These ‘epicenter’ stocks could surge higher, says analyst who called March bottom

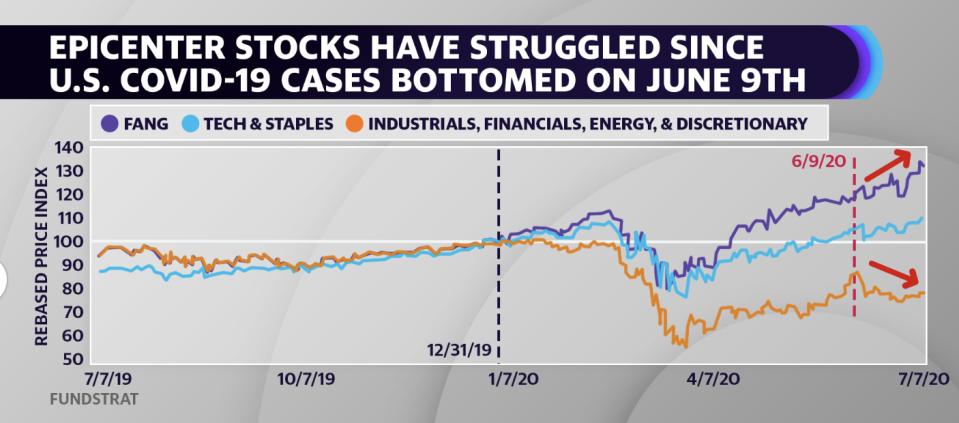

The S&P 500 has rallied more than 3% since the end of June, but an interesting split between sectors has been occurring under the hood as tech stocks continue to separate from a breakdown in value.

As recently highlighted by Fundstrat Managing Partner Tom Lee, the so-called FANG names (Facebook, Amazon, Netflix, and Google’s parent company Alphabet) have rallied an average of about 11% since then while consumer discretionary, energy, and financial names have started to roll over as Florida, Texas, and Arizona reported worrying spikes in coronavirus case counts.

However, just as New York state was able to control its own case count spike, Lee is optimistic that the same will unfold in those states. That, coupled with another wave of economic stimulus that the Trump administration is pushing for by August, could spark another rally among the hardest hit stocks from the pandemic, according to Lee.

“I would say that the epicenter stocks, which are the companies hit hardest by the crisis, are no different than what internet [stocks] looked like post-bubble in '02,“ Lee told Yahoo Finance Thursday after advocating for epicenter stocks earlier in June. “People wanted to stay away from internet [stocks,] but as you know the best performing stocks after the internet bubble crashed were internet stocks because you could buy 100 internet stocks and you could have 96% of them go to zero [even if] only 4% survived, and you still outperformed the S&P 500 over the next 10 years.”

Some of those so-called epicenter names have had a tough two weeks while the FANG names have rallied. Cruise lines Royal Caribbean (RCL) and Carnival (CCL), for example, have fallen 6% and 13%, respectively, over that time. Energy giant ConocoPhillips (COP) shed 7%, while Olive Garden parent company Darden Restaurants (DRI) fell by about the same percent.

All those names, however, could see a short-term boost, Lee says, either from a topping out of case counts in the most worrying states or from another round of economic stimulus.

“Investors [would] start to breathe a sigh of relief and they'll come into the 25% of the market that's still depressed,” Lee said.

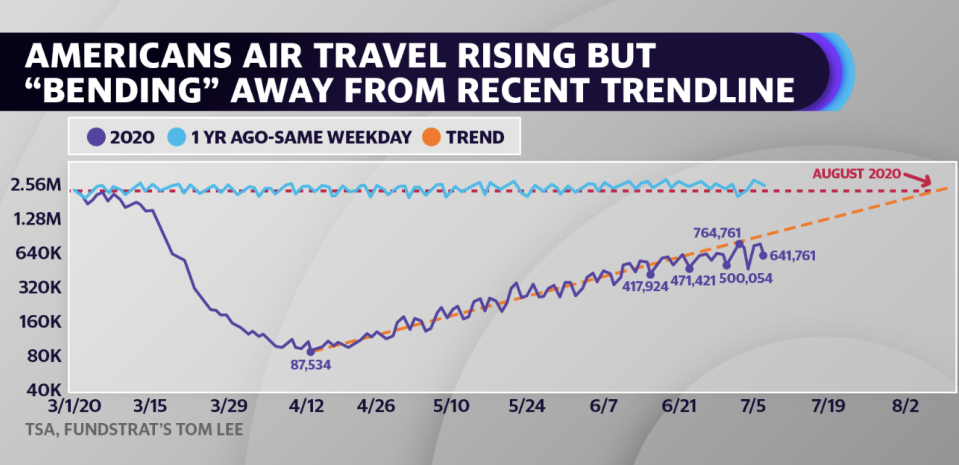

Of course, there is no guarantee that things improve on the coronavirus front in Florida, Texas, and Arizona, but bolstered efforts have worked to curtail the spread before. For names highly levered to discretionary spending, like Alaska Air (ALK) or aviation company General Dynamics (GD), an improving outlook would be a welcome boost to travel sentiment. Lately, Transportation Security Administration (TSA) airport passenger data has indicated a flattening out in rebounding air travel as coronavirus cases rose over the last two weeks. That has dampened hopes that travel might have been following a short-term exponential recovery.

For long-term investors, however, Lee again stressed the upside in the so-called epicenter names if the progress for a coronavirus vaccine continues on its path to get one by the beginning of 2021.

“If we were to freeze all progress here, then epicenter industries are in huge trouble because no one is going to get on a plane, confidently go to a hotel, casino, theater,” he said. “But if you think 12 months from now that technology and health care and re-engineering are going to make things safer, then the stocks that benefit from this really are the epicenter stocks.”

Zack Guzman is the host of YFi PM as well as a senior writer and on-air reporter covering entrepreneurship, cannabis, startups, and breaking news at Yahoo Finance. Follow him on Twitter @zGuz.

Read the latest financial and business news from Yahoo Finance

Read more:

OpenTable CEO says 25% of America's restaurants will close for good due to coronavirus

College students could be leaving up to $5,000 in coronavirus stimulus money on the table

Mayor of city famed for defunding police says abolishing police is not the solution

Analyst who predicted market's 40% rally says these stocks will lead to all-time highs

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance