These restaurants are the most at risk of defaulting due to coronavirus: report

Restaurants may have enjoyed two consecutive months of improving sales due to lockdowns being lifted across the country, but they are far from being out of the woods, according to a new restaurant default ranking from S&P Global Market Intelligence.

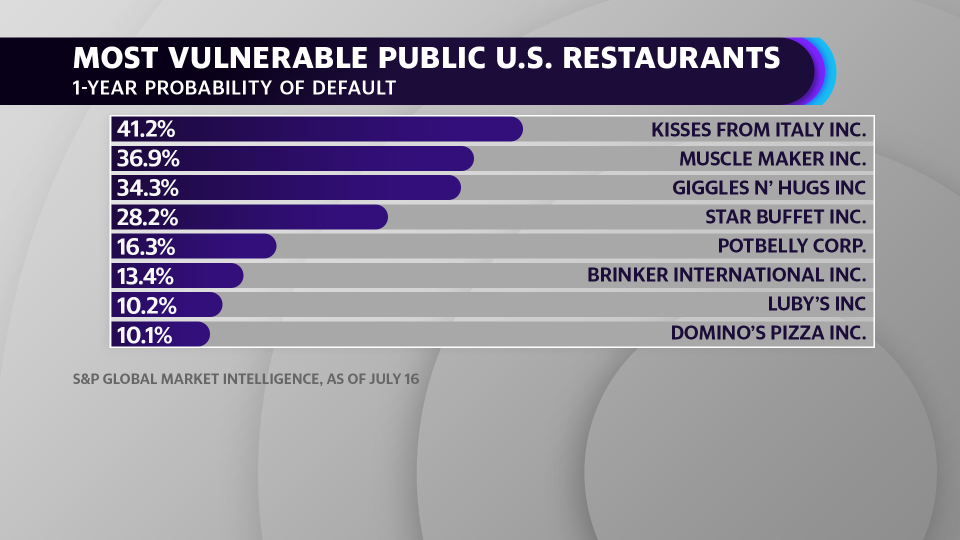

The new report, which breaks down one-year and two-year default probabilities based on the financial standing of some of America’s largest food and beverage operators, reveals that there is still an elevated risk for a lot of companies that have been unable to ramp up delivery or takeout efforts.

“A lot of the companies with higher scores would be those that are more highly leveraged, might have seen less sales growth,” explained S&P Global Market Intelligence Data journalist Chris Hudgins. “Some at the very, very top actually saw a net income loss.”

Sandwich chain Potbelly (PBPB) and Chili’s and Maggiano’s Little Italy parent company Brinker International (EAT) came in near the top of the list for major public restaurants facing financial hardships at one-year default probabilities of 16.3% and 13.4%, respectively. Other smaller operators topped those risks.

The ranking includes the latest publicly reported financial updates, which in some cases only capture the economic impact through the first quarter of 2020.

“For a lot of those companies we really only have data through March 31,” he said, “so you were really just starting to see COVID-19 ramp up in the U.S. at that time.”

For other names on the list, like Starbucks (SBUX) at a relatively smaller default probability of just 9.6%, investors will get updated financials next week as earnings season rolls on.

But even as the recent rise in coronavirus cases continues to cause concerns for those larger restaurants heavily dependent on indoor dining, delivery focused names like Domino’s Pizza (DPZ) and Papa John’s (PZZA) are likely to continue flexing their strength. Both names had a relatively lower default risk at just 10.1% and 5.7%, respectively.

Papa John’s has been reporting sales on a monthly basis since coronavirus upended the business, but just last month the pizza giant notched its third consecutive month of rising domestic sales. Comparable sales in North America rose 28% for the three months ended June 28. That relative strength has been evident in the chain’s share price as the stock hit an all-time high Monday to trade above $94 a share. The chain is slated to give investors an update on July later this month.

As Chicago and other big cities announce new shutdowns and restrictions for indoor dining there are sure to be an upwards revision to some of the default risks in the latest report, but things are clearly holding up relatively well for more delivery-focused contenders.

Zack Guzman is the host of YFi PM as well as a senior writer and on-air reporter covering entrepreneurship, cannabis, startups, and breaking news at Yahoo Finance. Follow him on Twitter @zGuz.

Read the latest financial and business news from Yahoo Finance

Read more:

Netflix co-founder brushes off NBC's new Peacock streaming competitor

Small US towns are neglected from coronavirus relief and it's a 'slap in the face': Georgia mayor

Why Costco could see a lasting boost from coronavirus panic buying

Yahoo Finance

Yahoo Finance