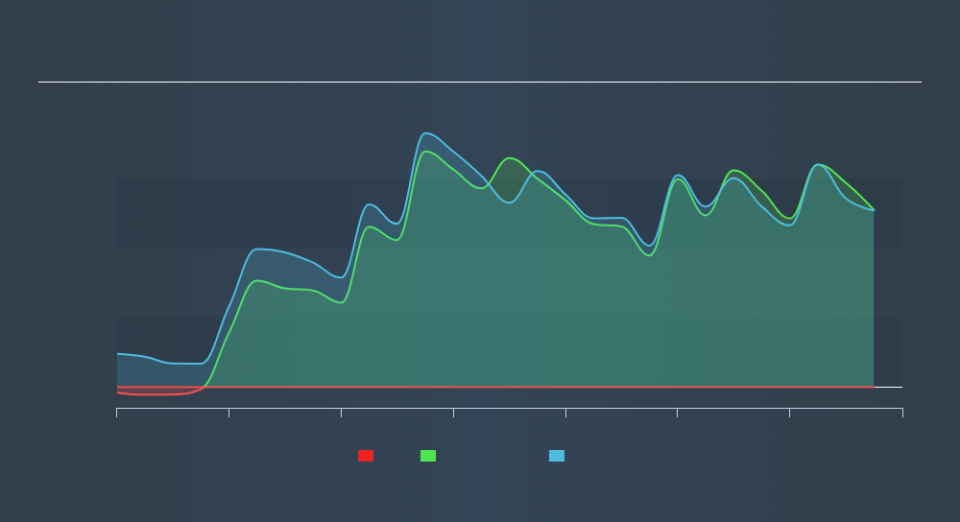

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When MacroGenics last reported its balance sheet in September 2019, it had zero debt and cash worth US$254m. In the last year, its cash burn was US$127m. That means it had a cash runway of about 2.0 years as of September 2019. While that cash runway isn't too concerning, sensible holders would be peering into the distance, and considering what happens if the company runs out of cash. Depicted below, you can see how its cash holdings have changed over time.

How Well Is MacroGenics Growing?

Notably, MacroGenics actually ramped up its cash burn very hard and fast in the last year, by 159%, signifying heavy investment in the business. And that is all the more of a concern in light of the fact that operating revenue was actually down by 72% in the last year, as the company no doubt scrambles to change its fortunes. Considering these two factors together makes us nervous about the direction the company seems to be heading. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For MacroGenics To Raise More Cash For Growth?

MacroGenics revenue is declining and its cash burn is increasing, so many may be considering its need to raise more cash in the future. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of US$410m, MacroGenics's US$127m in cash burn equates to about 31% of its market value. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

How Risky Is MacroGenics's Cash Burn Situation?

On this analysis of MacroGenics's cash burn, we think its cash runway was reassuring, while its falling revenue has us a bit worried. Looking at the factors mentioned in this short report, we do think that its cash burn is a bit risky, and it does make us slightly nervous about the stock. For us, it's always important to consider risks around cash burn rates. But investors should look at a whole range of factors when researching a new stock. For example, it could be interesting to see how much the MacroGenics CEO receives in total remuneration.

Of course MacroGenics may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance