Thermo Fisher (TMO) Q1 Earnings Top, Life Sciences Sales Grow

Thermo Fisher Scientific Inc.'s TMO first-quarter 2020 adjusted earnings per share of $2.94 beat the Zacks Consensus Estimate by 5.4%. The figure improved 4.6% year over year.

The adjusted number excludes certain non-recurring expenses, QIAGEN acquisitioncosts and certain restructuring costs, net, consisting principally of severance, abandoned facility and other expenses of headcount reductions within several businesses and real estate consolidation.

On a reported basis, earnings per share were $1.97, down 2.5% year over year.

Revenues in the quarter under review grossed $6.23 billion, up 1.6% year over year. The top line also exceeded the Zacks Consensus Estimate by 0.4%.

Quarter in Detail

Organic revenues in the reported quarter grew 2% year over year while acquisitions, net of a divestiture, increased revenues by 1%. However, currency translation adversely impacted total revenues by 1%.

Thermo Fisher operates under four business segments: Life Sciences Solutions, Analytical Instruments, Specialty Diagnostics and Laboratory Products and Services.

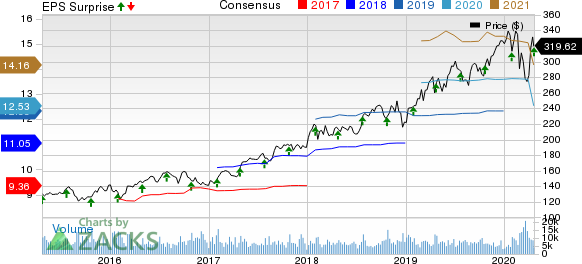

Thermo Fisher Scientific Inc. Price, Consensus and EPS Surprise

Thermo Fisher Scientific Inc. price-consensus-eps-surprise-chart | Thermo Fisher Scientific Inc. Quote

Revenues at the Life Sciences Solutions segment (28.5% of total revenues) improved 10% year over year to $1.77 billion while Analytical Instruments Segment sales (17.7%) declined 16.7% to $1.1 billion.

Revenues at the Laboratory Products and Services segment (43.8%) rose 9% to $2.73 billion. The Specialty Diagnostics segment (15.4%) recorded flat year-over-year revenues at $0.96 billion.

Gross margin of 45.9% in the first quarter contracted 25 basis points (bps) year over year despite a 1.2% rise in gross profits. Adjusted operating margin for the quarter came in at 21.9%, reflecting an expansion of 12 bps.

The company exited the first quarter of 2020 with cash and cash equivalents of $2.98 billion compared with $2.39 billion at the end of 2019. Net cash provided by operating activities in the first quarter was $356 million compared with $649 million a year ago.

We note that on Apr 6, 2020, Thermo Fisher had withdrawn its 2020 guidance due to the COVID-19 pandemic-led crisis and related customer impact.

COVID-19 Test Update

In terms of COVID-19 tests development, in the first half of March, the company successfully attained EUA from the FDA for its diagnostic test to be used by the CLIA high-complexity laboratories in the United States. The test has been developed for the detection of nucleic acid, exclusively from SARS-CoV-2. The authorized test utilizes the Applied Biosystems TaqPath Assay technology and has been developed to deliver patient outcomes within four hours of a sample reaching a laboratory. This authorization was amended on Mar 24 to include additional instruments, such as the company's Applied Biosystems 7500 Fast Real-Time PCR System. This boosted testing capabilities in the United States from approximately 1,000 instruments to more than 3,000 instruments on which Thermo Fisher's diagnostic test can be run. The expansion also includes manual sample extraction using the MagMax Viral/Pathogen Nucleic Acid Isolation Kit as well as Applied Biosystems COVID-19 Interpretive Software.

On Mar 26, the company announced that this test had received the CE mark in the European Union.

Bottom Line

Thermo Fisher ended the first quarter with better-than-expected numbers. We are encouraged about the strong year-over-year revenue growth at Life Sciences Solutions and Laboratory Products and Services segments. However, the coronavirus outbreak has massively disrupted the global supply chain. Given its huge international base, Thermo Fisher too recorded a decline in its quarterly Analytical Instruments revenues. Meanwhile, gross margin contraction in the first quarter is concerning.

We currently look forward to Thermo Fisher’s agreement to acquire QIAGEN N.V. for $11.5 billion (announced in March). It is aimed at expanding the company’s specialty diagnostics portfolio with QIAGEN’s molecular diagnostics capabilities and also enhancing the company’s life sciences offering with QIAGEN’s sample preparation technologies.

Zacks Rank and Key Picks

Thermo Fisher currently has a Zacks Ranks #3 (Hold).

Some better-ranked stocks in the broader medical space are Chemed Corporation CHE, DexCom DXCM and ViewRay, Inc. VRAY. All the three stocks carry a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Chemed’s first-quarter 2020 revenues is pegged at $523.6 million, suggesting 13.3% growth from the prior-year reported figure. The same for adjusted earnings per share is anticipated at $3.65, indicating 25% improvement from the year-ago reported number.

The Zacks Consensus Estimate for DexCom’s first-quarter 2020 revenues is $356.5 million, implying 27.1% increase from the year-earlier reported figure. The same for adjusted earnings per share stands at 10 cents, indicating a 300% surge from the year-ago reported figure.

The Zacks Consensus Estimate for ViewRay’s first-quarter 2020 earnings per share stands at a loss of 20 cents, suggesting 41.8% improvement from the year-ago period.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

Chemed Corporation (CHE) : Free Stock Analysis Report

ViewRay, Inc. (VRAY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance