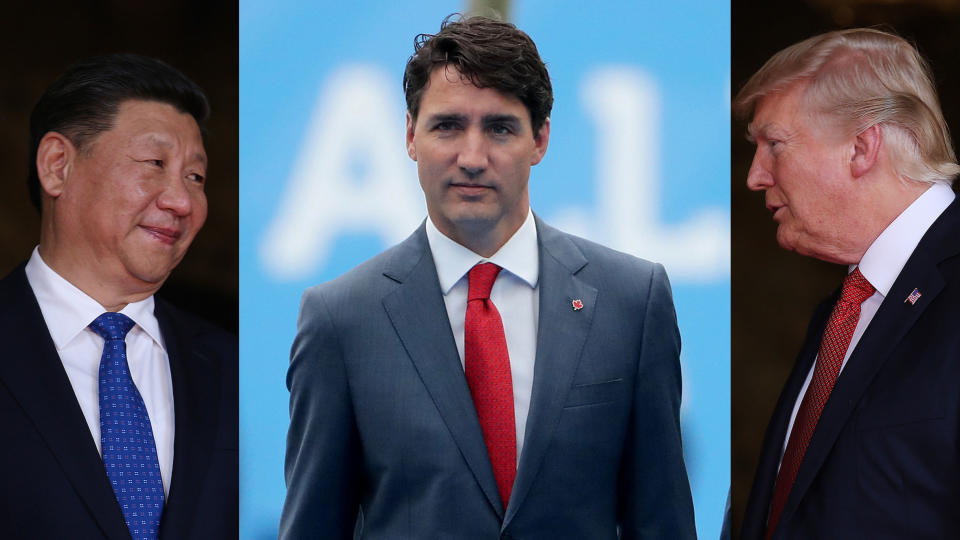

Think Canada wouldn't be dragged into a U.S.-China trade war? Think again

The U.S.-China tensions have increasingly become a subject of concern and as more tariffs are slapped onto goods, investors are closely monitoring the trade war’s impact on the stock market.

It may be premature to make definitive statements as to which companies will be hit the most by a trade war, but there are sectors that are already feeling it. Take the auto industry for example, which is likely to feel even more of an impact following the aluminum and steel tariffs placed on Canadian imports, key materials necessary for the manufacturing of auto parts.

Linamar, Canada’s second-largest auto manufacturer, has already seen its stock take a blow and the company’s CEO Linda Hasenfratz has stressed the negative impact this could have on Canadian jobs and the economy.

However, Canada’a deputy ambassador to the U.S. assures that Canada is in a position to hit back “in a proportional manner” should there be the application of tariffs on autos.

In June, U.S. President Donald Trump imposed a 25 per cent tariff on up to US$50 billion in Chinese imports. This affects items like soybeans, corn, nuts and of course, autos. China responded with a 25 per cent tariff on $34 billion of U.S. goods ranging from electric vehicles to soybeans.

Then on July 10, the U.S. government announced an additional 10 per cent tax to some $200 billion worth of Chinese imports. The announcement referenced a 195-page list of goods and food products that would be cause for taxation. Tobacco, handbags, car tires and dog and cat food were among the list of imports listed. The latest set of tariffs is expected to come into effect following a two-month public comment review process.

And earlier Friday, Trump voiced he was considering putting tariffs on all $500 billion of Chinese imports into the U.S. market. Further tariffs could hurt the market and put Canada in a worrisome position.

“We’re escalating to a point that has gotten quite serious particularly if the Chinese implement their own countermeasures in response to the U.S. announcement that there will be tariffs on an additional $200 billion of Chinese exports,” Brian Kingston, vice president of policy, international and fiscal for the Business Council of Canada, tells Yahoo Canada Finance.

“Now you’re looking at over $600 billion in bilateral U.S.-China trade subject to tariffs,” he cautions. “The U.S. is in the late stage of an extended business cycle and I worry that eventually markets will take notice and this could be a recession-triggering event which of course could be bad for Canada because of our reliance on the U.S.”

Kingston says companies are already seeing disruption to their supply chain and he fears this could only get worse.

“North America has very highly integrated supply chains so a lot of companies will source an input or a part from the U.S. but that part may originally come from China, then gone through some sort of transformation in the States, then sent to Canada where it is inputted into the supply chain and is eventually part of our final product,” Kingston says.

“Now the U.S. importer is paying a 25 per cent tariff on that product that course gets passed on along to the supply chain so those types of impacts will be very hard to determine until this all comes into force, but I think that could have a real implication for companies that are integrated with U.S. counterparts. Given that 76 per cent of our trade is with the U.S., a lot of Canadian companies are highly integrated with the U.S.”

Jessica Horwitz is a Toronto trade lawyer at Bennett Jones LLP and she tells Yahoo Canada Finance that the extent of the impact of the surtax will depend largely on the importance of the import. “If a Canadian company gets all of its supply of the goods that it sells or the goods that it uses as input to manufacture other goods in Canada from the U.S., and those goods are of U.S. origin, that’s going to be a big problem for the company,” she says. “The company would then need to find an alternative source of supply or products, or see whether they qualify for any exemption or programs that reduce the impact of the surtax.”

As a result, determining place of origin will be met with greater review and border inspection will intensify.

“We expect you’ll see tense and heightened scrutiny at the Canada-U.S. border as border agents crack down on perceived shipment of Chinese products through Canada,” explains Kingston. “So what that means is companies will have to be very clear about rules of origin, which they are, but there just may be more intense scrutiny which ultimately leads to border thickening as it slows down the process when products cross the border daily.”

The crackdown at the border comes too with the position that Canada could allow the transfer of Chinese products into the U.S. market, which Kingston believes is an unfounded claim.

“There seems to be this false mentality that’s emitting out of some sectors of the U.S. that Canada could be a weak backdoor for Chinese products into the U.S. market. Well, that’s simply not true because by taking a Chinese import and rerouting it from a U.S. destination to a Canadian destination it doesn’t mean that now it won’t be duty free when it goes and crosses the border in the U.S. The origin has not changed. So unless there’s some sort of substantial transformation that’s made to that product, it will still be Chinese and face a tariff as a result,” he says. “I don’t think it’s fair to criticize Canada or Mexico as a backdoor, I just don’t see how it happens.”

“From an investment standpoint, as this dispute intensifies you may see some increased Chinese investment in Mexico or Canada, and the U.S. as well, as Chinese companies try to get behind the tariff law and effectively produce products in the market. There’s a potential for that,” says Kingston. “We’ve also seen an increase in companies trying to hedge against potential U.S. protectionist measures that will impede their access into that market. There’s already a bit of that going on now,” he adds.

We’ve also seen soy prices depressed as a result of the ongoing U.S.-China trade tensions, but whether or not this is going to negatively impact Canada is yet to be seen.

Omar Allam, head of global trade consultancy Allam Advisory Group and former diplomat notes that with the Chinese proposing tariffs on soybean imports from the U.S., “which will hit the American midwest” there will then be opportunity for Canadian soybean growers coming out of Manitoba and the western provinces to benefit. However, “it will also open up competition among other countries like Brazil and Australia,” says Allam.

“For Canada, exports in nuts, fruit, wine, pork, soybeans—all awesome opportunities for Canadians, but Australia will compete with nuts, wine and fruits. Brazil will compete on pork and soybeans,” he notes.

As trade tensions escalate though prices will decline says Kingston, which could allow for Canadian producers to fill the void. “Canadian companies will fill that gap, however, it may be at lower prices,” he adds.

Canadian exporters are still pretty confident though according to Export Development Canada’s (EDC) latest Confident Index Report, released on July 13. Even with the protectionist measures from the U.S. and the potential downside of these measures, “the fact is the U.S. economy is absolutely booming right now,” says Kingston so the “order books are full” for Canadian exporters, however he believes this is masking some of the potential downsides of the measures.

“If you add the already in force U.S. steel and aluminum tariffs with tariffs on China-U.S. trade of over US$600 billion and finally tariffs on U.S. imports of autos and auto parts of around US$335 billion plus equivalent countermeasures, we’re approaching a trade war affecting over one trillion dollars in annual trade. This is concerning.”

Kingston says Canada’s number one priority should be securing and finalizing the NAFTA negotiations so that will protect Canadian companies and their access into the U.S. market.

“Securing a NAFTA 2.0 is the absolute number one priority, we have to protect that agreement, that relationship that we have. The idea of going through a NAFTA withdrawal or having tariffs reimplemented on Canada-U.S. trade is just something we don’t even want to fathom.”

“Canada needs to step up and build out a coordinated international export and investment attraction strategy,” says Allam.

Whether or not this trade war will be felt at the cash register is too soon to tell. Horwitz explains the impact will depend on the business decisions of a company and whether the company wants to pass down the cost onto the consumers or not.

“Some companies might make the decision to absorb the cost because they don’t want to lose sales. That could affect the performance of the company but not necessarily consumers,” she says.

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance