One of the top TSX performers in 2019 is a company you probably never heard of

In the 1990s and early 2000s, Ford (F), DaimlerChrysler, Honda (HMC), Mazda (MZDAY), Nissan (NSANY) and Volkswagen (VLKAF) were among the big automakers experimenting with passenger vehicles powered by hydrogen technology from Ballard Power Systems (BLDP.TO)(BLDP).

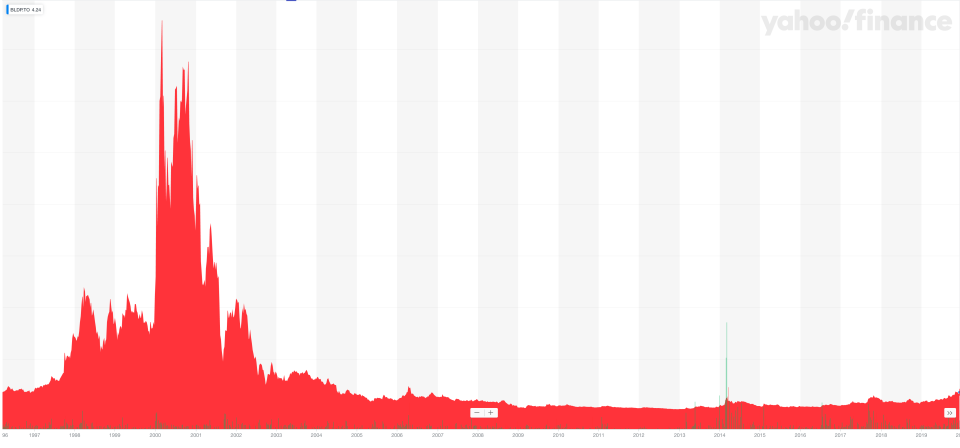

Shares of the Vancouver-based company briefly roared above $200. Then the auto industry changed course, and expectations for a hydrogen-powered future began to fade. The company was eventually reduced to a penny stock as gas-guzzling SUVs overtook demand for fuel efficient vehicles.

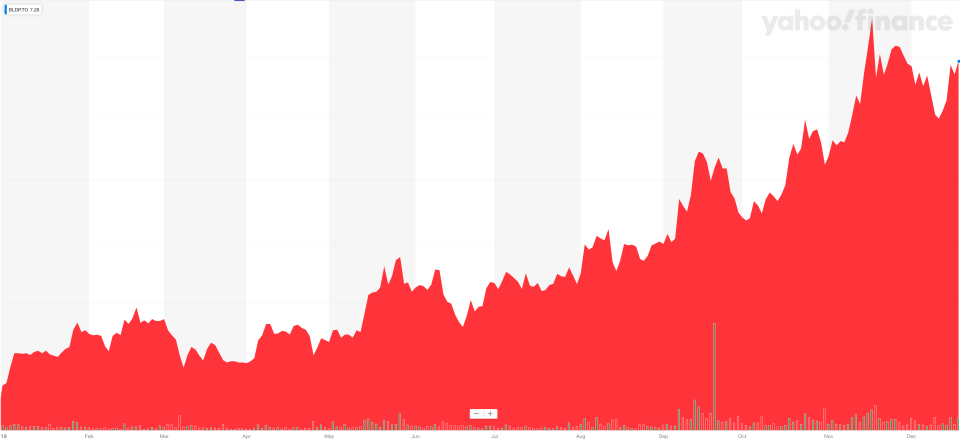

While analysts doubt Ballard will retrace its previous highs, 2019 has been a resoundingly positive year for investors. Toronto-listed shares have surged more than 150 per cent year-to-date, one of the strongest performers on the TSX in 2019.

President and Chief Executive Officer Randy MacEwen credits three factors; a flurry of fuel cell investment by some of the biggest names in transportation, emissions-targeting government policies, and fuel cells outperforming battery electric power when distances are long and payloads are heavy.

“These factors are not just supporting Ballard’s stock price, but industry momentum in general,” he told Yahoo Finance Canada.

Hydrogen fuel cells combine elemental hydrogen with oxygen in the air, capturing the energy for conversion to electricity. The only byproduct is water. Ballard sells hydrogen fuel cells for vehicles like buses, trucks, trains and forklifts to a host of major global manufacturers. It also works with companies like Audi and Siemens (SHL.DE) to develop its in-house fuel cell solutions.

Ballard is laser-focused on applications where battery-electric vehicles tend to fall short.

“Fuel cell electric provides all the performance characteristics from diesel with zero emissions. Where fuel cells will dominate will be in cases with heavy weight, long daily rages, and where you need fast refuelling,” MacEwen said, adding that Tesla’s (TSLA) controversial battery-electric Cybertruck is “not heavy duty.”

In other words, battery-electric is fine for cars, but the technology can’t hang with hydrogen fuel cells when it comes to big trucks, buses and fleet vehicles that can afford to sit around charging.

Investment in fuel cell technology has been brisk. Late last year, Hyundai (HYMTF) announced plans to invest US$6.7 billion on hydrogen fuel cell technology to advance its “FCEV Vision 2030” plan. Bosch (BOSCHLTD.BO), the world’s largest auto parts supplier, announced a major licencing partnership with Powercell Sweden AB in April. The German company said the fuel cell business is “potentially worth billions of euros.” Dutch commercial vehicle-maker CNH Industrial (CNHI) said it would invest $250 million in zero-emission heavy truck-marker Nikola for fuel cell development in September. That same month, U.S. heavy-duty engine and powertrain manufacturer Cummins (CMI) closed a US$290 million acquisition of the hydrogen tech company Hydrogenics.

Ballard inked its own splashy deal in August, announcing a cash injection from Weichai Power (WEICY). The state-backed Chinese automotive and equipment manufacturer purchased a 19.9 per cent stake in the B.C.-based company for $163 million. Another $20 million came from Ballard investor and Chinese partner, Zhongshan Broad-Ocean Motor Co.

Weichai builds about 900,000 engines per year. That volume is the result of strong ties to Chinese commercial truck and bus-makers, companies that are increasingly looking to pivot from fossil fuel. Ballard and Weichai are partnered on a joint venture in Shandong province to tap into China’s fuel cell electric vehicle market.

MacEwen said about 2,000 fuel cell buses and trucks running on Ballard technology have been deployed onto Chinese roads so far. On Monday, the joint venture, Weichai Ballard Hy-Energy Technologies, placed a $19.2 million order with Ballard for fuel stack components. Ballard announced an initial $44 million order in May.

“I believe that JV will become the premier platform for fuel cell engines for commercial vehicles in China,” MacEwen said.

China leads the world in government fuel cell subsidies. But there are concerns that Beijing could turn off the funding taps. In October, China Daily quoted the country’s finance ministry as saying, “Some carmakers have become over-reliant on subsidies, and thus find it difficult to compete in the global markets. And despite the financial support, China's fuel cell industry has not made breakthroughs, and has not seen rapid development."

MacEwen isn’t worried.

“That was probably a reference to passenger cars rather than commercial vehicles. We’re focused on the commercial market,” he said. “I’m expecting an announcement in the first quarter of 2020 that will support the fuel cell industry, and will support the Weichai-Ballard joint venture.”

While he remains confident, the uncertain outlook for Chinese government subsidies was enough to rattle Roth Capital analyst Craig Irwin. He’s also called Ballard’s stock “egregiously overvalued” and criticized the company for having yet to turn an annual profit.

“There is no Chinese central government fuel cell subsidy plan in place for after 2020,” he wrote in a November note to clients. “With around 60 per cent of Ballard's 2020 revenue likely coming from Chinese customers, we are cautious on longer term momentum.”

MacMurray Whale of Cormark Securities is more optimistic about additional Chinese government support.

“In the early part of 2020, likely before the Chinese New Year, the Chinese government is expected to bring out a new five-year program for new energy vehicles,” he wrote in a recent research note. “While subsidies are likely to fall, reflecting lower costs, support for hydrogen infrastructure as well as fuel cells for the heavy-duty market are anticipated.”

MacEwen sees massive growth potential beyond the 15,000 hydrogen fuel cell passenger vehicles, 28,000 forklifts and 4,000 commercial vehicles he estimates to be in use today. Ballard can do more than move things with wheels, he explains.

The company’s fuel cell products extend to boats, trains and even UAVs.

MacEwen sees few limits to the technology. For example, he expects cruise ships could soon use hydrogen fuel cells while in port to meet the needs of the thousands of guests inside. By 2040, he said the massive container ships that underpin global trade could even run on hydrogen. Military and commercial drones are already benefiting from the long range, low thermal signature, and minimal vibration for better picture quality that Ballard’s power plants offer.

Asked if the stock is once again benefiting from high-flying expectations for a distant hydrogen-powered future, MacEwen said, “I understand that sentiment. But pull back and look at what the company has accomplished from a technology perspective, and look at the customer engagement we have. There is a lot of work the company has done that speaks to the leadership we have in the market today.”

Jeff Lagerquist is a senior reporter at Yahoo Finance Canada. Follow him on Twitter @jefflagerquist.

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance